RBNZ Review: More Dovish Surprise

RBNZ cut its cash rate by 50bp to 2.5%

Forward guidance dovish pointing towards more potential cut

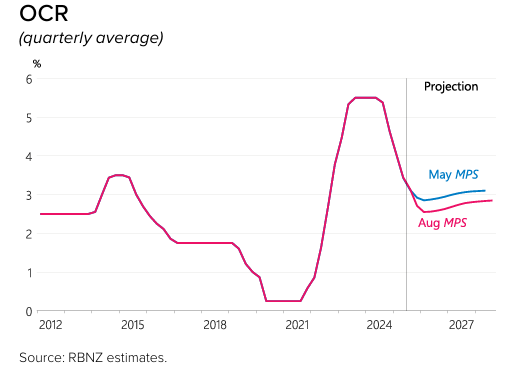

The RBNZ cut its cash rate by 50bp to 2.5% in the October meeting with no official revision to the OCR forecast since August. Different from the August cut, the 50bps cut in October is a consensus cut, which means all members agree that short term CPI may be volatile but the long time economic condition needs more accommodation. In the forward guidance, the RBNZ is consistent with their August forecast which points towards at least one more cut in the November meeting.

Some key takeaways:

Spare Capacity: The RBNZ highlight "spare capacity" in their statement. The priority of such "spare capacity" has even exceeded inflation. The RBNZ sees prolong spare capacity in New Zealand and weighed being accommodative to stimulate the economy to be more important than containing any short term spike in CPI.

Short term Inflation Expectation: It is forecasted Q3 CPI will be at 3% y/y but should be converging towards the mid point of target range in 2026. They also see global inflationary pressure to ease further in 2026.

Slowing Outlook: The RBNZ believe the global economic outlook will slow in 2026 after the AI boom in 2025. Thus, balancing the upside and downside risk with the broader picture, the RBNZ thinks that lower interest rate will be more beneficial to New Zealand and will be cutting further.

I,Cephas Kin Long Yung, the FX Analyst declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.