U.S. September S&P PMIs - Slower but still portraying a growing economy

September’s preliminary S and P PMIs are weaker than in August, manufacturing at 52.0 from 53.0 and services at 53.9 from 54.5, but still paint a picture of an economy growing at a respectable pace. The composite was 53.6 from 54.6.

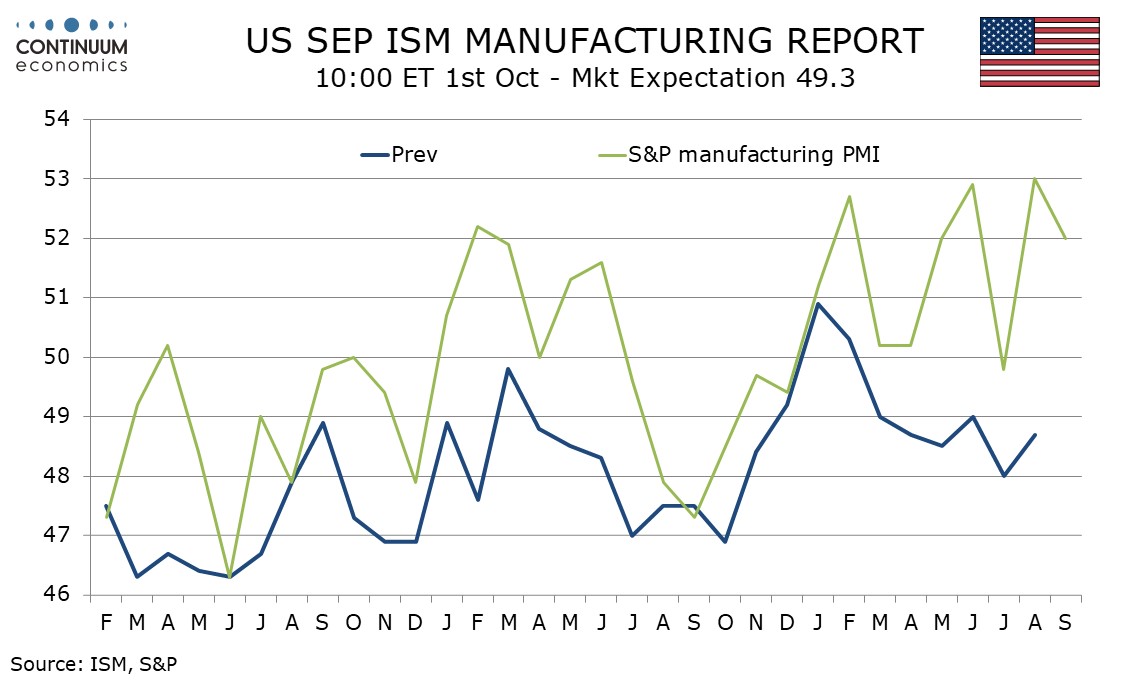

Apart from July’s marginal dip below at 49.8 the manufacturing index has been above the neutral 50 in each month of 2025 to date, something the ISM manufacturing index has not achieved since February. For September the Philly Fed index was surprisingly strong but the Empire State index was weaker. The ISM manufacturing index does not look set to show increased weakness.

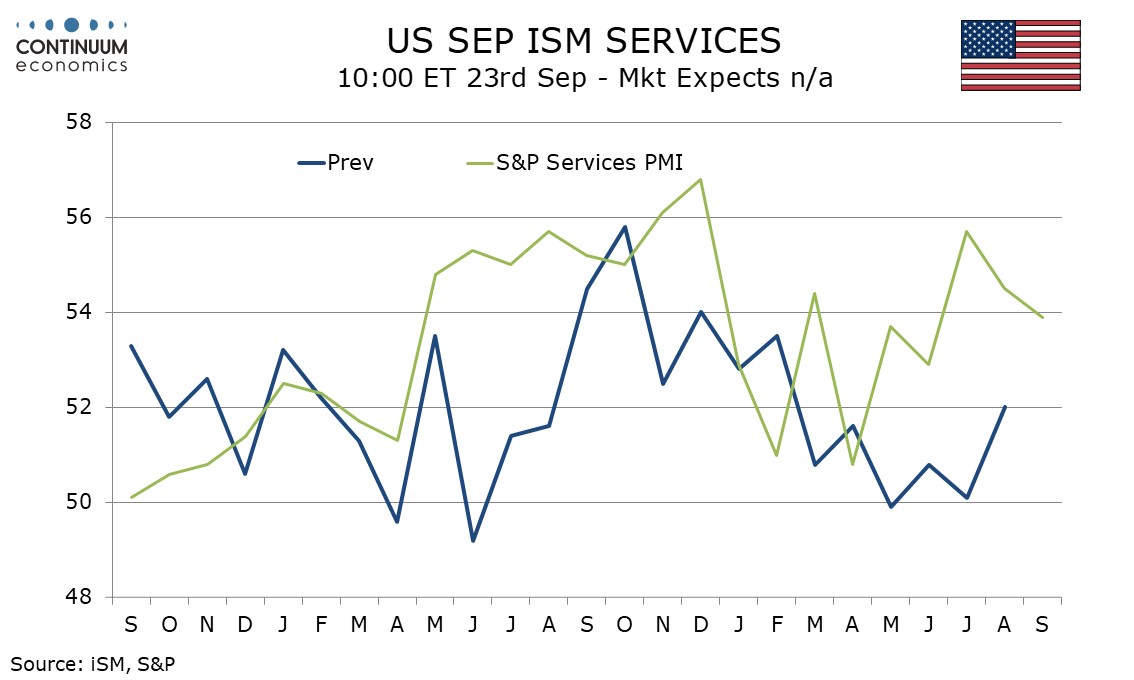

The S and P services index is not well correlated with its ISM counterpart, and remains above the latter’s August outcome of 52.0 despite having seen two straight declines from July’s high of 55.7. The Philly Fed and Empire State have both released services sector surveys too, which remain negative, the Philly Fed’s less so but the Empire State’s increasingly so. There are no clear signals for the ISM data.