CAD, USD, JPY, EUR flows: USD firmer on tariff announcement

USD gains strongly versus CAD and MXN after Trump tariff annoucnment. General USD gains may not hold

The CAD and MXN have suffered from Trump’s comments overnight indicating he would introduce 25% tariffs on Canadian and Mexican goods from the start of his administration. USD/CAD gained 1% and USD/MXN around 1.5% on the news. The USD made general but much more modest gains elsewhere. While a tariff increase has been flagged as likely, its immediate introduction would be faster than expected. The implication of likely higher inflation and slower growth has had little impact on US yields, which have so far remained lower after the nomination of Bessent as treasury secretary at the weekend.

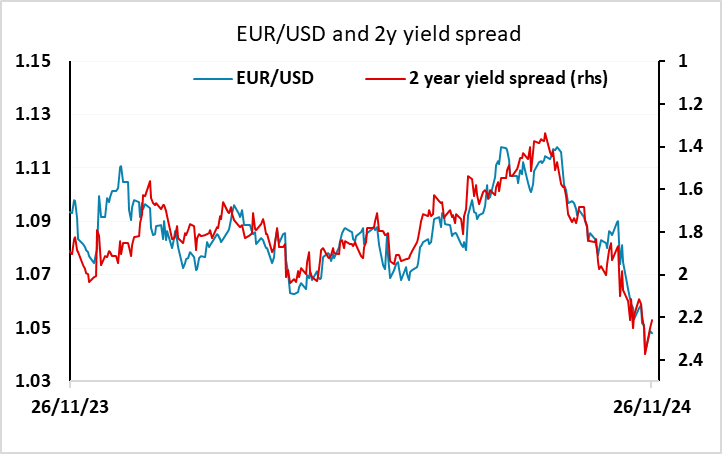

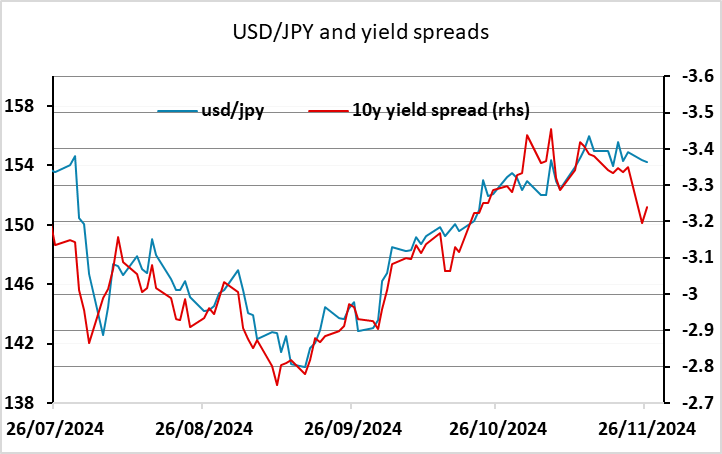

From a yield spread perspective, the USD looks vulnerable to a correction lower, notably against the JPY, but the market reaction to tariffs may prevent this. Even so, we would see some JPY upside from here, with the lack of mention of Europe or Japan on the tariff menu suggesting the JPY and European currencies can outperform. With little of note on today’s calendar, expect overnight USD strength to fade a little against the JPY and EUR.