FX Weekly Strategy: Europe, January 2-6th

Slate of U.S. Data to Kick Start the New Year

Followed by the Non-farm Payroll

USD/JPY Continue To Correct

German Headline CPI to Jump on Base Effects

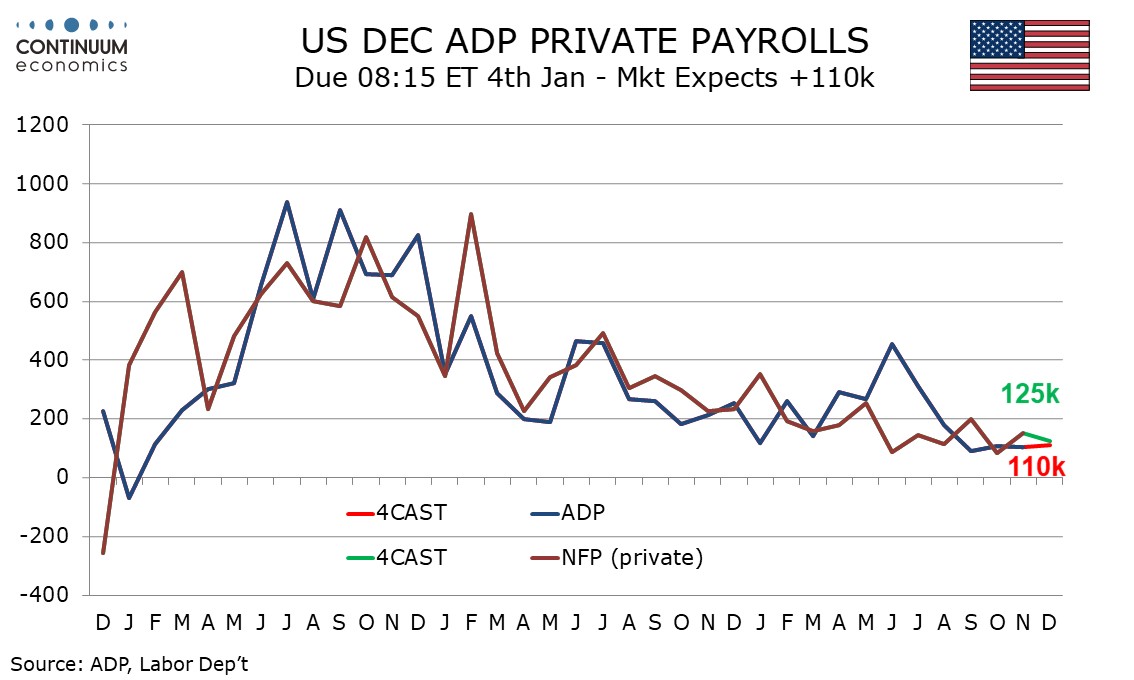

We expect a 110k increase in December’s ADP estimate for private sector employment growth, similar to if marginally stronger than the gains seen in the last three months, each of which was close to 100k. Trend in ADP data has slowed a little more than has that for the non-farm payroll, and we expect the ADP data to again modestly underperform. looking for private sector non-farm payrolls to rise by 125k with a 175k payroll increase overall. Positive signals for December come from initial claims losing upward momentum and generally resilient economic data, though anecdotal evidence that the economy is losing momentum persists.

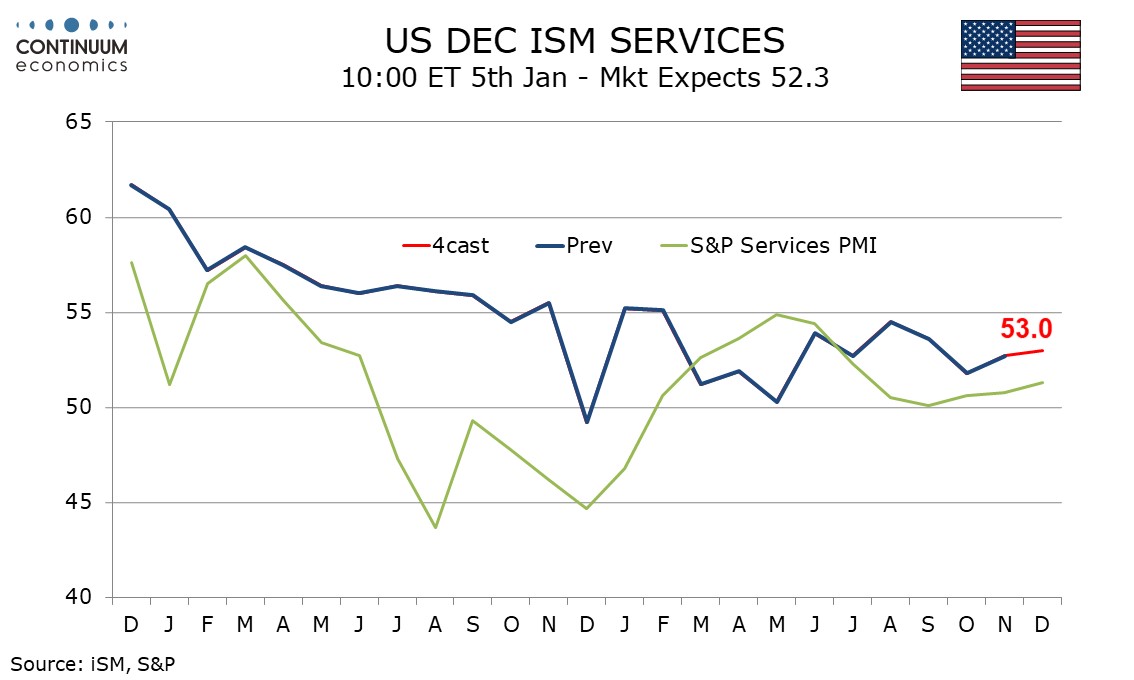

We expect a modest increase in December’s ISM services index to 53.0 from 52.7 in October. While this would be the second straight increase there is little direction to trend with the index in a 50.0 to 55.0 range.

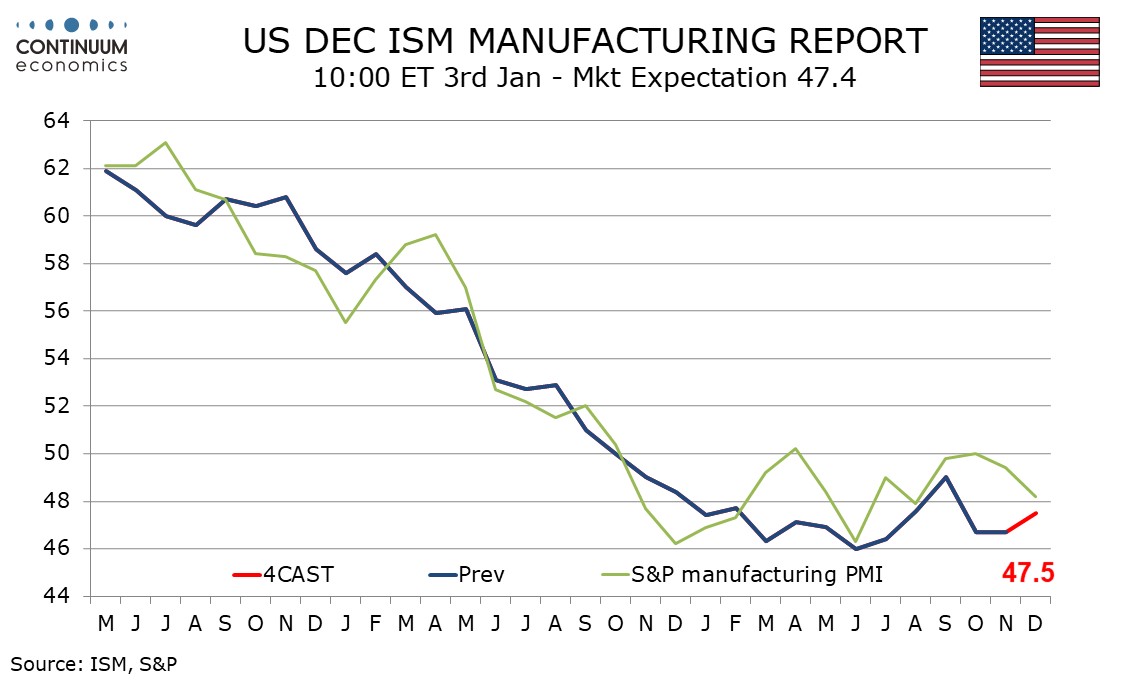

We expect a December ISM manufacturing index of 47.5, up from two straight months at 46.7 which generally underperformed most comparable manufacturing surveys. The underlying picture remains marginally negative.

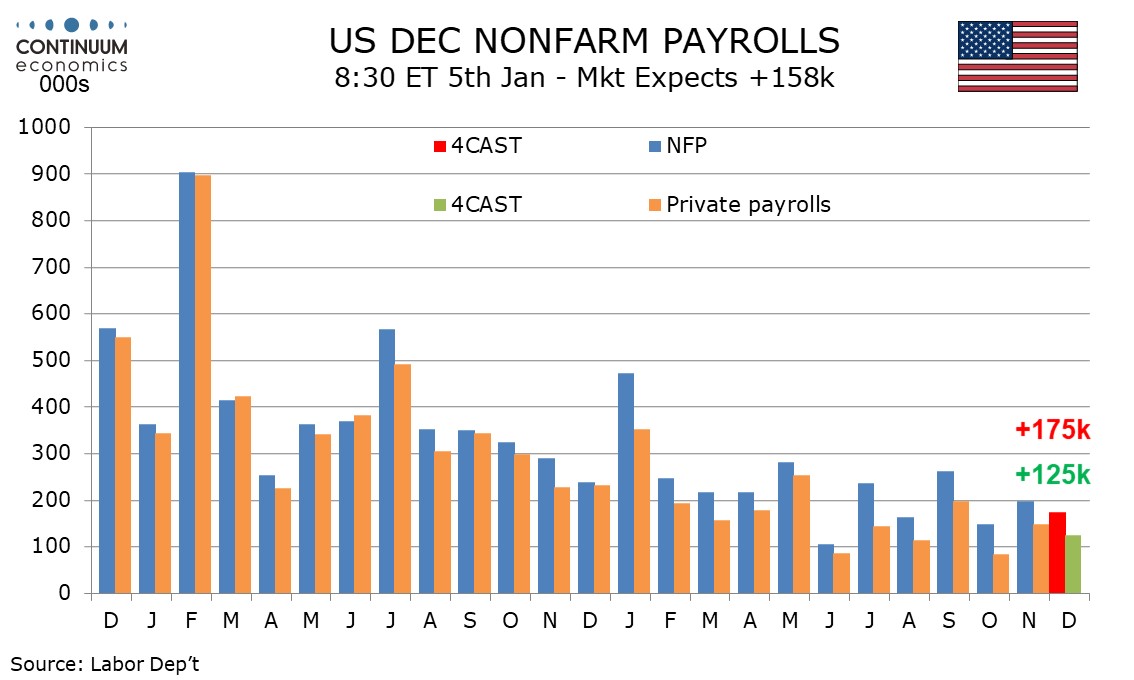

We expect a 175k increase in December’s non-farm payroll, with private payrolls up by 125k, which would be consistent with recent trend, though risk may lean to the upside. We expect an unchanged unemployment rate of 3.7% and a 0.3% increase in average hourly earnings. A 125k increase in private sector payrolls would compare to 150k in November and 85k and October but would be slightly stronger than both excluding the impact of strikes. Hinting at upside risk are a stalling of an upmove in initial claims, and more supportive seasonal adjustments. Average hourly earnings trend has been gradually losing momentum with trend now on the low side of 0.3%, and we expect a rise of 0.26% in December before rounding. This would follow an above trend 0.35% in November which was resumed up to 0.4%, which corrected a below trend 0.21% increase in October. Yr/yr growth would then slip to 3.9% from 4.0%. There is extra uncertainty on unemployment in December with historical revisions due, though we expect any changes to be marginal. Historical revisions for non-farm payrolls data come with January’s report. We expect an unchanged rate of 3.7% assuming November is unrevised, with employment and the workforce seen delivering similar moderate gains, contrasting sharp bounced in both in November which corrected declines in October. In the last nine months we have seen six months with the workweek at 34.4 and three at 34.3. In December we expect slippage to 34.3 after November increased to 34.4, with the leaning being that trend continues to edge slowly lower. This would leave aggregate hours worked down by 0.2% in December but up by 0.9% annualized in Q4, a modest slowing from 1.3% in Q3.

JPY should continue its correction against USD despite the BoJ kicking the can down the road to March's spring wage negotiation in Japan. The key factor is Fed signalling potential peak rates and BoJ heading into an exit of current ultra-loose monetary policy, regardless of pace, will further narrow the yield differential between USD and JPY. U.S. 2yr T-yields has rotated from 5.2% to 4.2% and 10yr from 5 to 3.8%. while 10yr JGB is consolidating at 0.6%. With equity performance unlikely to sustain, haven bids in JPY should return and accelerate the fall in USD/JPY in the coming year.

On the chart, prices extend consolidation above congestion support at 142.00 in quiet trade. Daily readings have ticked higher, highlighting potential for a drift higher towards 143.30. However, mixed/negative daily readings are expected to limit any tests/break in fresh selling interest beneath congestion resistance at 144.00. Meanwhile, support remains at congestion around 142.00 and should underpin any immediate setbacks. A later break, however, will turn sentiment negative and target critical support at the 140.95 weekly low of 14 December and stronger support at the 140.70 Fibonacci retracement.

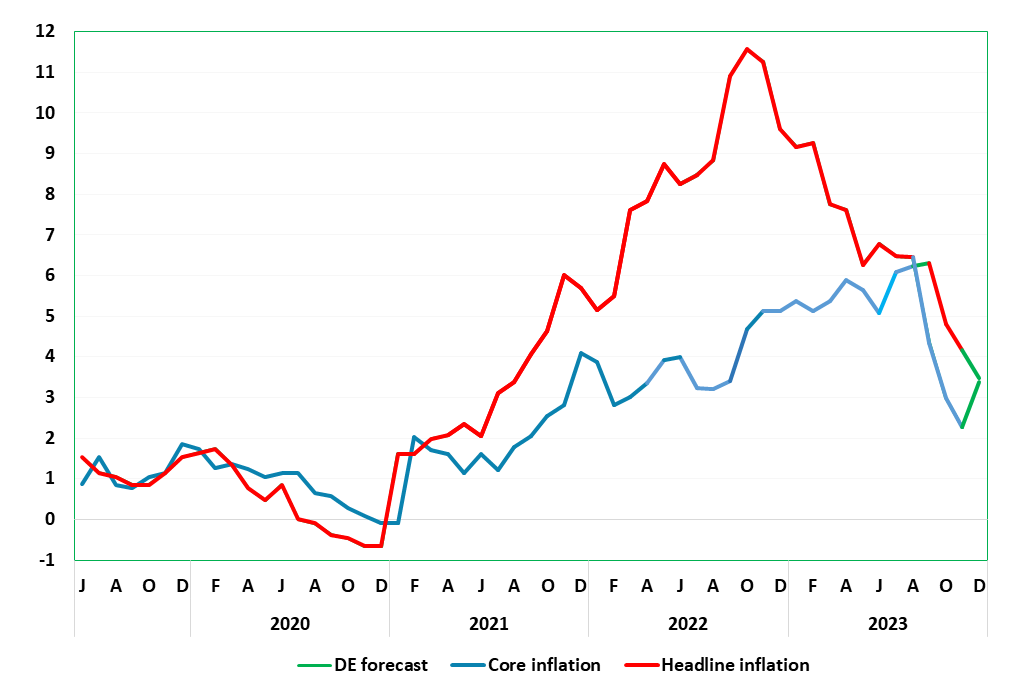

Figure: HICP Inflation

We have been highlighting repeatedly a clear and continued fall in overall German and EZ inflation pressures, initially evident in survey data but spreading to official numbers. This downtrend was much more evident in the softer-than-expected October and also the November HICP numbers. Indeed, helped by a small and further fall in fuel prices, weaker food inflation, all alongside favourable recreational sector base effects, the headline and core rate came down further, the former easing 0.7 ppt to 2.3%, a 29-month low, with the core dropping by 0.7 ppt to 3.5%. Despite by a further fall in fuel prices, recreation-sourced and particularly energy-related base effects, are likely to push up the headline rate back to 3.3% in December but with the core stable (Figure). Regardless, the disinflation backdrop underlined by an ever softer core seasonally adjusted data (Figure 2). Indeed, the headline y/y rate may resume a downtrend in the new year.

German HICP inflation continues to be volatile but with a downtrend more discernible and ever broader after the downside surprises of recent months. But that headline rate may rise afresh in December, albeit where energy inflation will jump due to bse effects and despite a m/m fall in fuel costs.