U.S. February Preliminary Michigan CSI - Highest since August

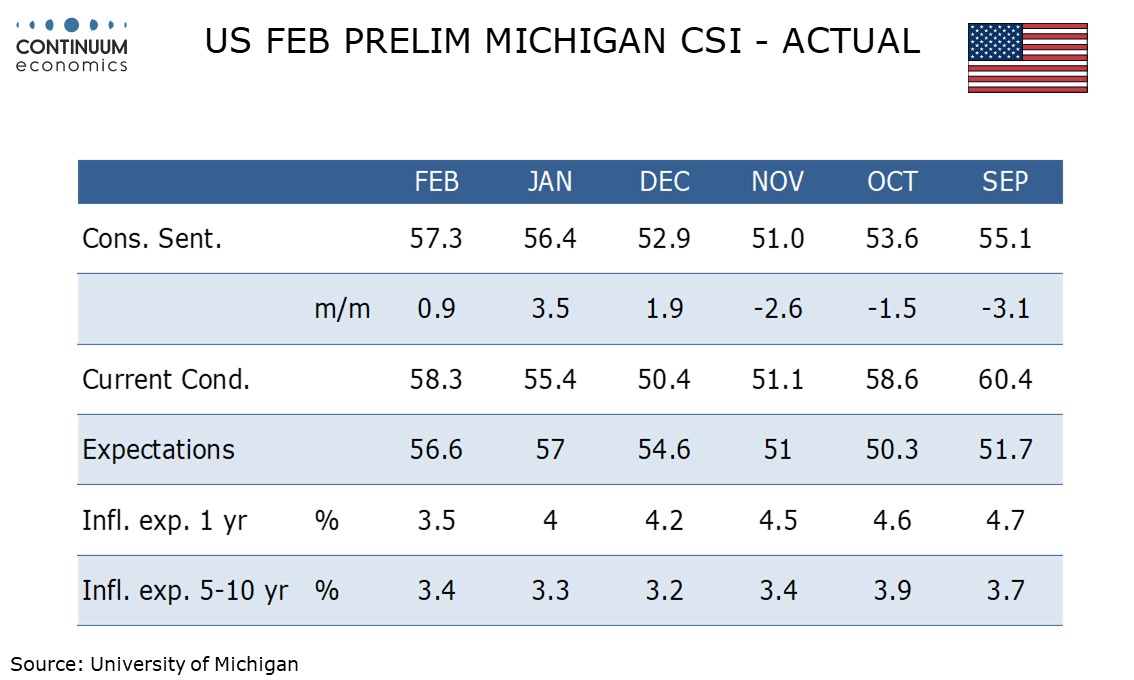

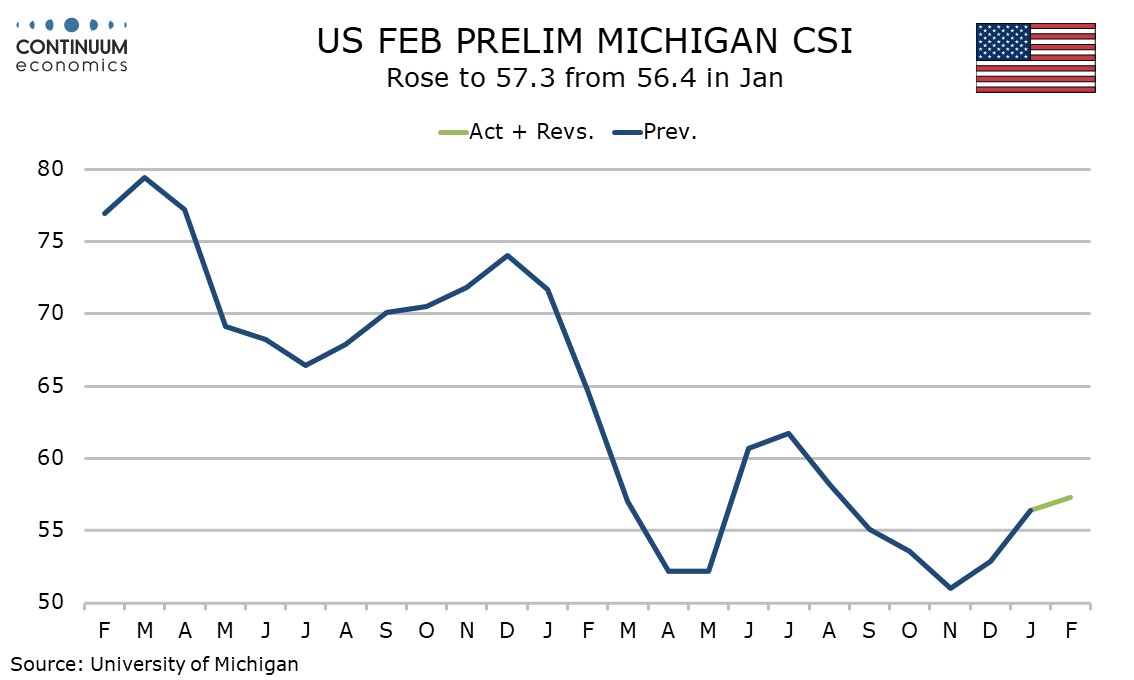

February’s preliminary Michigan CSI at 57.3 from 56.4 has seen a third straight increase to the highest level since August.

The increase follows weaker January data from the Conference Board’s consumer confidence index, where weakness was led by the labor market, something the Michigan CSI tends to be less sensitive to.

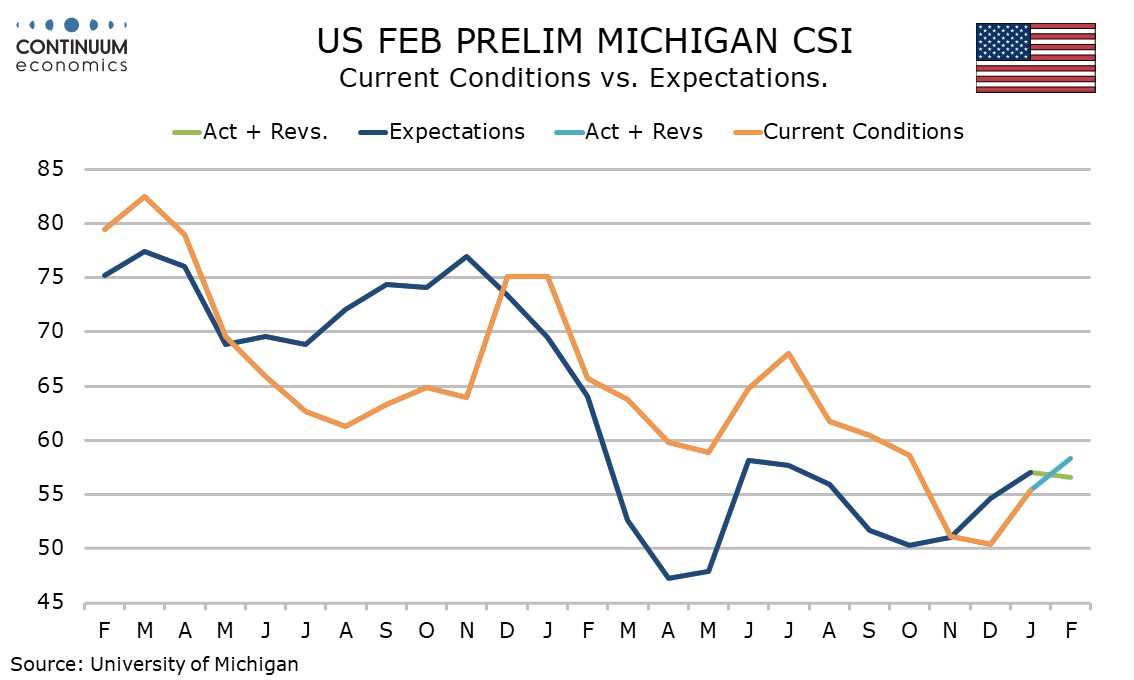

The latest Michigan CSI improvement is fully due to current conditions, rising to 58.3 from 55.5, with expectations slipping marginally to 56.6 from 57.0, though expectations remain from a low of 51.0 seen in November.

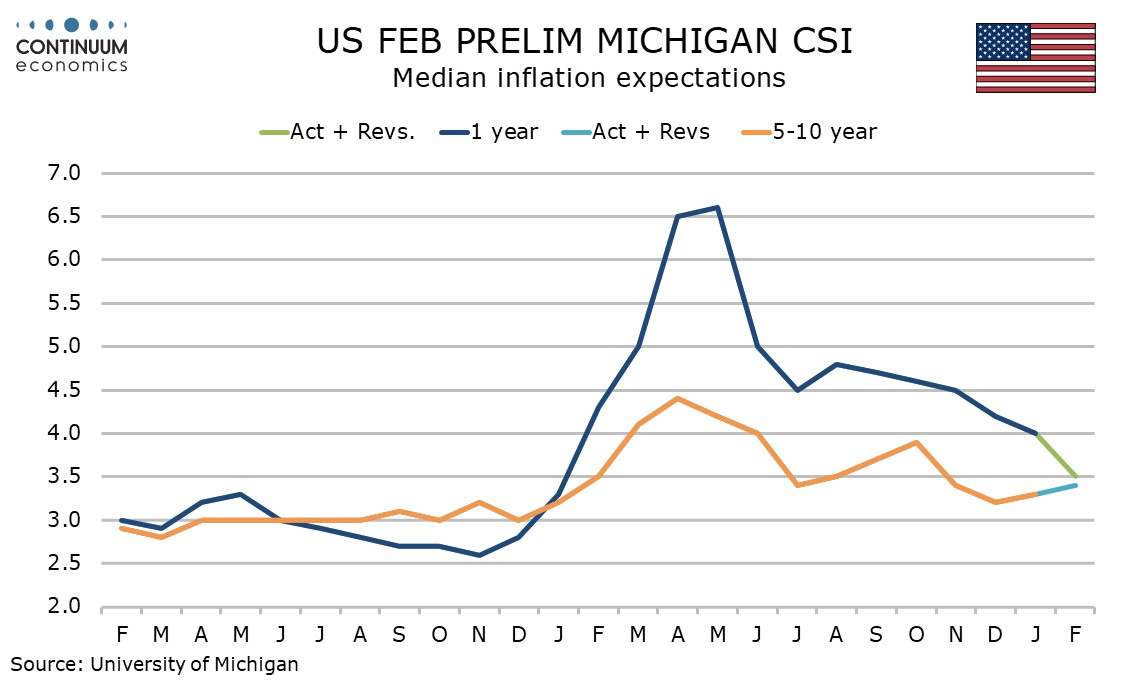

The current conditions index may have been lifted by lower 1-year inflation expectations of 3.5% from 4.0%, this the lest since January 2025 and suggesting tariff-induced worries are fading.

However the 5-10 year view increased to 3.4% from 3.3%, suggesting the 1-yerar view is converging towards the longer term view.