FX Daily Strategy: Asia, December 20th

GBP risks on the upside on UK CPI

BoE priced to cut less than ECB and Fed, but this looks justified

USD weakness on Tuesday to fade

JPY decline overdone, most obviously against the CAD and CHF

GBP risks on the upside on UK CPI

BoE priced to cut less than ECB and Fed, but this looks justified

USD weakness on Tuesday to fade

JPY decline overdone, most obviously against the CAD and CHF

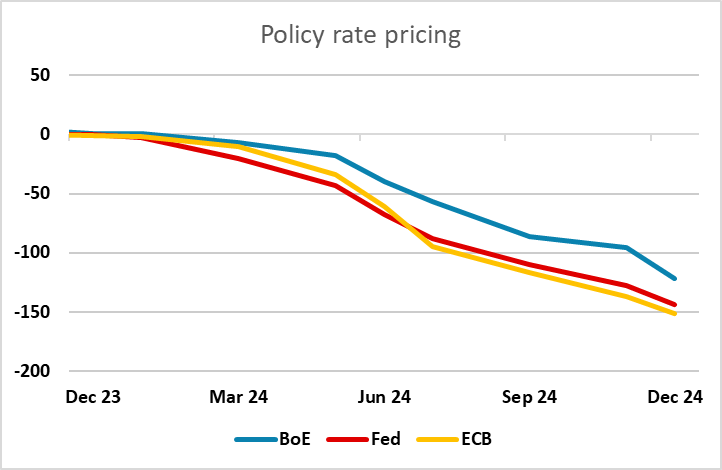

UK CPI is the main data on Wednesday. The market currently prices less Bank of England easing over the next year than Fed or ECB easing, due to the hawkish tone of BoE commentary and the relatively high level of UK inflation. The latest MPC vote still of course had three votes for a further rate hike. While UK core CPI is expected to decline in Wednesday’s November data, the consensus expectation for core CPI inflation is still 5.5% y/y, which remains well above the levels in the US and Eurozone. Our own forecast is slightly higher at 5.6%, so it’s hard to make a case for further declines in UK rate expectations. MPC member Ben Broadbent indicated this week that the MPC is still very focused on the wage data, including the somewhat discredited average earnings numbers. As long as this remains well above the level consistent with inflation at target, it’s hard to see the MPC turning significantly more dovish, so the market can be expected to continue to price in less BoE easing than Fed or ECB easing.

EUR/GBP has moved closely with 2 year yield spreads in the last year, so we would see a bias towards a stronger pound on the CPI data, both because our forecast is slightly above the market consensus, and because UK inflation will remain well above Eurozone and US inflation even on a sub-consensus reading. With the BoE also more hawkish, and the market only pricing in one fewer rate cut from the BoE relative to the ECB and the Fed, it’s hard to justify any convergence in short term yields.

Otherwise Wednesday is a relatively quiet calendar. There is German consumer confidence and US existing home sales, but neither seem likely to move the market. The USD was generally soft on Tuesday against everything but the JPY, helped by the gains in equity markets on the back of lower yields. Nevertheless, we don’t see much more USD downside here, with yields unlikely to fall significantly and 1.10 likely to be a difficult barrier for EUR/USD to break.

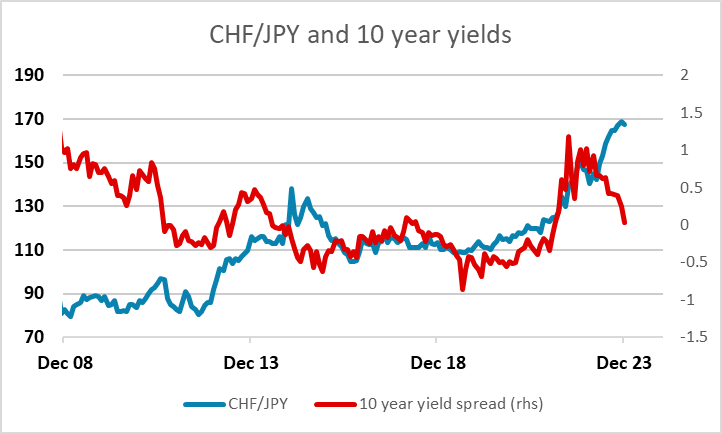

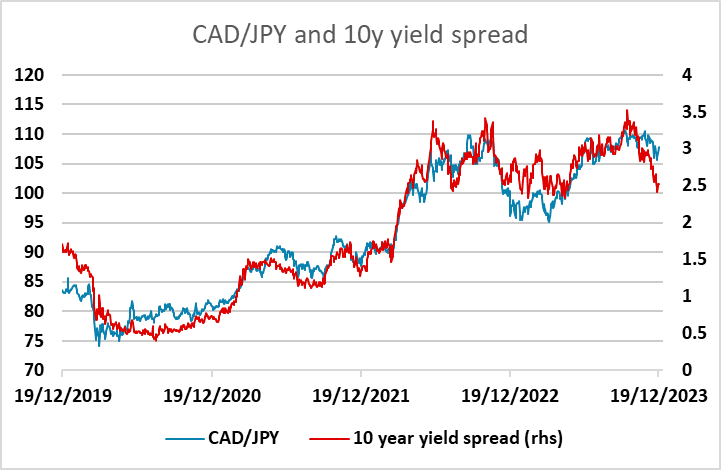

The JPY was the outlier, as the market showed disappointment at the lack of any change in BoJ rhetoric at the BoJ meeting. Even so, JPY weakness looks very overdone, with yield spreads still pointing the general JPY gains. The correlation with yield spreads has been strongest with USD/JPY and CAD/JPY, but from a value perspective CHF/JPY looks the most obvious trade, with the CHF having no significant yield advantage to justify the 30% rise in CHF/JPY in the last two years. Meanwhile, the SNB indicated that they will wind down their CHF buying/FX selling going forward, which should reduce CJF strength.