Published: 2025-11-19T07:25:05.000Z

GBP flows: UK CPI data marginally on the soft side

1

GBP a tad weaker as core CPI rises slightly less than expected

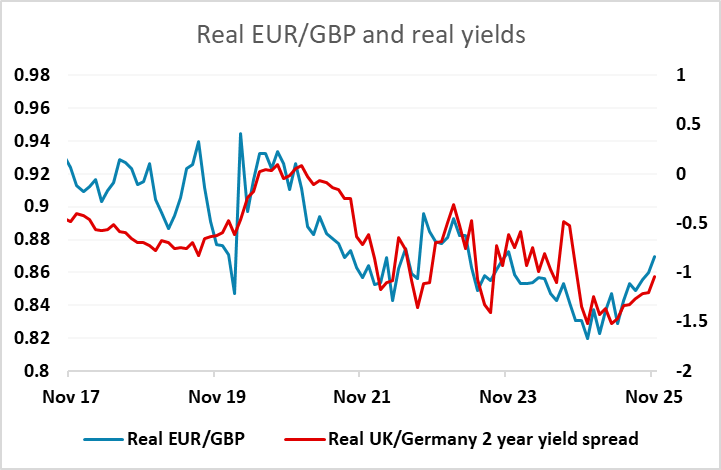

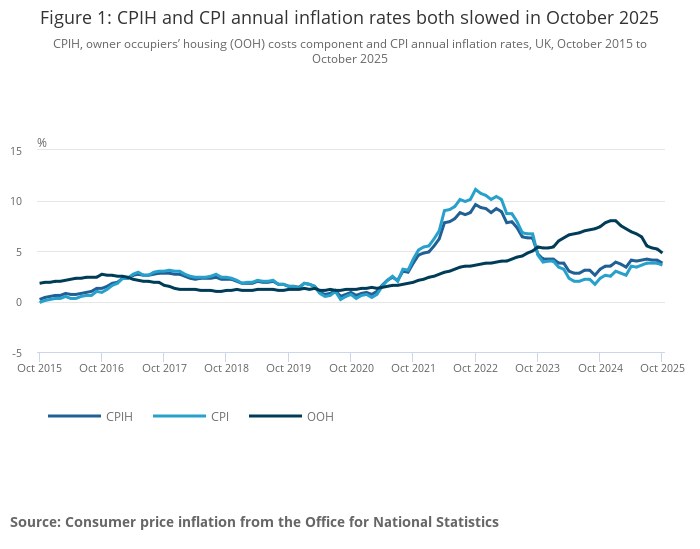

UK October CPI has come in marginally on the soft side of consensus, with the core rising 0.3% m/m against a market consensus of 0.4%, although the y/y rate was still in line with expectations at 3.4%. Services inflation was lower than expected at 0.2% m/m and 4.5% y/y. Stronger than expected PPI output data was offset by weaker than expected PPI input numbers. While the data is close to expectations, the weakening of services prices supports a BoE rate cut in December, and should maintain an upside bias to EUR/GBP. However, with a rate cut already 80% priced in, the upside scope is quite limited, and we would still expect it to be hard for EUR/GBP to break above 0.8850 near term.

UK October CPI has come in marginally on the soft side of consensus, with the core rising 0.3% m/m against a market consensus of 0.4%, although the y/y rate was still in line with expectations at 3.4%. Services inflation was lower than expected at 0.2% m/m and 4.5% y/y. Stronger than expected PPI output data was offset by weaker than expected PPI input numbers. While the data is close to expectations, the weakening of services prices supports a BoE rate cut in December, and should maintain an upside bias to EUR/GBP. However, with a rate cut already 80% priced in, the upside scope is quite limited, and we would still expect it to be hard for EUR/GBP to break above 0.8850 near term.