CHF, AUD flows: CHF soft, AUD has recovery scope

CHF increasingly the preferred funding currency. AUD has scope for recovery given extended short positioning

Swedish PPI data early on is on the strong side of expectations, but hardly strong, at flat m/m, and EURE/SEK is not much changed, with the economic tendency survey at 08:00 GMT more of a focus ahead of tomorrow’s Riksbank meeting.

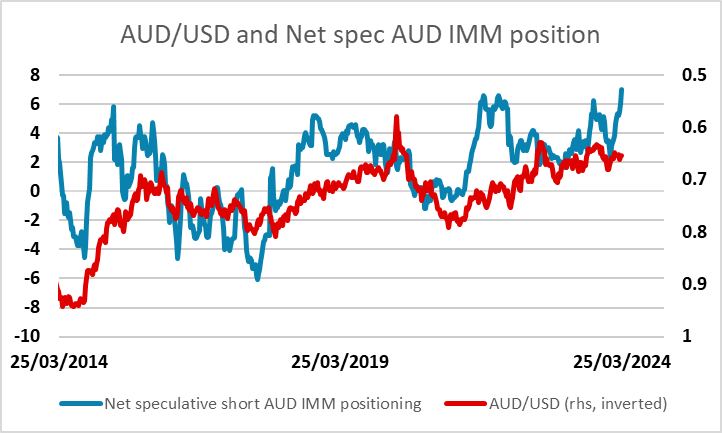

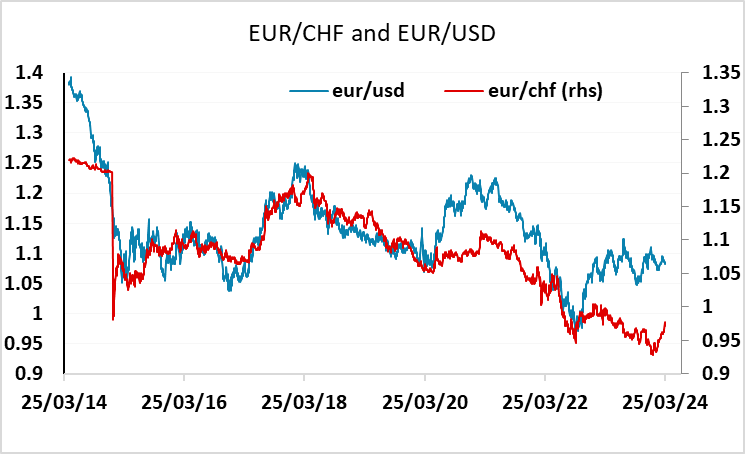

FX wise, the main trend in the last 24 hours has been weakness in the CHF, with EUR/CHF up 60 pips since the open on Monday. The CHF has been on the back foot since the SNB rate cut last week, and looks to have taken over the mantle of preferred funding currency from the JPY. Japanese finance minister Suzuki escalated the level of verbal intervention overnight by saying he won't rule out steps to address disorderly FX moves, and this should discourage JPY bears. There is also a mild positive risk tone in general, with a modest recovery for the AUD and small EUR/USD and GBP/USD gains overnight. It was notable in the latest CFTC data that net short speculative AUD positioning reached a record level in last Tuesday’s data, and even though there isn’t a great deal of correlation between the AUD and the CFTC data, we would favour the AUD for risk positive trades.