UK Labor Market: Clearly Softening Wage Growth

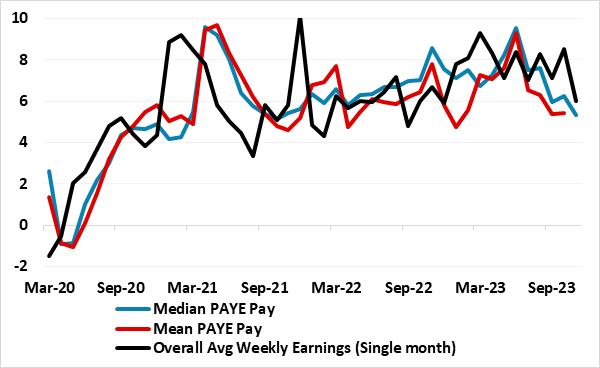

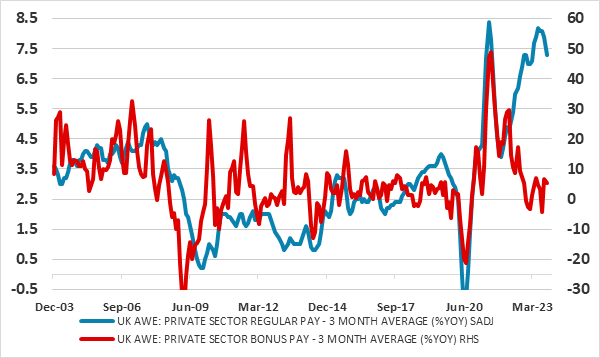

As we have underscored repeatedly, the BoE has come to regard the official average earnings data with some suspicion; after all, until the latest they have been yet to show any sign of material slowing in pay growth despite clear signs of a looser labor market, most notably evident in a further drop in vacancies in the latest data. But such signs of looser labor market, in still somewhat curtailed labor market numbers out today, also show a further and sizeable drop in mean and median pay growth, at least according to alternatively sourced numbers from the UK tax authority. But even the official earings data are belatedly showing some easing (Figure 1), now chiming with the mean and median pay numbers. Regardless even in the official labor force data there are increasingly clear signs of slowing wage pressures, most discernibly in terms of the manner flagged by weaker bonus growth (Figure 2). The latter is something the BoE will be paying ever clearer attention to and drawing reassurance from as it assesses that signs of more persistent inflation pressures have started to abate.

Figure 1: Pay Pressures Easing Clearly?

Source: ONS, HMRC

Official ONS labor market data showed average earnings growth down a little more than expected at 7.3% but with the ex-bonus measure also down and to a lower rate at 7.2%. But this data still may be too backward-looking, something we have been suggesting for some time and a view that the BoE has taken on board of late. Indeed, in the minutes to the September MPC decisions, it was noted that ‘the recent path of the average weekly earnings (AWE) is, however, difficult to reconcile with other indicators of pay growth’. This was echoed even more so in the minutes to this month’s meeting

As for the other indicators of pay growth, the most notable and possibly more definitive if the mean and median pay growth produced by the HMRC, the UK’s tax authority. Other measures such as the Bank’s Agents were continuing to report that average annual pay settlements were in the region of 5 to 5½%, with contacts expecting settlements to begin to drift down and for there to be fewer additional payments provided to compensate for a higher cost of living..

Figure 2: Bonus Pay Slowing points to Overall Pay Following Suit?

Source: ONS, HMRC, % chg y/y

However, the HMRC data are now very much showing a clear slowing (Figure 1) with median pay levels dropping in October and the growth rate hitting an 18-month below 6% and the mean rate even low at 5.4%, the lowest rate of growth since April 2022. Regardless even in the official labor force data there are clearer signs of slowing wage pressures, most discernibly in terms of the manner flagged by weaker bonus growth (Figure 2). This makes sense as bonus pay growth will usually ebb ahead of regular pay both as fewer hours and overtime are worked and firms are less pressurized to react to labor market shortages.