USD flows: USD rises after stronger PPI

USD up after stronger PPI

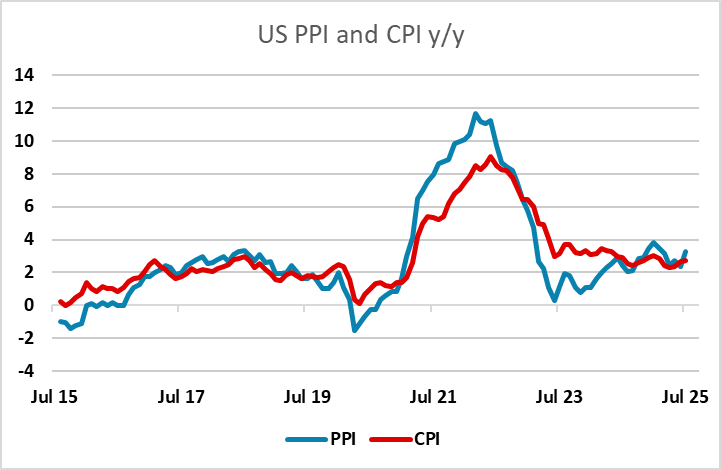

Much stronger than expected US PPI has sent the USD higher and equities lower. Both headline and core are up 0.9% m/m against a market consensus of a 0.2% rise. Front end US yields are also slightly higher, but yield rises may be being restricted by the negative equity market reaction. The lack of significant US yield rises and the negative equity market reaction, if they persist, shouldn’t see the USD holding onto its gains against the JPY. The fact that the rise in PPI was services led suggests it isn’t mainly due to tariff effects. Although goods price increases were also above consensus, services led the way. There may be some erratic element to the data, so we wouldn’t put too much weight on it at this stage, but if the negative equity market reaction persists expect the riskier currencies to struggle against the USD and JPY.