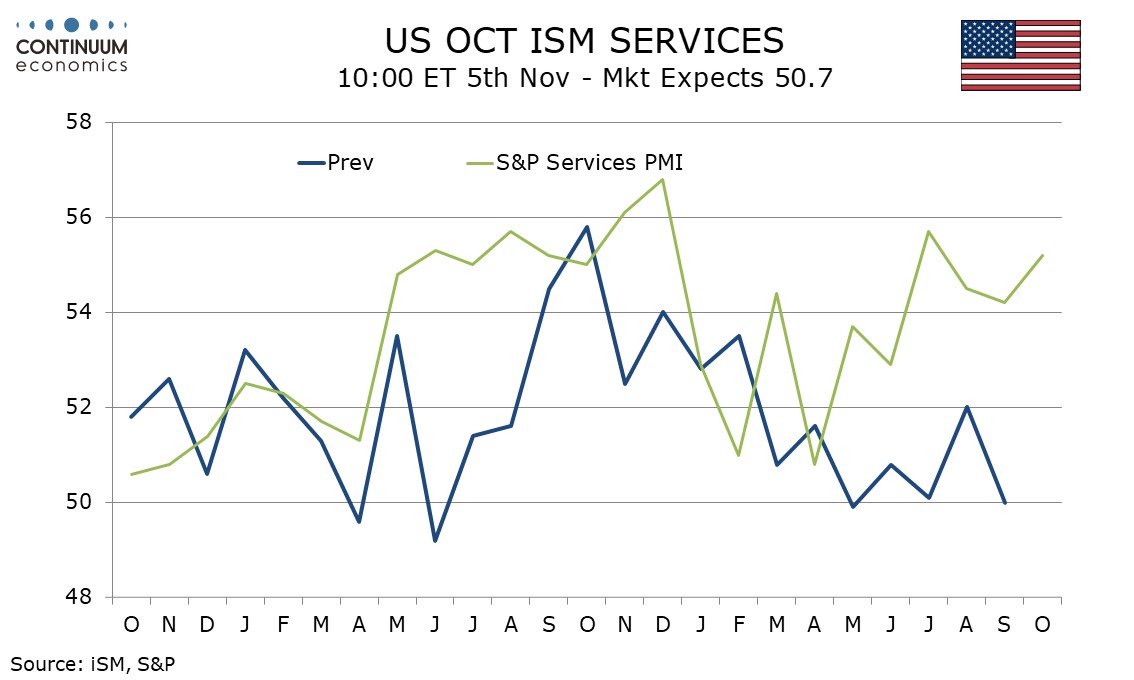

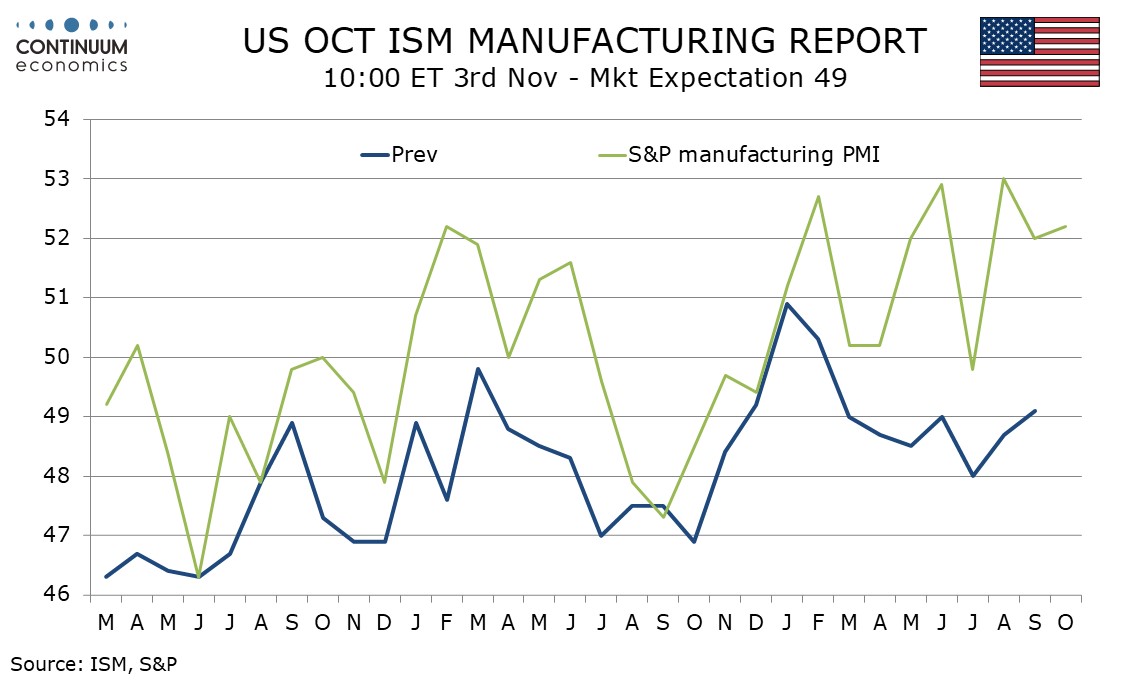

U.S. October S&P PMIs - Positive signal more reliable for ISM manufacturing than ISM services

October’s preliminary S and P PMIs are unexpectedly stronger, manufacturing marginally at 52.2 from 52.0 and services significantly at 55.2 from 54.2, The services index may be getting support from Fed easing and may not be a reliable guide to ISM services data.

The improvement in manufacturing sustains a positive picture that has largely been in place though 2025 to date, outperforming ISM manufacturing data. Regional manufacturing surveys are on balance positive in October to date, with Empire State and Kansas City Fed data improved, and a softer Philly Fed reading less weak in its detail. This argues for some improvement in October’s ISM manufacturing index from September’s 49.1, possibly even to neutral.

The S and P’s services index resumes a positive picture after two straight slowing from July’s 55.7. The index has been showing a positive picture after falling to near neutral at 50.8 in April, and improvement not matched by ISM services data which has remained not far above neutral. Here early October regional data is weaker, both the Philly Fed and Empire State service sector service sector surveys being increasingly negative. The S and P services PMI has historically shown more sensitivity to interest rates than other service sector surveys, and we suspect this will help explain a likely outperformance of October ISM services data.