JPY flows: JPY rallying without an obvious trigger

The JPY correction higher is overdue, and should have further to go, but weaker risk sentiment is needed to create a positive JPY trend

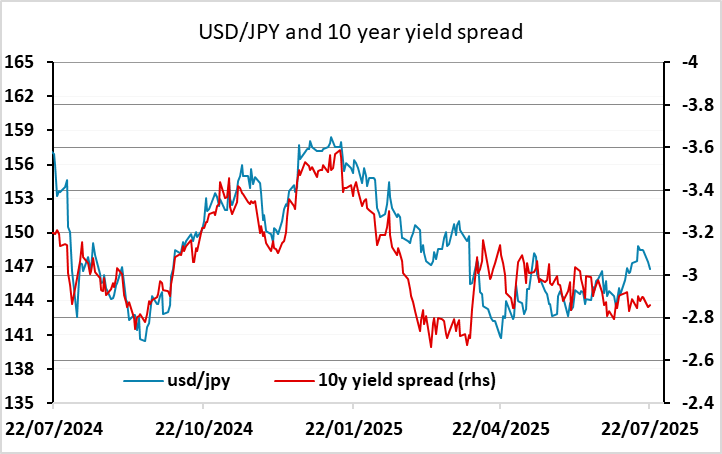

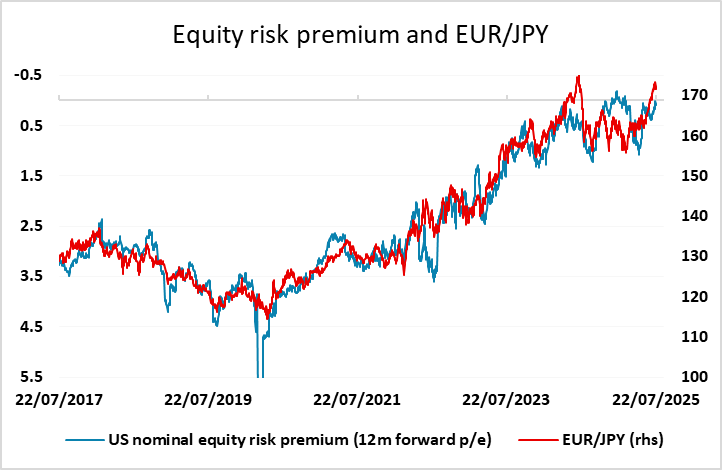

The JPY is showing some sharp gains early in the US session, building on the strength seen on Monday. There is no obvious trigger, with yields and equities both little changed on the day, but a JPY recovery was overdue after two months of weakness, particularly on the crosses. As we noted in our daily, and in earlier comments this morning, both the USD/JPY correlation with yield spreads and the EUR/JPY correlation with risk premia suggested the JPY had overshot, and with eight consecutive weeks of EUR/JPY gains up to last week, it is not surprising that we are seeing some correction. As far as we can tell, there is only one instance of nine consecutive weeks of EUR/JPY gains in the history of the EUR, and it came from nearly 50 figures below current levels.

There is sufficient uncertainty around tariffs, the status of Powell at the Fed and the high valuation of the equity market to justify a correction. That it is coming this week partly reflects the lack of news. It is often the case that medium term issues only come to the fore when there is little short term news. Yield spreads suggest USD/JPY has scope to 144 just to reconnect with the most USD favourable version of the yield spread relationship, while EUR/JPY has scope sub-170 to move back in line with risk premia. This doesn’t mean we are necessarily going to see a restart of a positive JPY trend. That will likely require more negative risk sentiment and either lower US yields or lower equities (or both). We do expect this in the longer run but for now the move is corrective.