U.S. Initial Claims correct higher but still low, Few scares in Q4 Productivity and Costs report

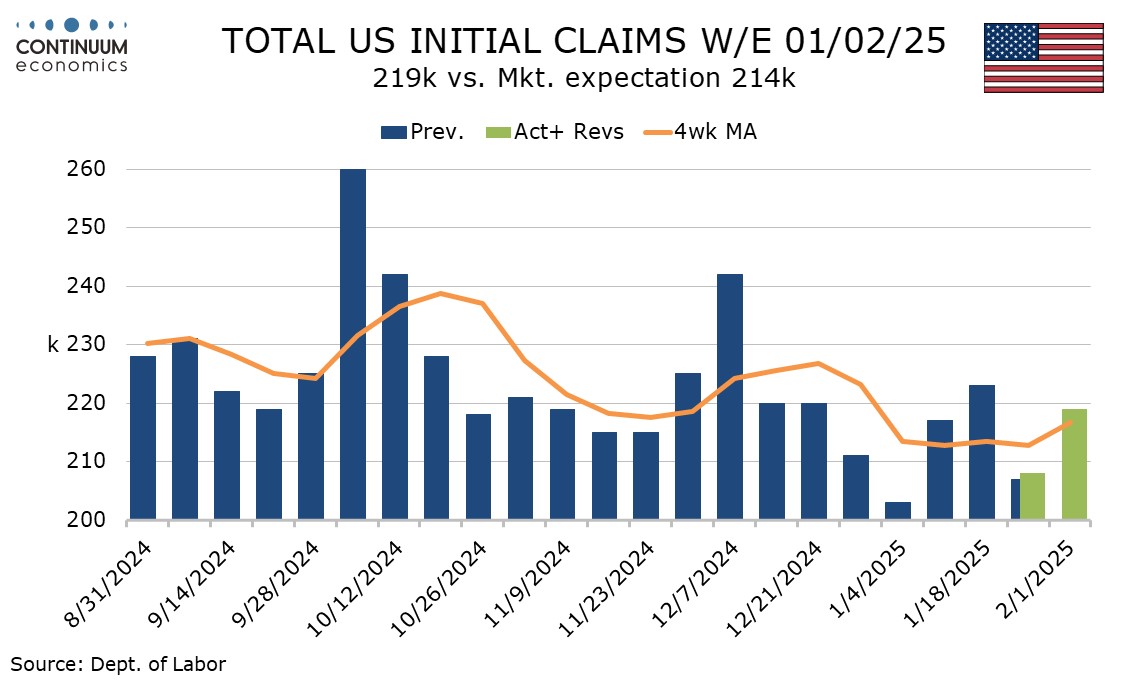

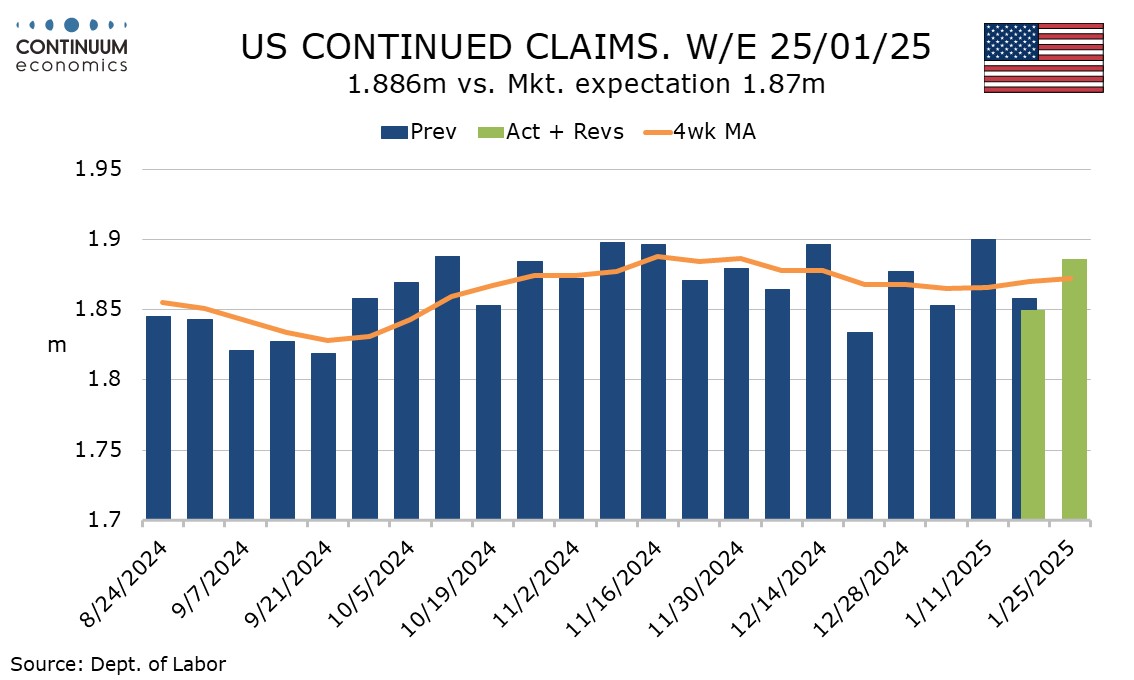

Initial claims at 219k have corrected higher from last week’s 208k which was the lowest since February 2024 but remain consistent with a healthy labor market. Continued claims with a 36k rise to 1.886k have also corrected higher following a preceding 50k decline.

Last week’s very low initial claims data may reflect seasonal adjustment issues for the week that included the Martin Luther King Day holiday, but the 4-week average has remained low and the continued claims 4-week average has stopped rising.

While we expect January’s non-farm payroll to come in at a below trend 125k due to bad weather, the initial claims data, and yesterday’s ADP report, a series that is less weather-sensitive, suggest underlying labor market strength persists.

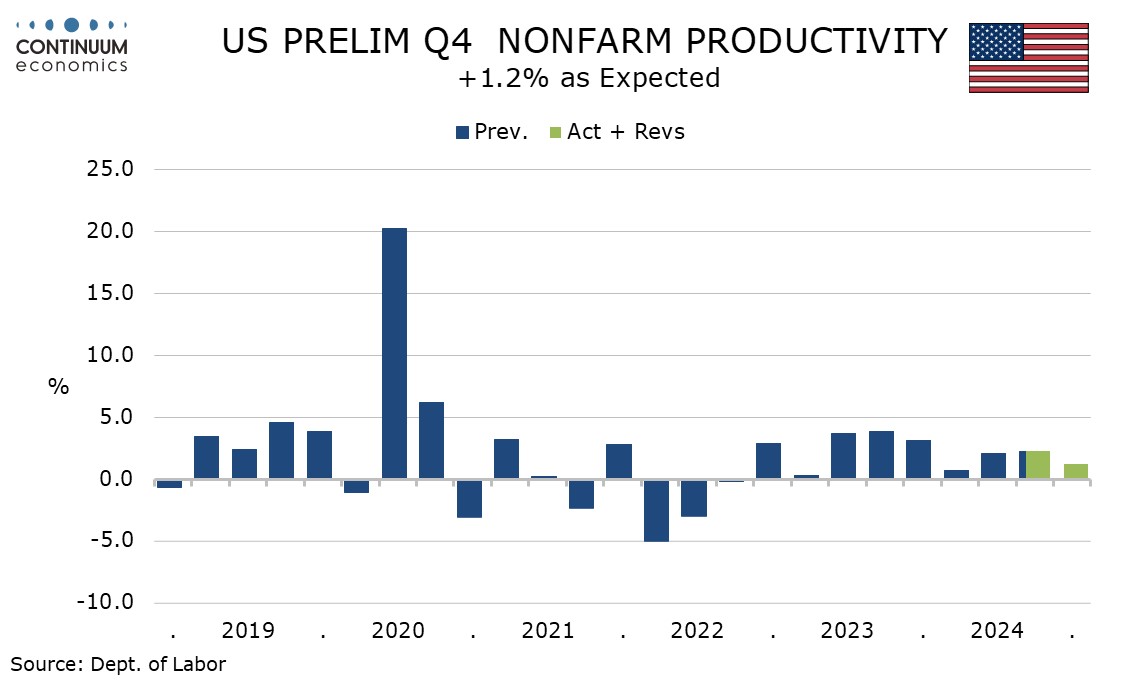

Q4 non-farm productivity at 1.2% was slower than the preceding two quarters but in line with market expectations, reflecting a 2.3% rise in private output as seen in GDP data and a 1.0% rise in aggregate hours worked, slightly slower than a 1.4% rise suggested by payroll details.

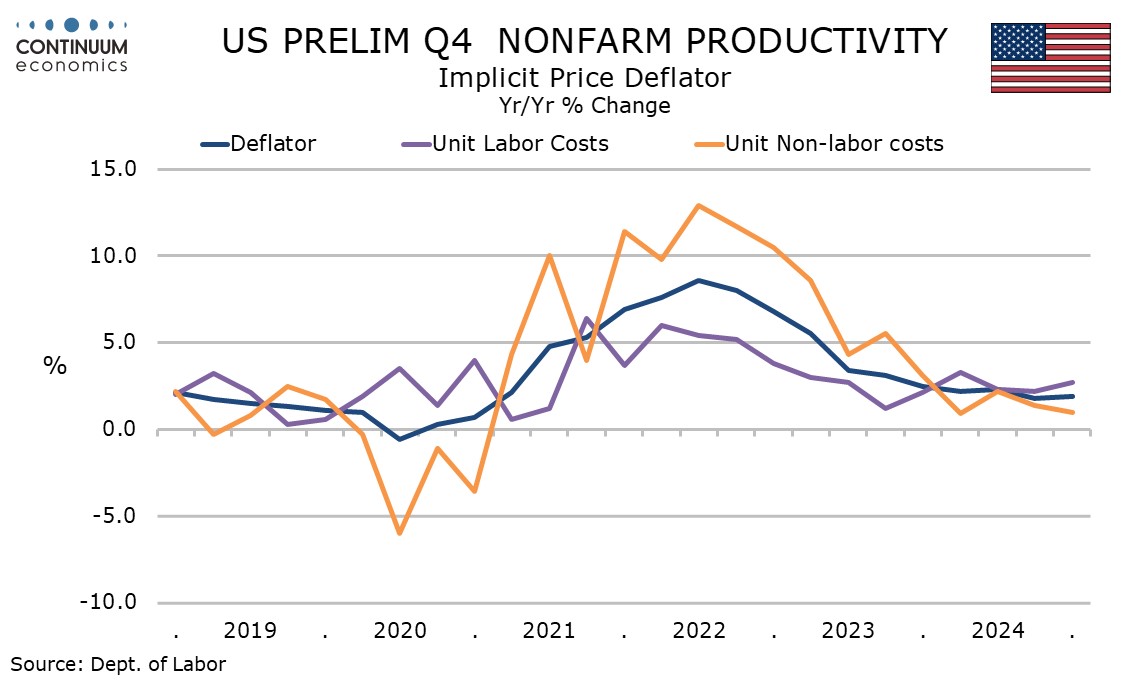

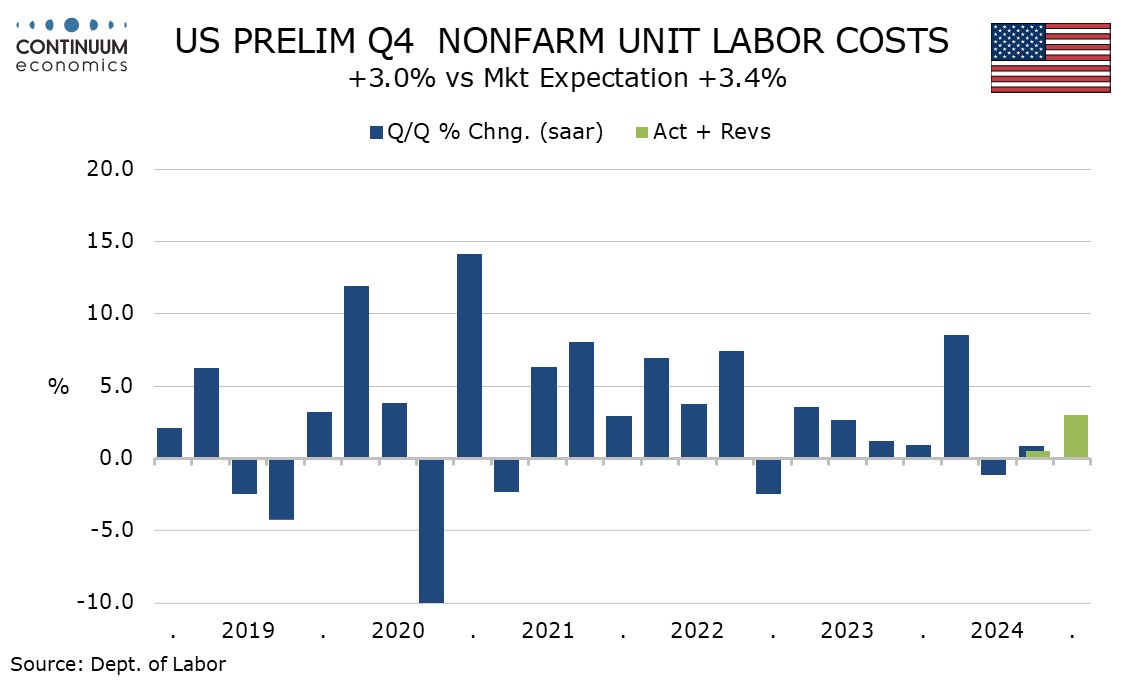

Unit labor costs at 3.0% were a little softer than expected but stronger than in the preceding two quarters as a stronger 4.2% increase in compensation exceeded the productivity gain. Non-labor costs rose by only 0.2% however, meaning that the overall deflator was up by a moderate 1.7%.

Yr/yr growth in the overall deflator at 1.9% looks consistent with the Fed’s 2% inflation target. Unit labor costs are up 2.7% yr/yr, a 3-quarter high, while productivity at 1.6% yr/yr is at a 6-quarter low.