SEK flows: SEK not much changed despite dovish Riksbank

Riksbank indicating much steeper rate cuts but SEK little changed as yields beyond the very front end stay steady. But SEK risks on the downside especially against the NOK.

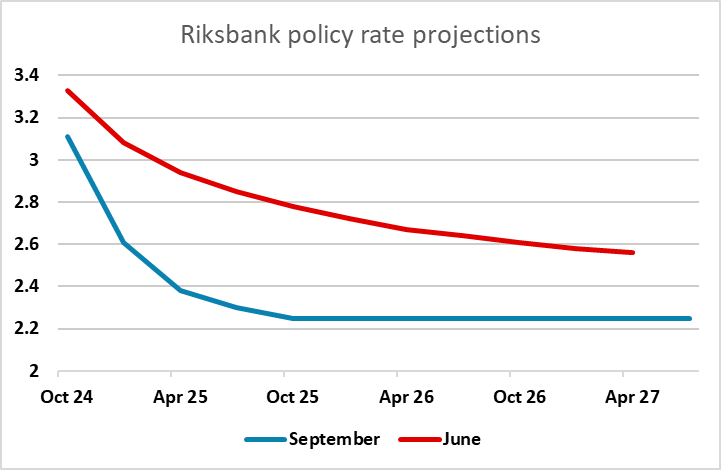

The Riksbank cut rates 25bp as expected, but the statement was more dovish than expected and the projections in the monetary policy report show a much lower trajectory for the policy rate. The statement also indicated that there was a possibility of a sharp 50bp cut in rates at one of the two remaining meetings this year. Ahead of the meeting, the market was pricing 78bps of rate cuts this year. In the wake of the statement this has been increased to a total of 88bps (63bps in the last two meetings).

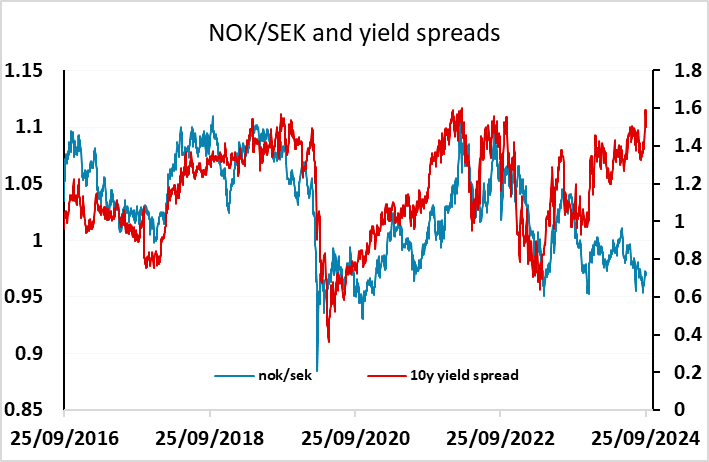

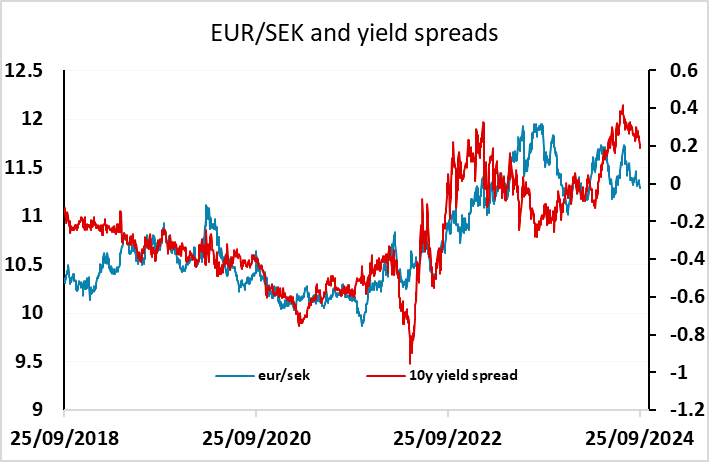

So the statement was clearly more dovish than the market had been pricing in, but after a brief surge higher, EUR/SEK is now nearly unchanged form opening levels. This is partly because Swedish yields beyond the very front end are not much changed, but the correlation with yield spreads has been fairly weak this year in any case. Even so, there does look to be some downside scope for the SEK from here due to the easier policy outlook, both against the EUR and the NOK, but particularly the NOK with the Norges Bank holding a much more hawkish policy line and yield spreads pointing to substantial NOK/SEK gains.