CAD flows: Two way risks after better trade data

CAD little changed after trade data. Risks remain two way

Canadian trade numbers show a small surplus against market expectations of a small deficit, but the market isn’t too interested in such data at the moment. Even so, the CAD is in an interesting position here.

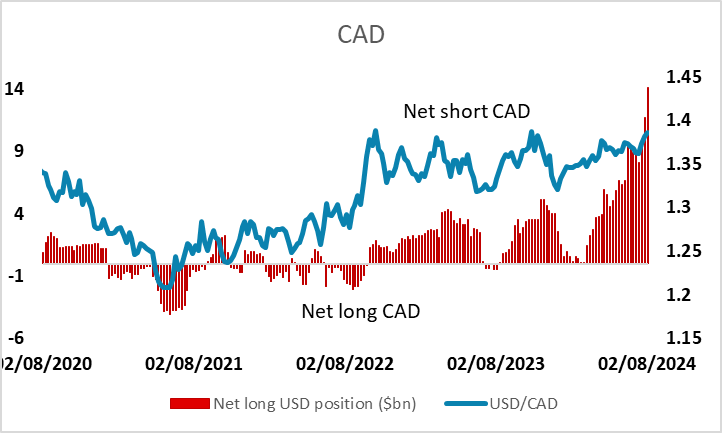

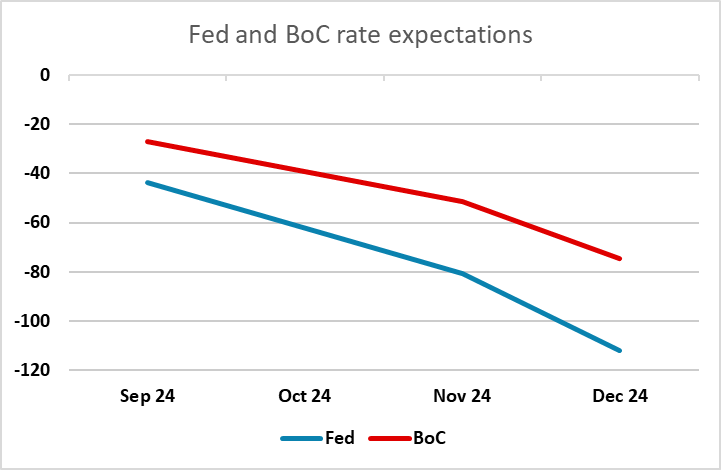

Current short end yield spreads broadly support the current USD/CAD level, but these levels assume a very dovish Fed, with 200bps of easing over the next year, and 112bps by year end compared to 74bp from the BoC. If risk sentiment recovers after the recent panic, the market is likely to reduce the Fed tightening priced in, so spreads might move in the CAD’s favour. But such risk positive news would normally be favourable for the CAD. At the same time, the latest CFTC data shows record speculative net short CAD positions, which suggests a big CAD upside risk if we get a turn in the USD/CAD trend lower.

From here we would expect some consolidation. We see the recent equity market weakness as a result of overvaluation rather than significant news. We don’t see any major negative news emerging, with a slowdown rather than a recession in the US. But equity valuations are still expensive, so we doubt there will be much of an equity market bounce. Risks look to be more towards further risk weakness rather than major recovery, and that suggests that immediate risks are more towards USD/CAD gains towards 1.40. But if there is a significant risk recovery, positioning may allow a sharp CAD recovery.