Mexico GDP Preview: Stagnation in the First Quarter

INEGI will release Mexico's Preliminary GDP data, indicating 0% growth in Q1, likely due to stagnation in key sectors like manufacturing and construction. The service sector, hit hard by the pandemic, also shows signs of sluggishness. While recovery is expected, sustained poor growth raises concerns. This weaker growth will likely boost Banxico’s confidence to continue with the policy rate cuts.

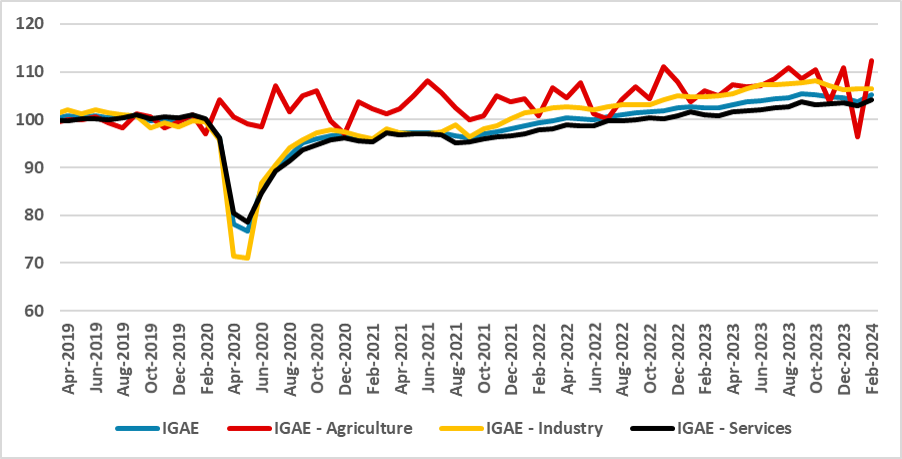

Figure 1: Mexico Global Activity Index (IGAE, 2019 = 100, Seasonally Adjusted)

Source: INEGI

The Mexican National Statistics Institute (INEGI) will release the Preliminary GDP data for Mexico. We forecast the Mexican Economy to have grown 0% during the first quarter, showing some sort of stagnation in the quarter. The main activity index for Mexico (IGAE) is showing a bleak picture. First, the main motor of the Mexican economy, the Industrial Sector, is somehow showing some stagnation. This is likely related to two factors: the demand from the U.S. is somehow stagnating, which limits the potential growth. Manufacturing is showing signs of stabilization, while the Construction sector is also decelerating. It is very likely that we will see some recovery of the Construction sector in the upcoming months as the Construction projects financed by the government kick in.

In the Services sectors, it is also giving signs of stagnation. The services sector was the most affected by the pandemic, and due to the level of damage to this sector in Mexico, a consequence of the small aid package offered by the government, its recovery was also lagged. Therefore, even the services growth seen in 2023 could still be related to the recovery of this sector. Agriculture also tends to perform poorly, a consequence of the erratic raindrops seen in the interior of the country.

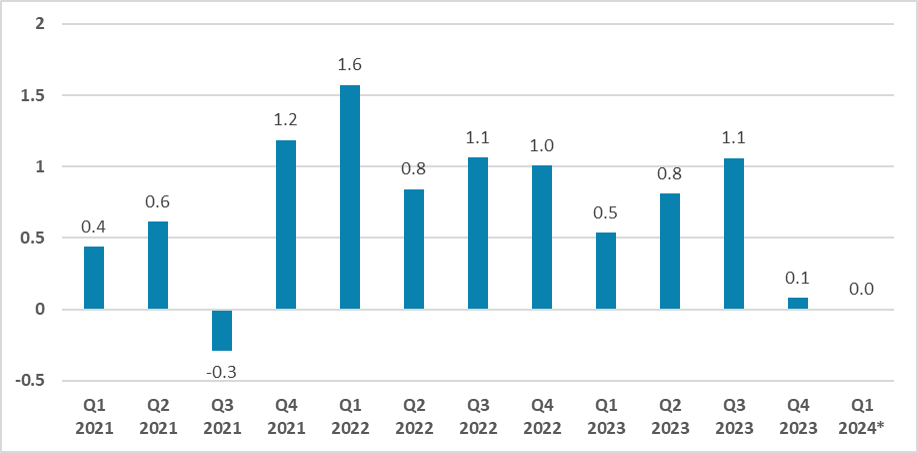

Figure 2: Quarterly GDP Growth (%, Q/Q)

Source: INEGI and Continuum Economics

Source: INEGI and Continuum Economics

With this growth, some flags could start to arise. It is the second consecutive quarter in which the Mexican economy shows poor growth. We believe these slower numbers in terms of growth could still be affected by the lagged effects of tight monetary policy. The weaker numbers will likely be reversed in the next quarters, but this momentary weakness will possibly give confidence for Banxico to continue cutting the interest rate, although we don’t see them accelerating from the current 25bps pace.