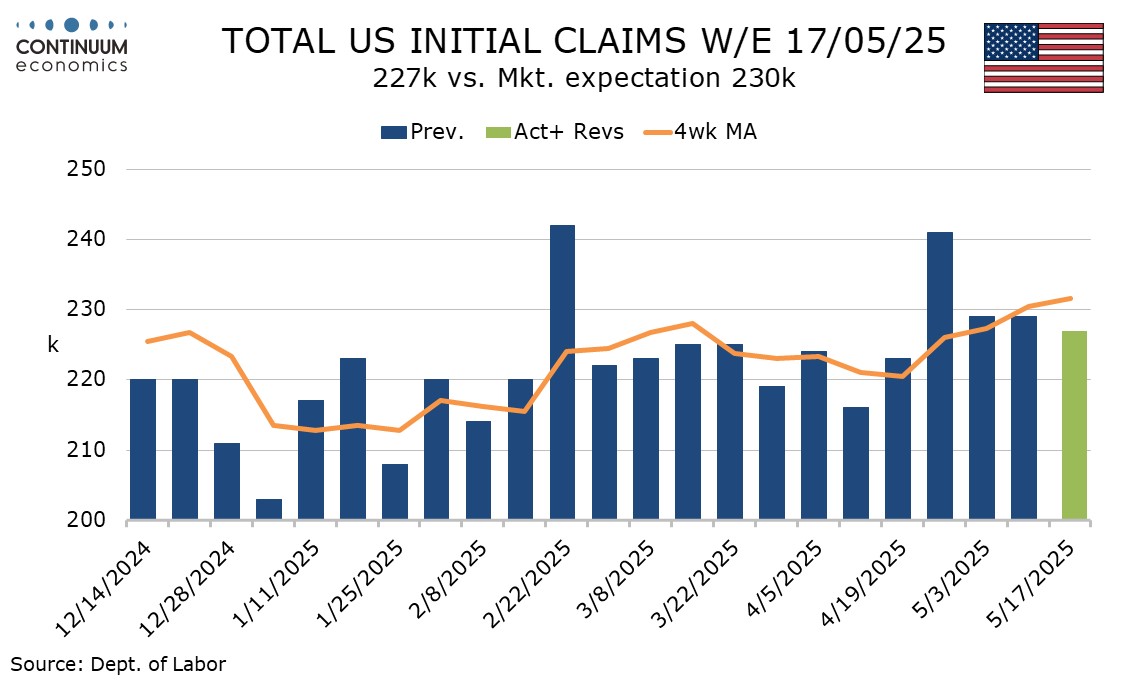

U.S. Initial Claims slip, trend moving up but only slowly

Initial claims have seen a modest decline to 227k from 229k in the latest week, the survey week for May’s non-farm payroll. Trend is creeping higher but consistent with only a marginal slowing in the labor market, with no recessionary signal.

The 4-week average of 231.5k is the highest since August 2024 but inflated by a figure three weeks ago that was lifted by temporary Easter-related layoffs in New York schools. Still, the last three weeks, two at 229k and this week at 227k have been exceeded this year only by two weeks, both subject to holiday distortions (Presidents’ Day and Easter).

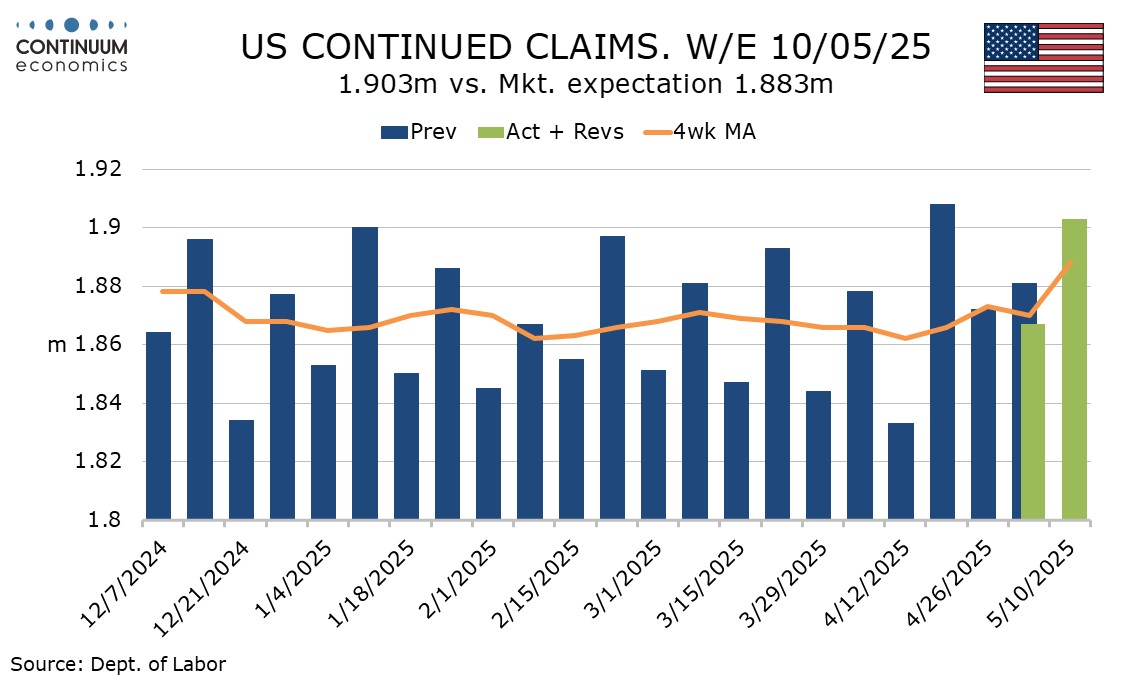

Continued claims cover the week before initial claims. The latest week saw a 36k rise to 1.903m, though that follows a decline of 5k in the preceding week (after a downward revision to 1.867m from 1.881m) and 36k in the week before that. The 4-week average of 1.888m is the highest since a matching total in November 2024, which was the highest since December 2021. Again, the message is for a modest slowing in the labor market but with no recession signal.