Published: 2025-10-23T13:47:44.000Z

Preview: Due October 31 - Canada August GDP - A flat month to follow the first rise in four months

3

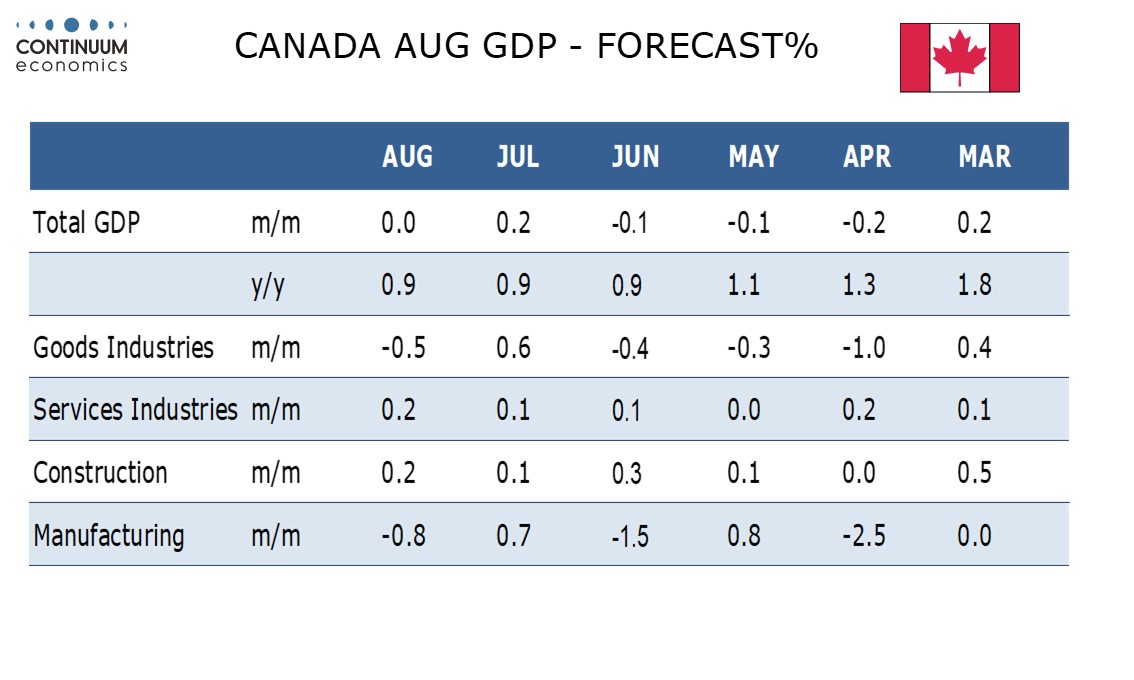

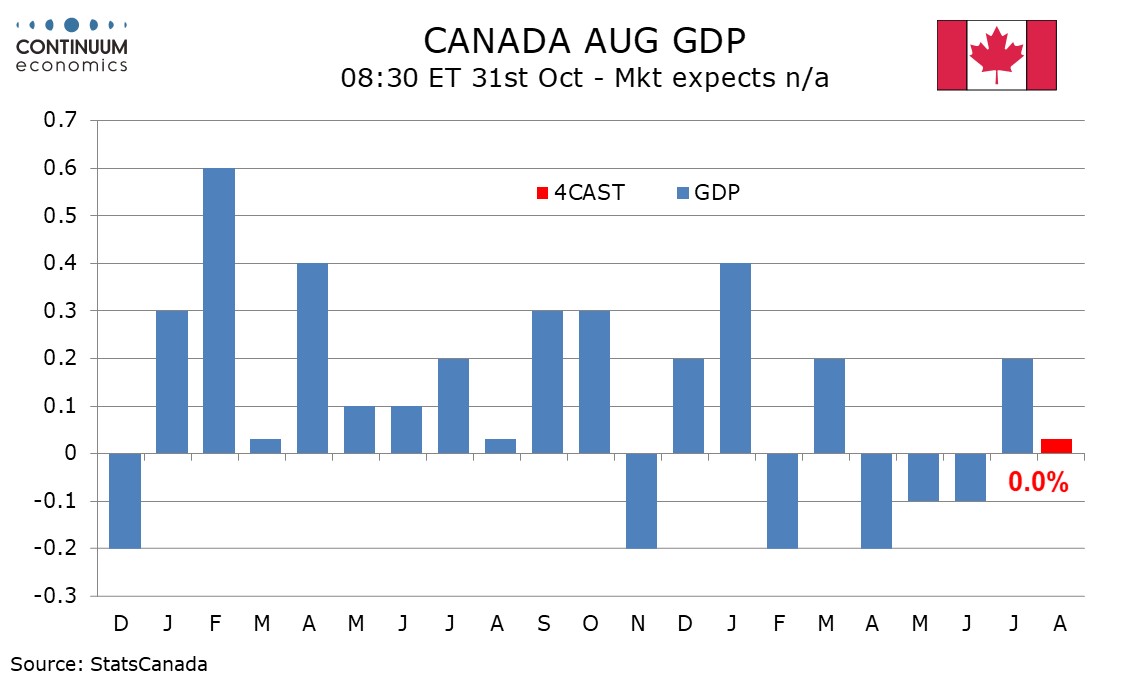

We expect August Canadian GDP to be unchanged after a 0.2% July increase that followed three straight monthly declines in Q2. If September is also unchanged that would imply a modest annualized gain of around 0.7% in Q3 after a negative Q2.

We expect details to show a 0.5% decline in goods output on weakness in mining and manufacturing, the latter as implied by August’s monthly manufacturing report, but a 0.2% rise in services, which would be the strongest gain in that sector since April. A positive month for retail sales is likely to lead the rise in services. A decline is however seen in transportation and warehousing.

Yr/yr GDP is likely to remain at the 0.9% pace seen in June and July. The economy appears to be stabilizing after a Q2 decline that came largely on a sharp fall in exports as US tariffs were implemented, but is still performing below potential. Early September signals are positive for manufacturing but negative for retail, in each case reversing direction from August.