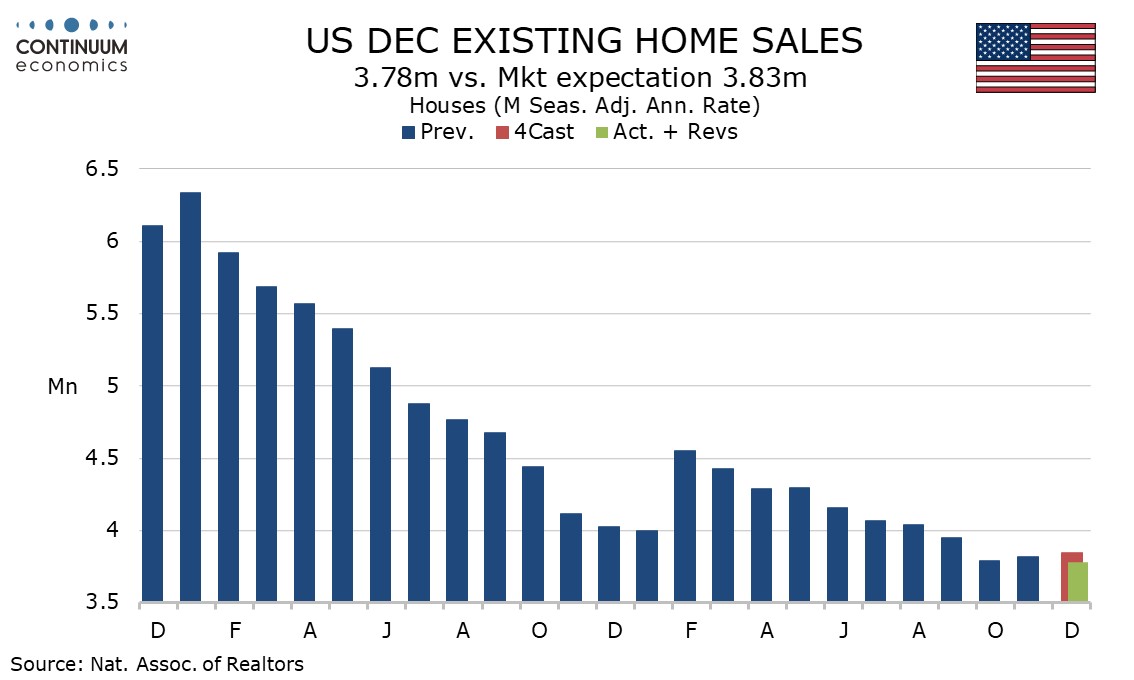

U.S. January Michigan CSI up sharply, December Existing Home Sales remain weak

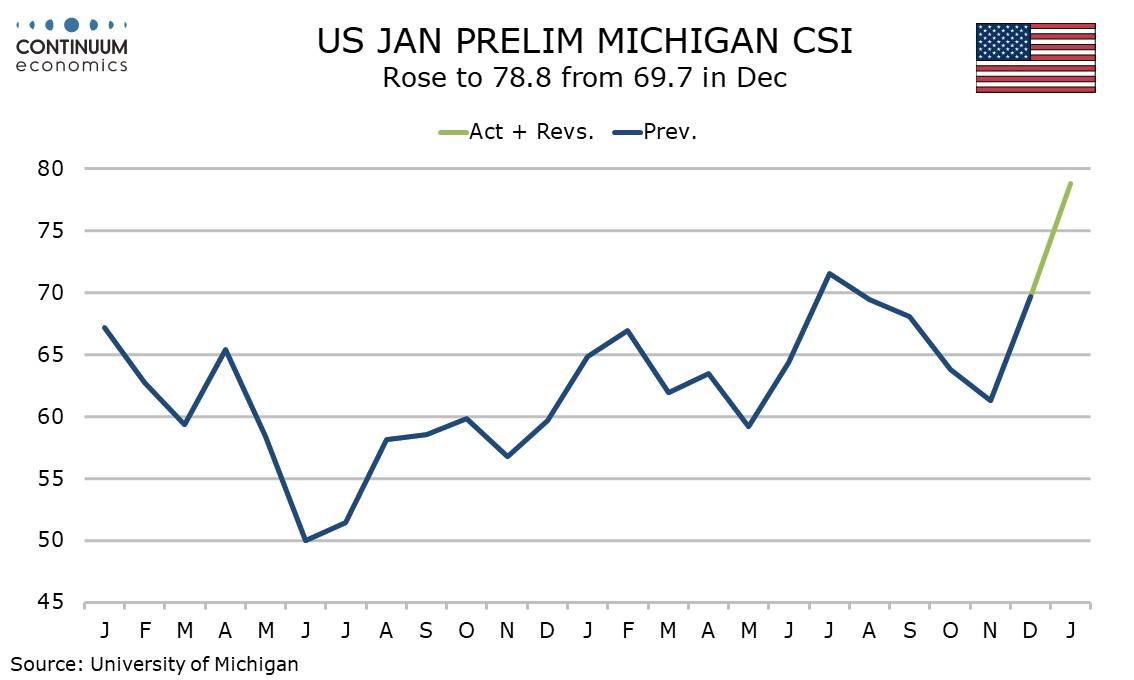

January’s preliminary Michigan CSI of 78.8 from 69.7 is a second straight strong rise and the highest since July 2021. Inflation expectations also edged slightly lower. December existing home sales however remain weak, -1.0% to 3.78m.

The latest data marks two straight strong gains in the Michigan CSI after four straight falls, which have now been more than fully reversed. Expectations for lower rates and associated gains in equities appear to have lifted sentiment.

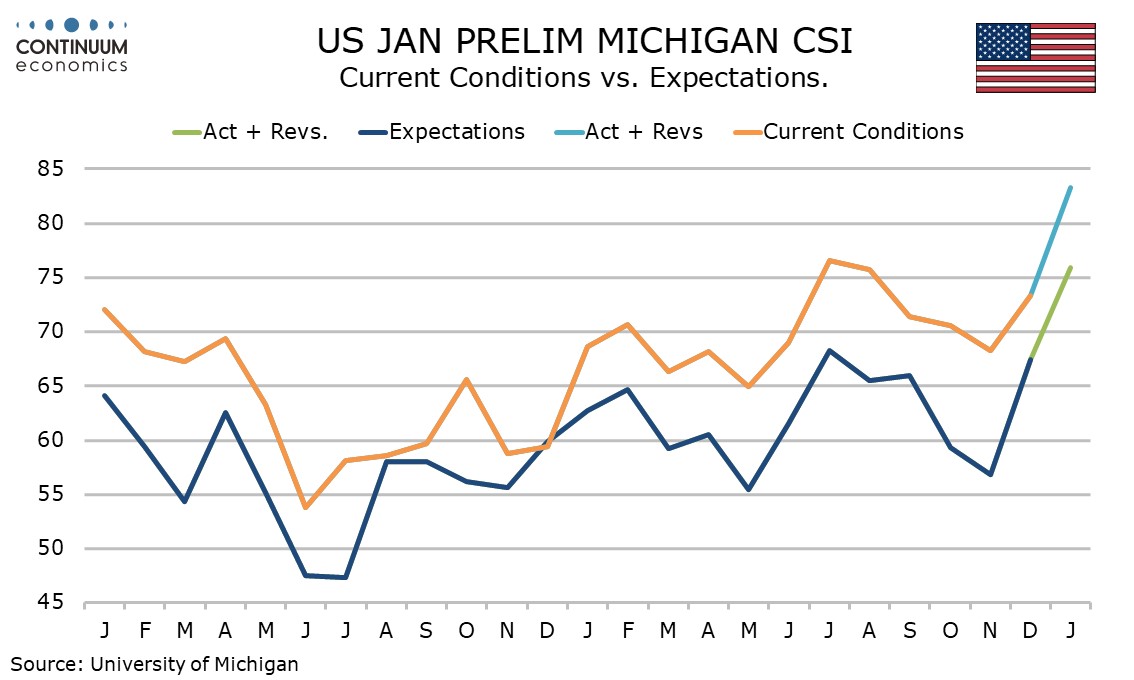

Current conditions led the increase by 10 points to 83.3, which suggests that the labor market remains strong. Expectations also saw a strong rise, to 75.9 from 67.4. Both are at their highest since July 2021.

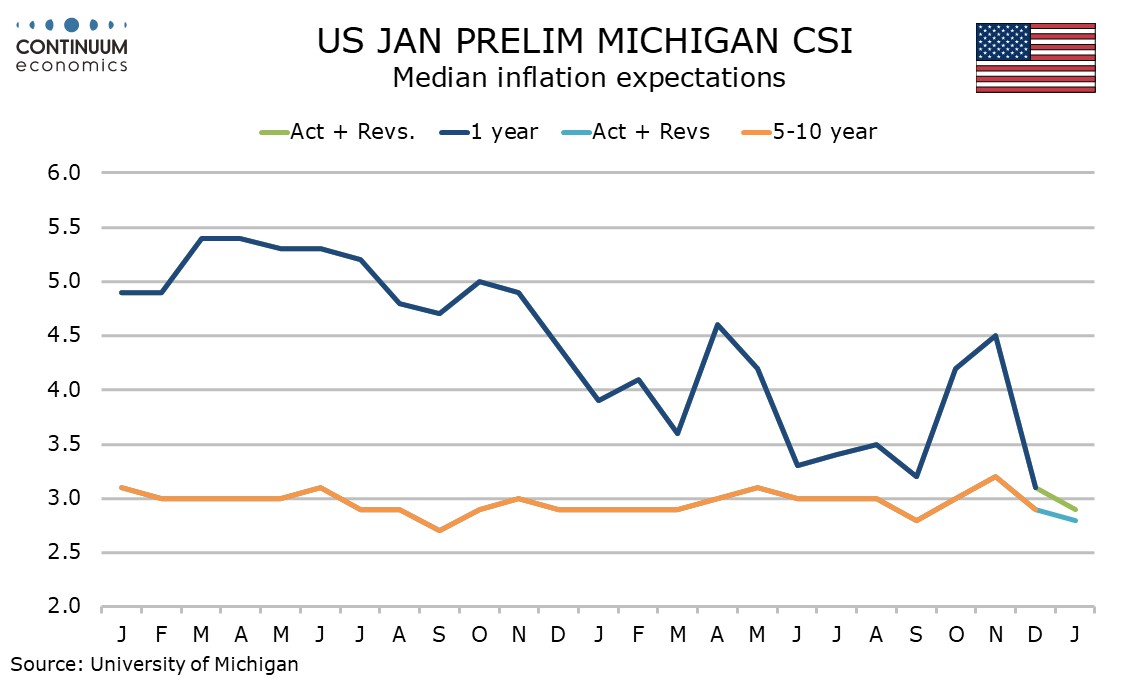

Falls in inflation expectations were modest, the 1-year view to 2.9% from 3.1% and the 5-10 year view to 2.8% from 2.9%. The 1-year view is the lowest since August 2010, while the 5-10 year view is at the lower end of what remains a tight range.

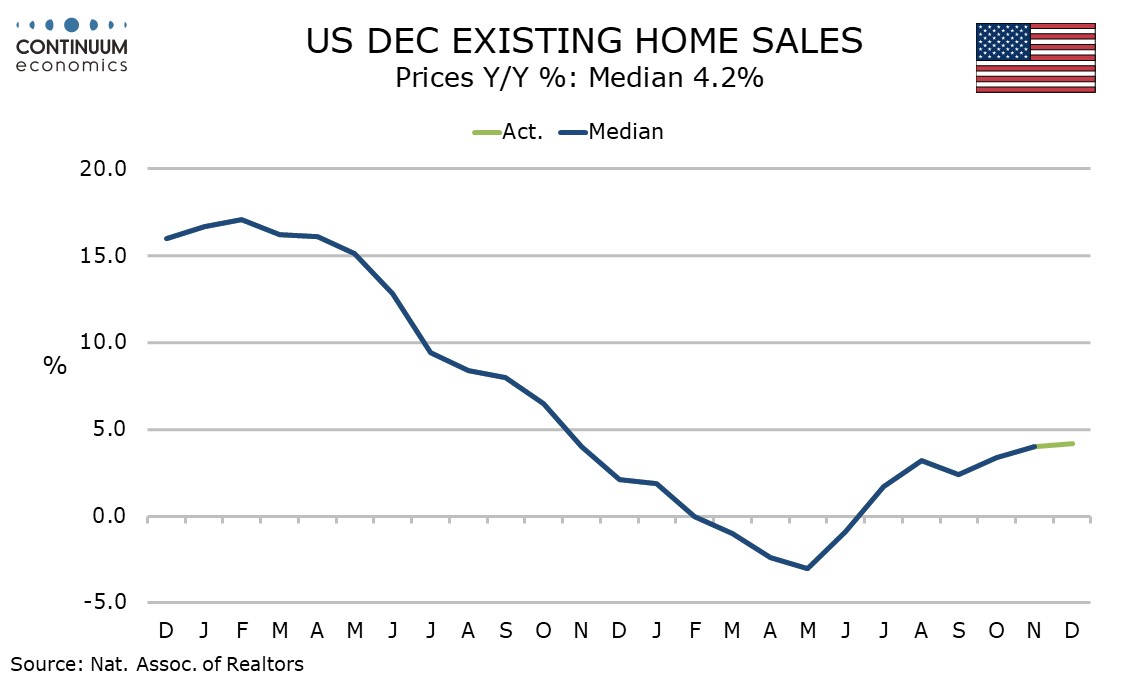

The 1.0% fall in existing home sales more than fully reverses a 0.8% November increase which was the first since May and the strongest since a sharp bounce in February. The level is the lowest since August 2010, though recent declines in mortgage rates may mean that further downside is limited.

The median price fell by 1.5%, a sixth straight monthly decline, though the declines are in part seasonal and yr/yr data edged up to a 4.2% increase from 4.0% in November.