USD flows: USD makes modest gains after mixed data

US data mixed but net slightly stronger, USD makes some gains versus JPY

The US data is mixed but net will be seen as slightly on the strong side of consensus. Probably most significant is the drop in the initial jobless claims to 236k, reversing some of the gains seen in recent weeks, although continuing claims continued to rise. Durable goods orders rose a whopping 16.4% in May, but this was almost all due to aircraft so is of limited significance. The revised Q1 GDP data was on the weak side of consensus at -0.5% q/q annualised, with consumer spending revised lower to 0.5%, but the Q1 core PCE deflator was revised a little higher to 3.5%. The May goods trade deficit was higher than expected at USD96.6bn.

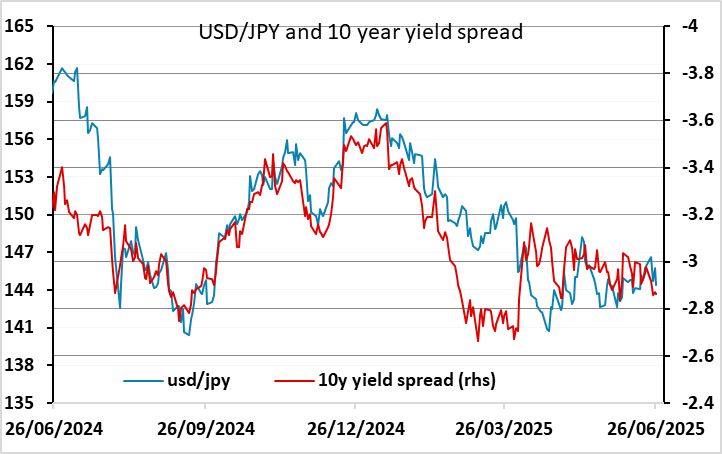

The USD initially gained on the data, but has reversed the initial gains against the EUR, with none of the data likely to have a significant policy impact. However, the USD has held onto some gains against the JPY. The rational for JPY weakness remains unclear, with equities actually softer after the data, and we would expect it to reverse.