Published: 2025-03-31T16:50:26.000Z

Preview: Due April 11 - U.S. March PPI - Ex food and energy to bounce from a weak February

6

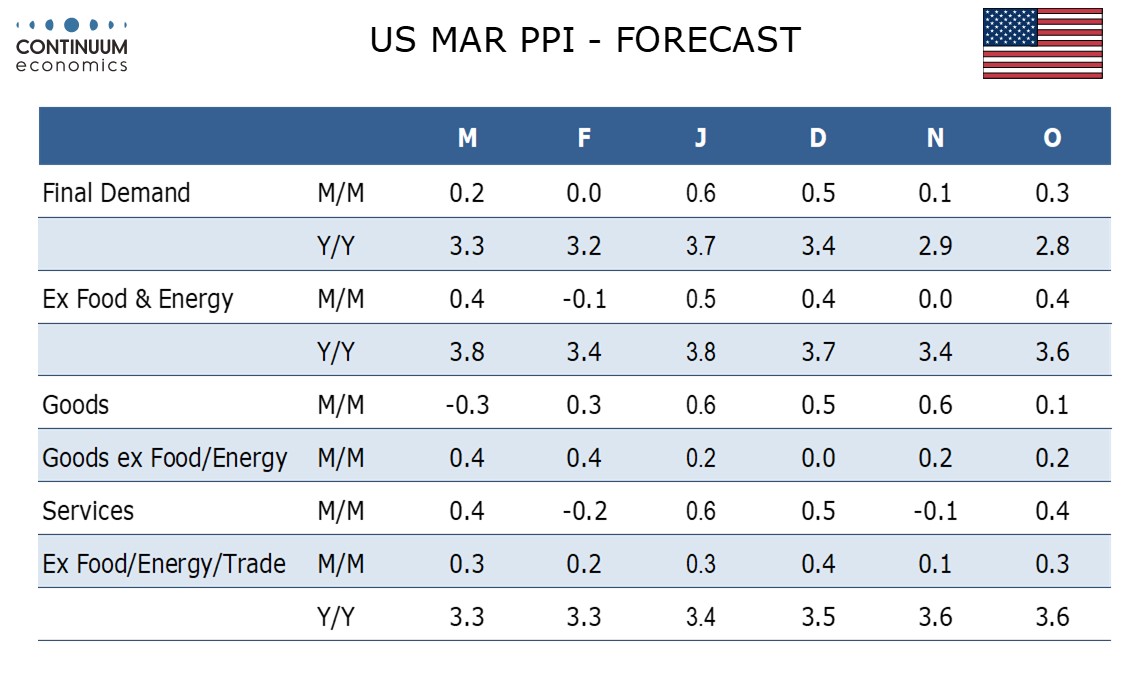

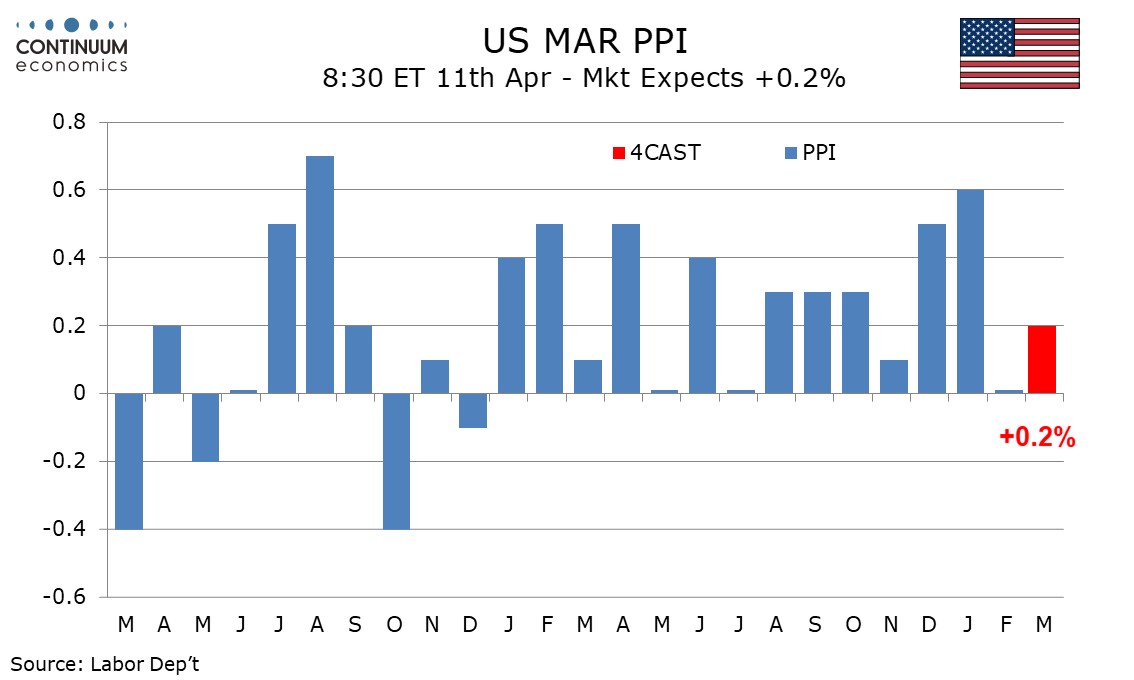

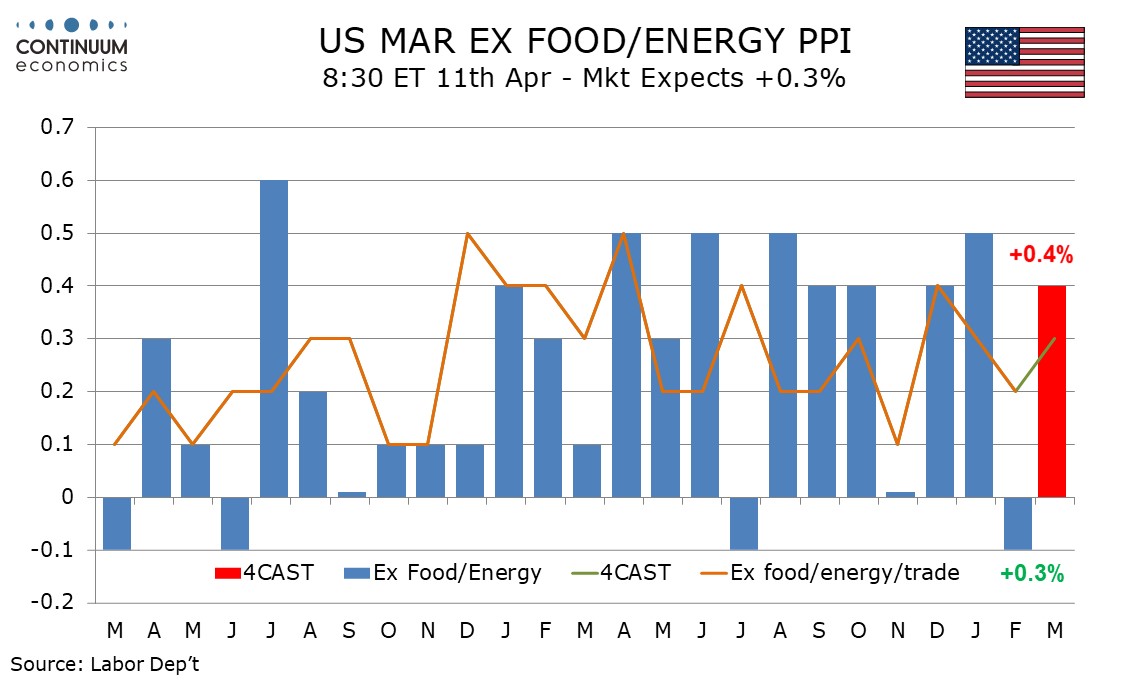

We expect March PPI to increase by a moderate 0.2% overall, restrained by dips in food and energy, but we expect a 0.4% bounce ex food and energy after a 0.1% dip in February. Ex food, energy and trade, we expect a rise of 0.3%.

Gasoline prices have slipped, and seasonal adjustments are likely to exaggerate the decline. Food also looks due for a modest correction from recent strength led by eggs.

February’s soft ex food and energy rate came despite a 0.4% rise in goods ex food and energy, which we expect to be repeated as tariff risks build. February saw service prices slip by 0.2% after a 0.6% rise in January. We expect a 0.4% rise in March, led by a rebound in trade, which slipped in February.

We expect yr/yr growth to rise to 3.3% from 3.2% overall, and to 3.8% from 3.4% ex food and energy, reversing a February dip. Ex food, energy and trade, we expect yr/yr growth to be unchanged at 3.3%.