Published: 2024-09-16T12:48:19.000Z

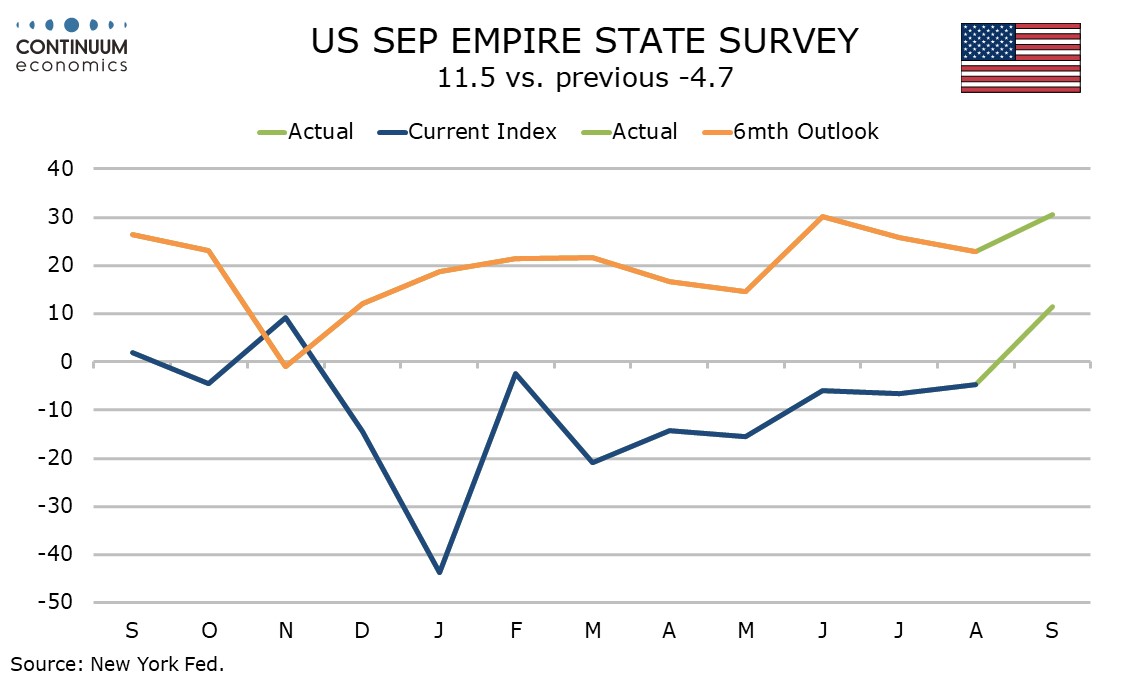

U.S. September Empire State Manufacturing Survey - first positive since November

10

September’s Empire Sate manufacturing index of 11.5 from -4.7 is the first positive since November 2023 and the strongest since April 2022. The series is volatile and should be read cautiously but argues against recent signs of economic slowing extending into risk of recession.

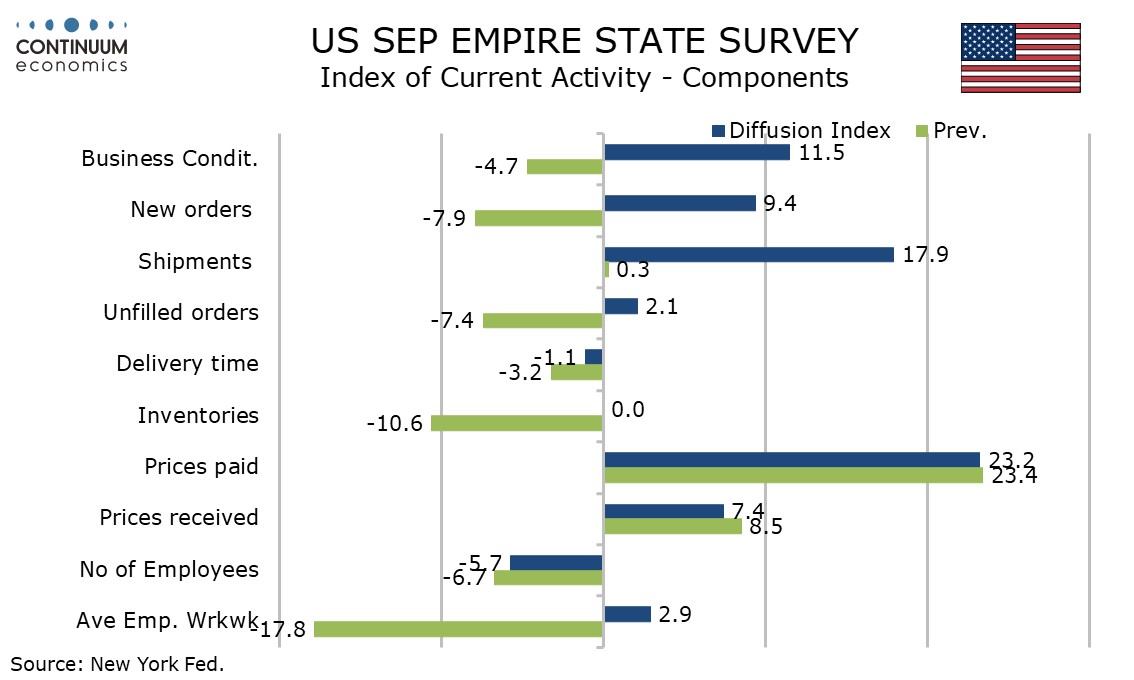

Current month data shows new orders at 9.4 from -7.9 and the workweek at 2.9 from -17.8 turning positive but employment at -5.7 from -6.7 remains negative.

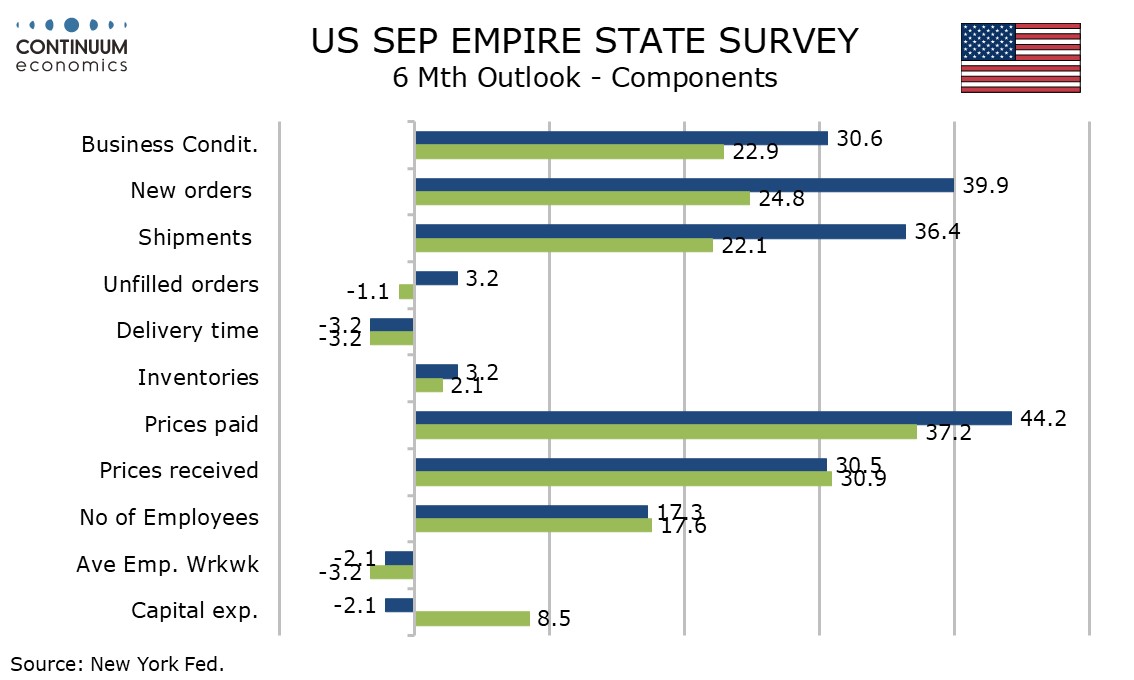

Six month expectations at 30.6 from 22.9 showed a less sharp rise but are the strongest since March 2022.

The stronger signals on activity do not appear to be having much impact on prices, with current month prices paid at 23.2 and prices received at 23.4 marginally softer, as are six month expectations of prices received at 30.5. However six month expectations of prices paid at 44.2 rom 37.2 are the highest since February 2023.