Published: 2024-09-18T13:37:25.000Z

Preview: Due September 23 - U.S. September S&P PMIs - Manufacturing less weak, Services stronger still

6

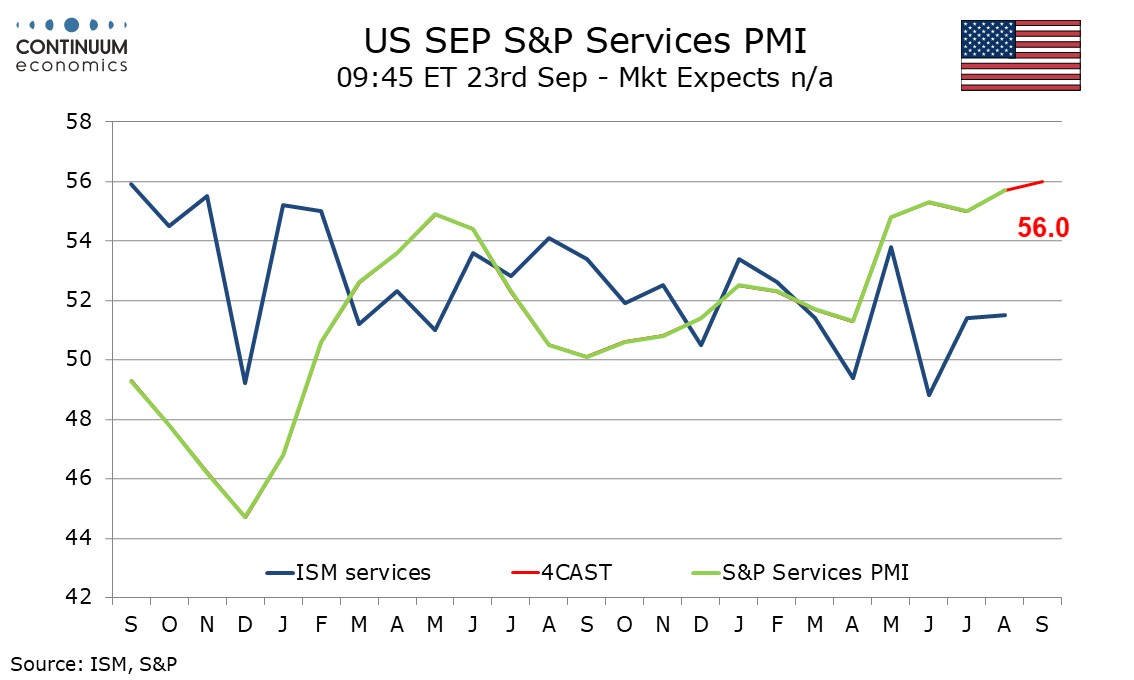

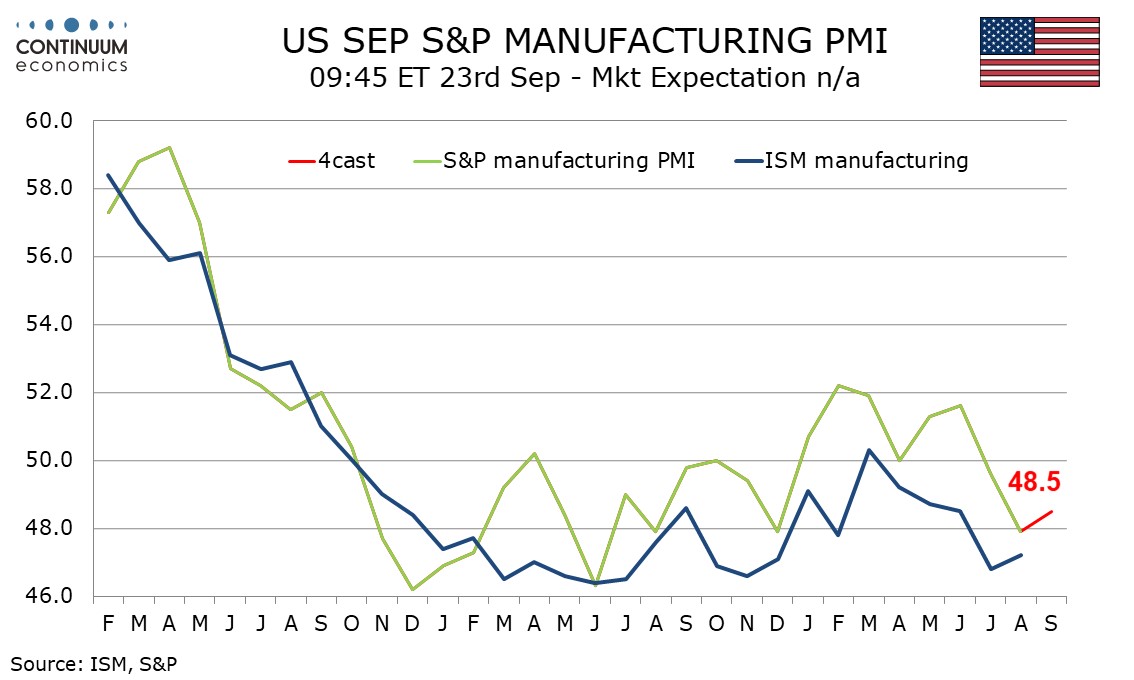

We expect September’s S and P PMIs to show modest improvements, manufacturing to a still negative 48.5 from August’s eight-month low of 47.9, 48.5 from 49.5, and services to 56.0 from 55.7, reaching the highest level since March 2022.

Manufacturing has seen two straight declines after recording above neutral readings in the first six months of the year and ISM manufacturing has been subdued too. However resilience in August manufacturing output argues against further downside.

The S and P and ISM service indices are less well correlated, with the former having been trending higher while the latter has had a marginal downward trend over the last two years. The S and P index seems more sensitive to interest rate expectations than the ISM’s and this should keep the index supported, though a sharp advance looks unlikely with most service sector surveys still subdued.