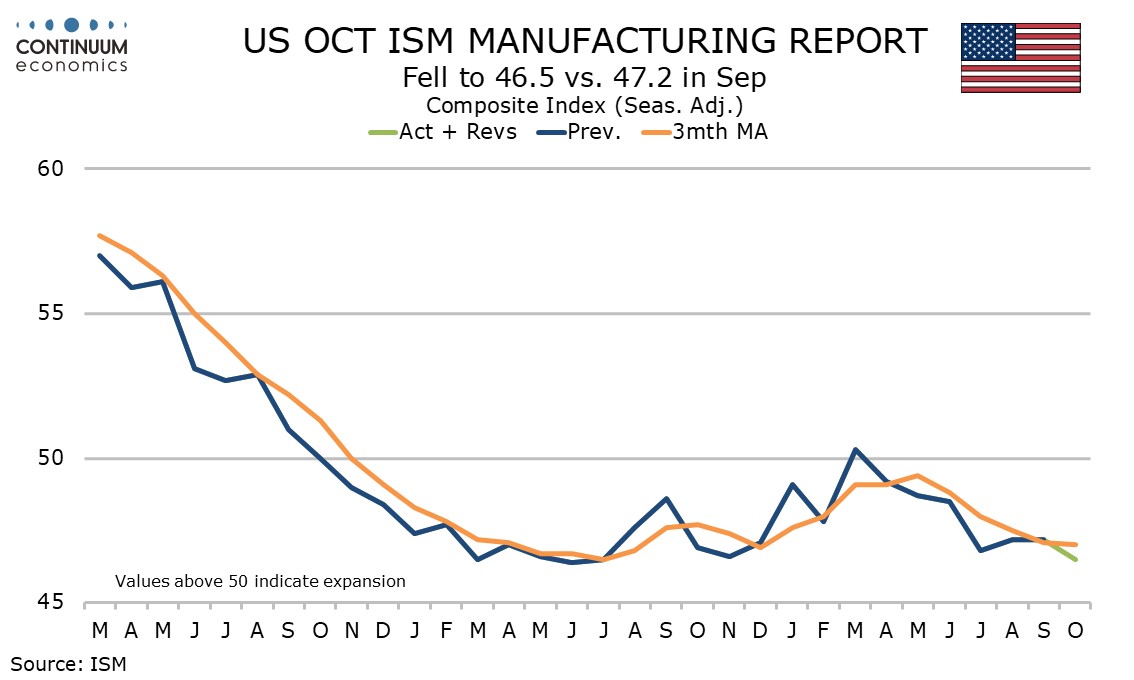

U.S. October ISM Manufacturing - Weakest since July 2023, but not a sharp slide

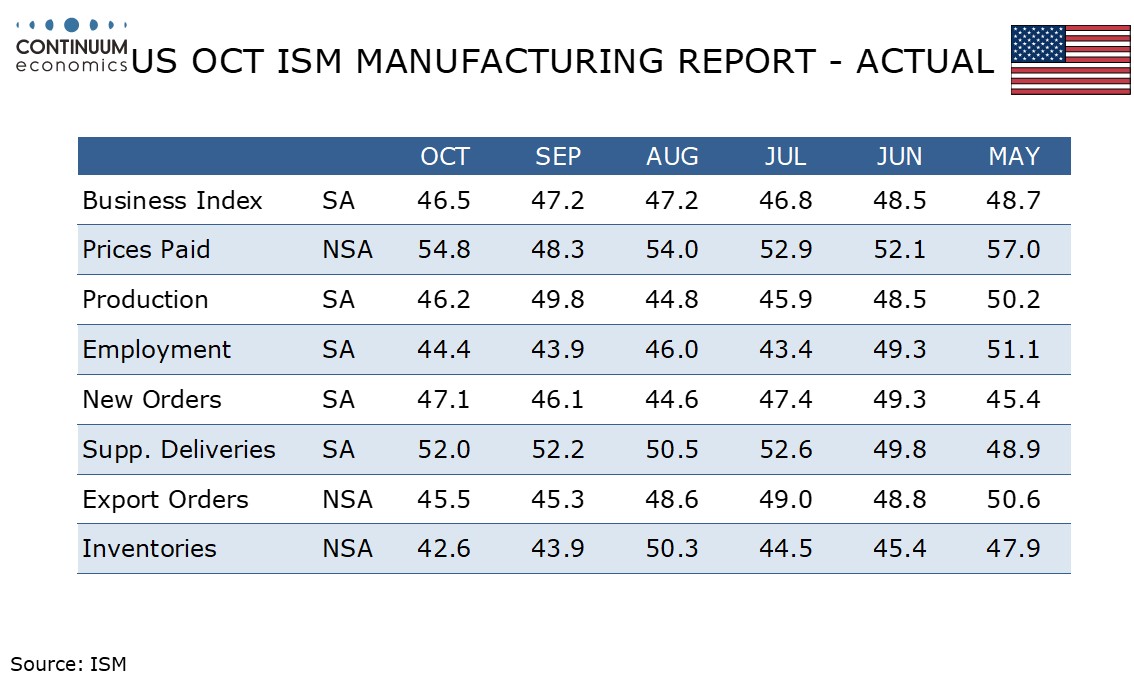

October’s ISM manufacturing index at 46.5 from 47.2 is the weakest since July 2023 if only a modest deterioration. We doubt the Boeing strike had a major impact on this report which is less sensitive to issues in one large company than are aggregate measures of output.

Two of the five components that make up the composite improved, new orders to 47.1 from 46.1 and employment to a still weak 44.4 from 43.9. Three components slipped, most notably production to 46.2 from September’s significantly improved 49.8, as well as inventories to a weak 42.6 from 43.9, and deliveries to a still firm 52.0 from 52.2. Overall this is not a major shift.

Prices paid are not a contributor to the composite but saw a significant bounce, to 54.8 from 48.3, more than reversing September’s dip from August’s 54.0.

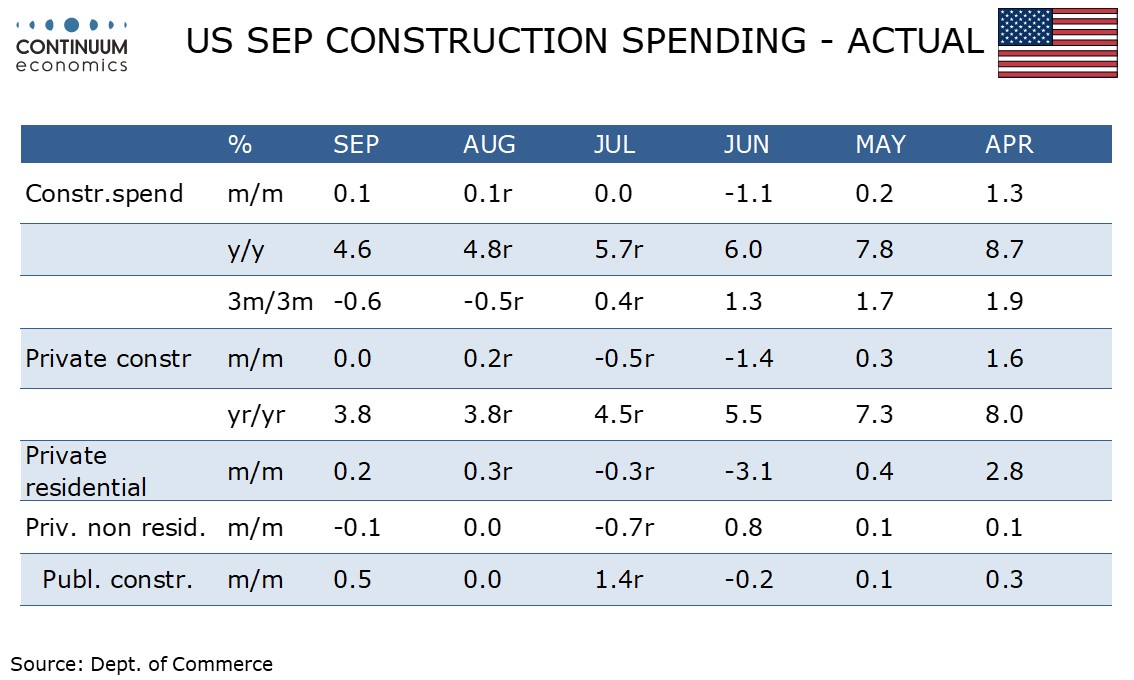

September construction spending rose by 0.1%, matching August’s gain and following a flat July. This keeps trend flat, and the moves in the key components were all minor.