U.S. Initial Claims show last week's bounce was erratic, September Philly Fed surprisingly strong

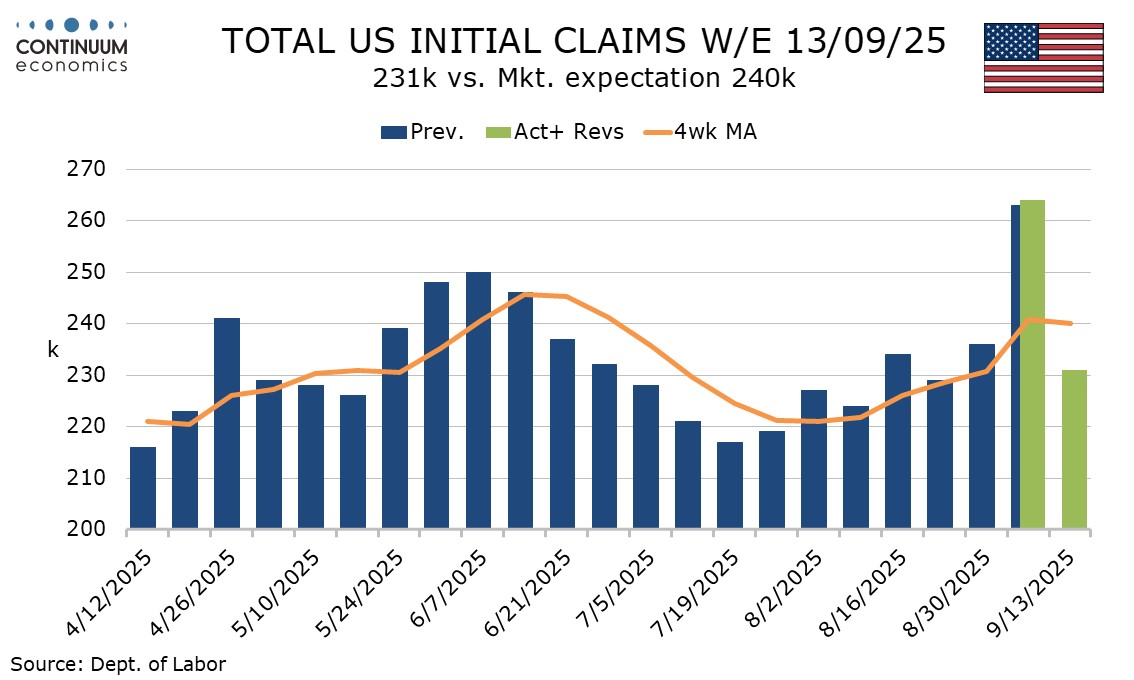

Weekly initial claims at 231k have returned to trend after last week’s surprisingly high 264k which appears to have been influenced by Labor Day seasonal adjustments. September’s 23.2 Philly Fed manufacturing index is also surprisingly strong, contrasting weaker Empire State data.

Seasonally adjusted, initial claims increased by 28k last week before falling by 33k this week. Unadjusted last week’s increase was a more moderate 8k and followed by a 10k decline this week, to 194k.

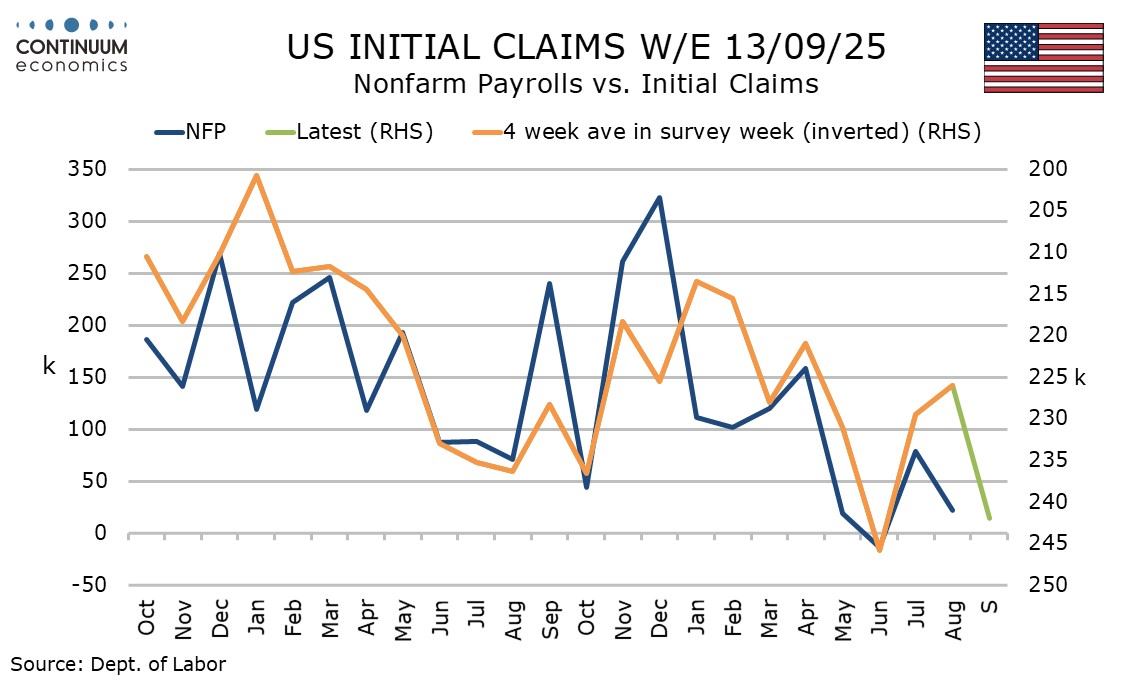

The latest week covers the survey week for September’s non-farm payroll and the 4-week average of 240k is well above the 226k seen in August’s payroll survey week. Even without last week’s high figure, trend is moving higher.

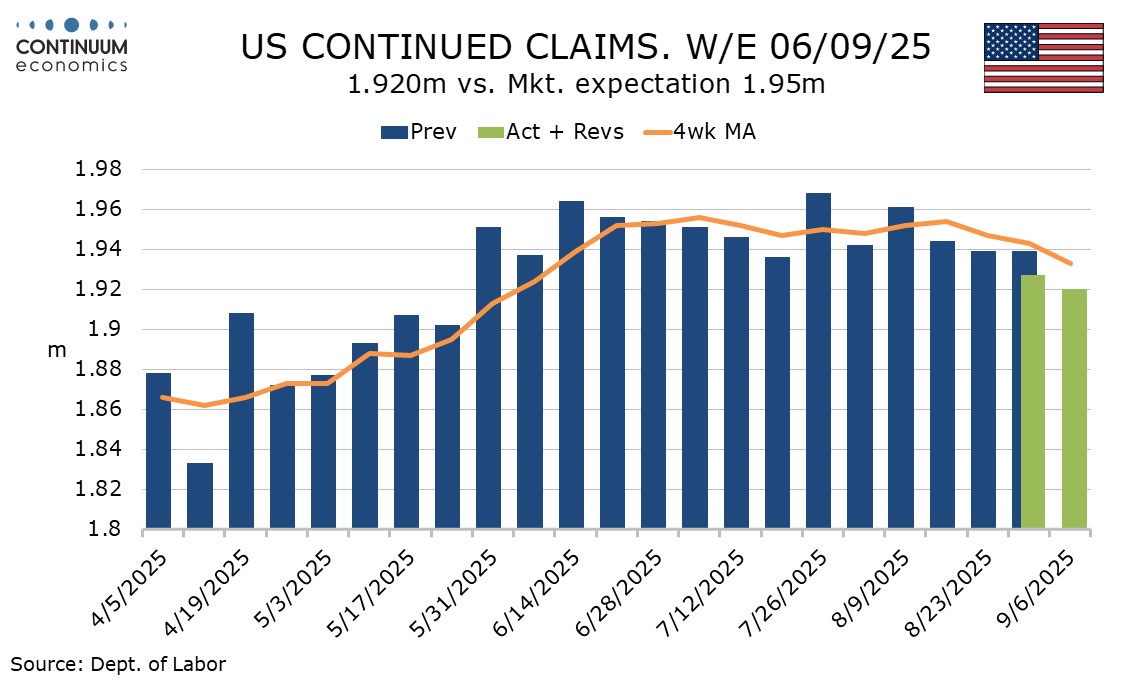

Negative payroll signals from initial claims are however contrasted by a fourth straight decline in continued claims, by 7k to 1.92k, the lowest since May 24. Continued claims cover the week before initial claims, meaning next week’s will cover the payroll survey week. This week’s continued claims data did not match the week’s sharp rise in initial claims.

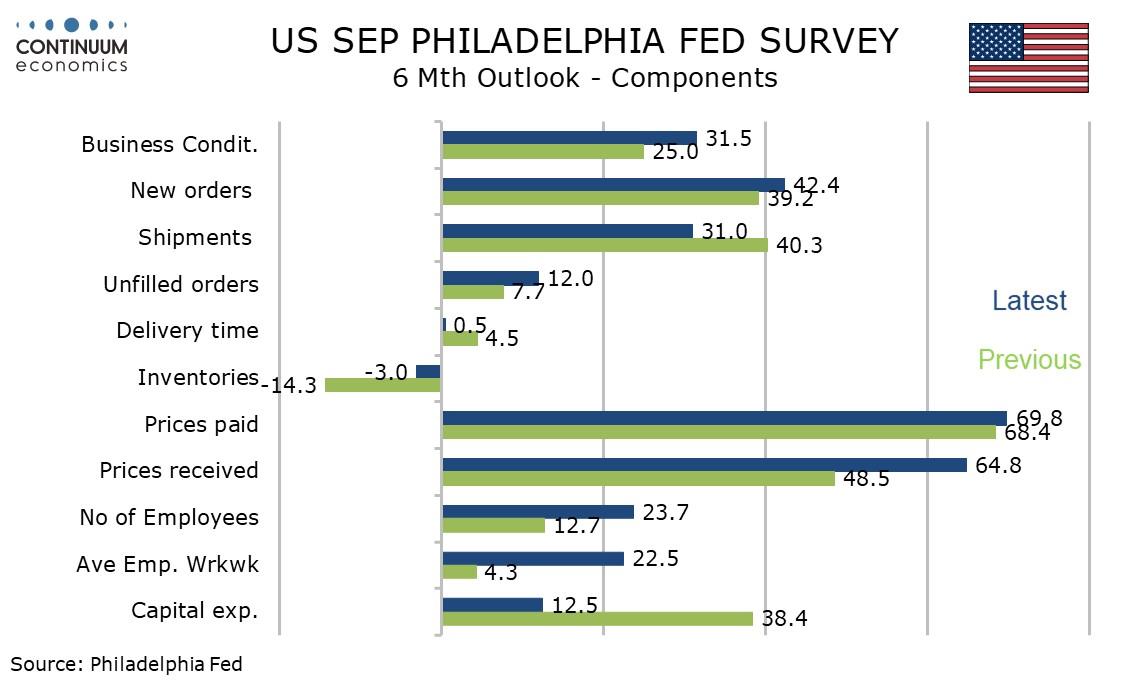

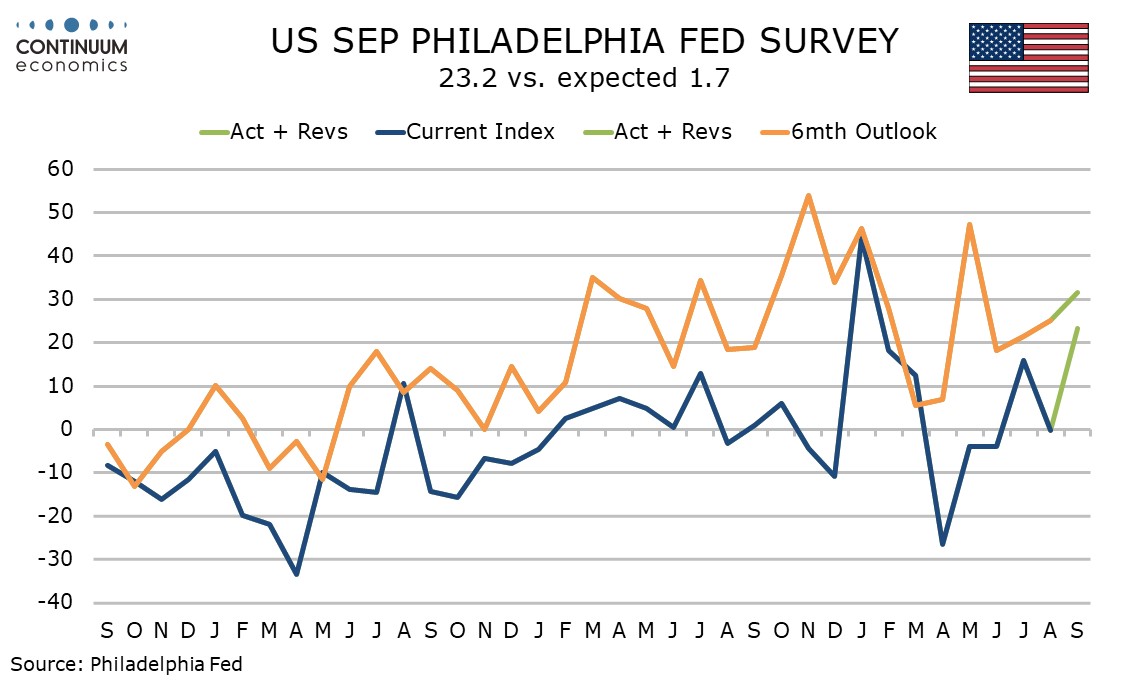

The Philly Fed index of 22.3 is the highest since January and follows a marginal negative of -0.3 in August. It contrasts a dip in the Empire State index to -8.7 from a positive August of 11.9. Only April of this year has seen the Philly Fed strongly negative.

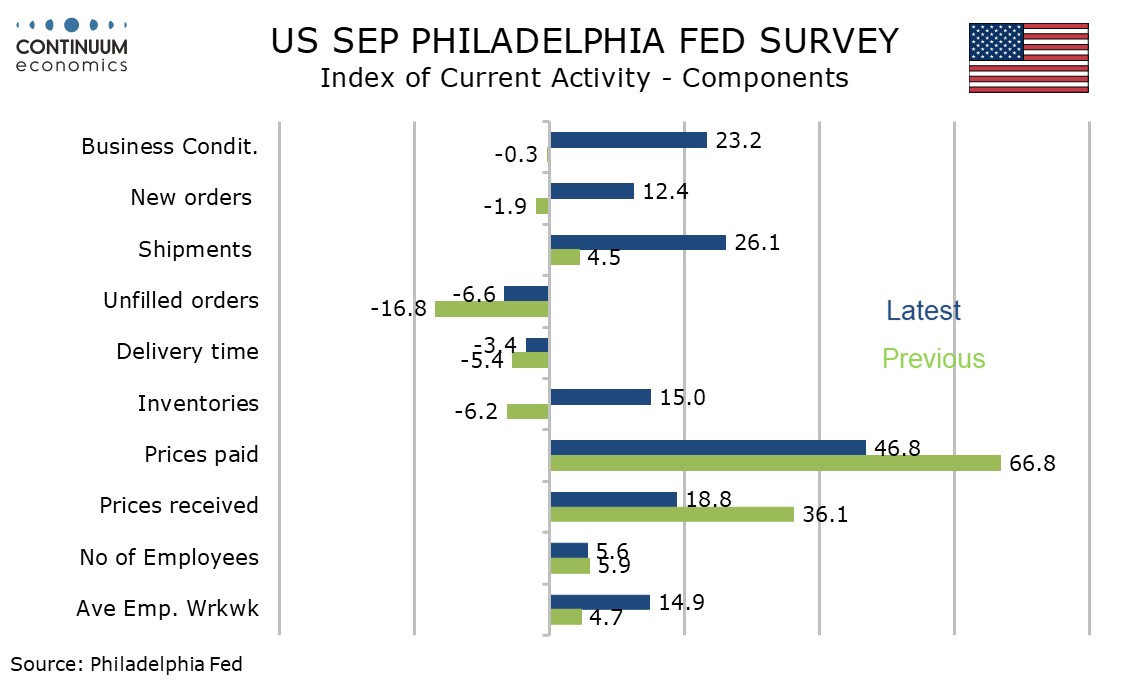

Details show new orders at 12.4 from -1.9 and employment at 5.6 from 5.9, positive but less so than the headline. Price indices are encouragingly slower, paid at 46.8 from 66.8, the slowest since June, and received at 18.8 from 36.1, the slowest since December 2024, which is notable.

Six month expectations for activity at 31.5 from 25.0 are the highest since May. Six month price expectations give a different message from the current month, paid at 69.8 from 68.4 up only marginally but received at 64.8 from 48.5 the highest since April.