This week's five highlights

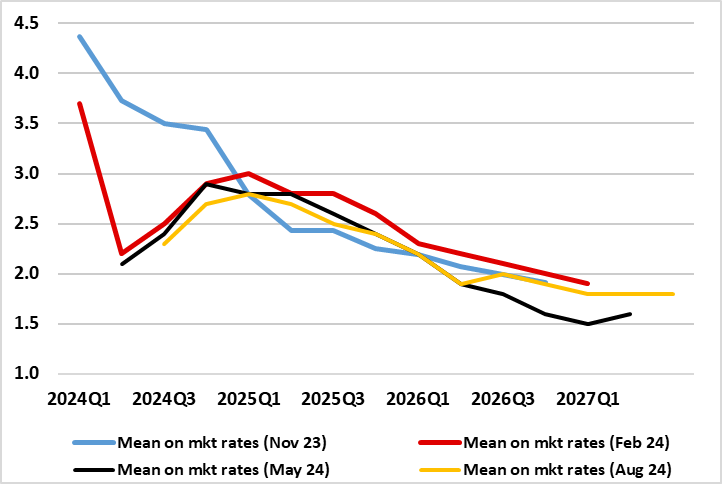

FOMC leaves rates unchanged and put September Easing on the Table but not a Commitment

BoE Getting Less Restrictive

BoJ Too hawkish, too fast

Canada Q2 GDP looking stronger than BoC forecasted

U.S. Initial Claims higher, Q2 Unit Labor Costs consistent with falling inflation

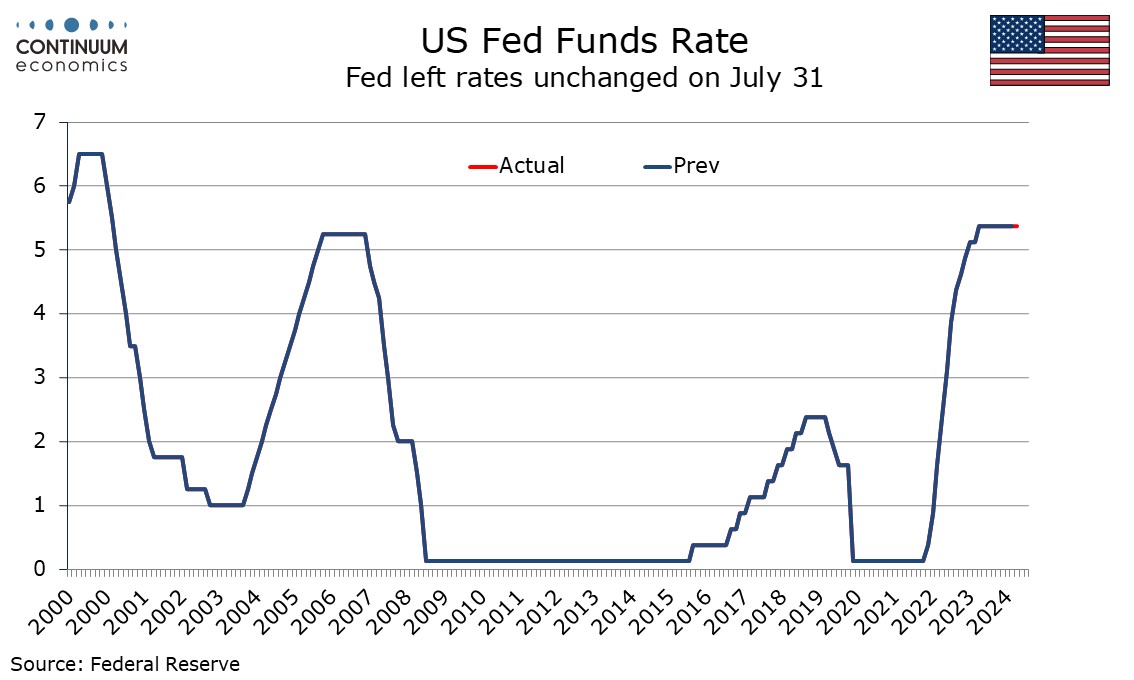

The FOMC has made some adjustments to its statement to signal that it is closer to cutting rates, but the key sentence that “the Committee does not expect it will be appropriate to reduce the target rate until it has gained greater confidence that inflation is moving sustainably toward 2%” remains intact. The most notable changes in the statement were signaling greater concern over risks to employment.

The statement does signal a more dovish line on employment. Instead of saying that job gains have remained strong and the unemployment rate has remained low it now says that job gains have moderated and the unemployment rate has moved up, though it still states the rate remains low. The adjustment on inflation is subtle, describing it as somewhat elevated rather than elevated, and states there has been some further progress toward the 2% inflation objective rather than modest further progress. It states that risks have continued to move into better balance rather than have moved. Consistent with the greater concern placed on employment, the FOMC now states that it is attentive to risks on both sides of its duel mandate rather than highly attentive to inflation risks.

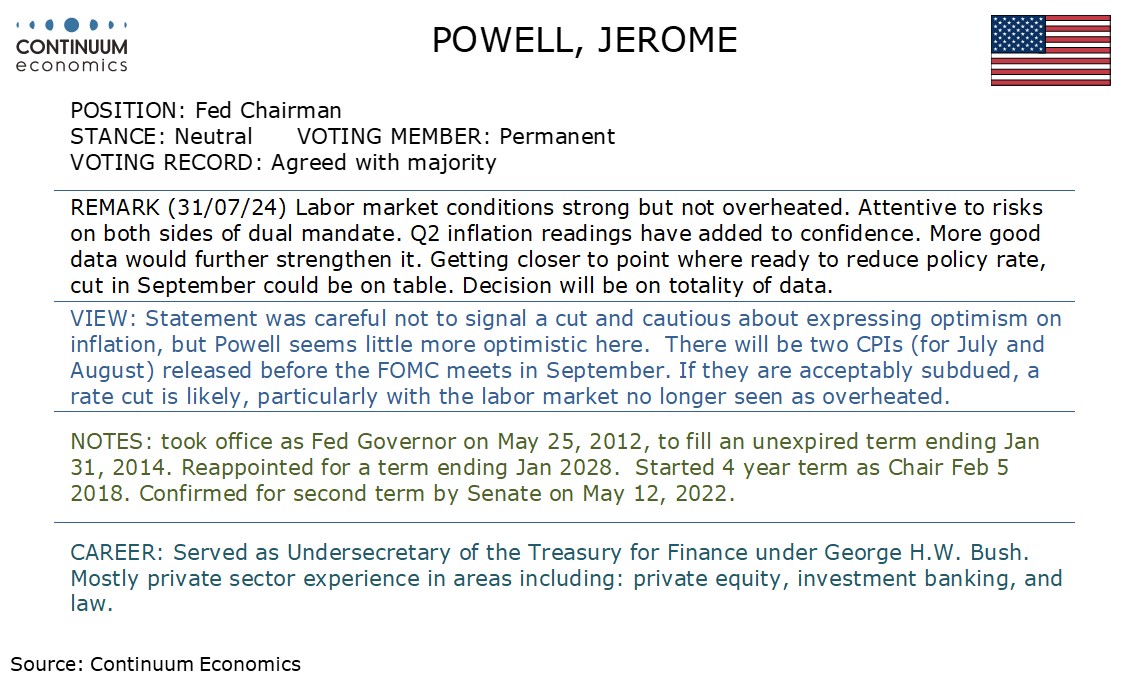

The FOMC statement made fairly subtle changes to the language on inflation, with more significant dovish shifts made in the language on employment. The Fed is not willing to signal that a September easing is a done deal. However the tone of Fed Chairman Jerome Powell’s press conference was generally optimistic, suggesting a September move is likely provided data does not surprise on the upside.

On employment, the FOMC statement changed its wording to state that job gains have moderated and that the unemployment rate has moved up, and went on to state that the Committee is attentive to risks on both sides of its dual mandate rather than highly attentive to inflation risks. On inflation however the adjustments were cautious, seeing it as somewhat elevated rather than simply elevated, and seeing some further progress toward the 2% rather rather than modest further progress. Most significantly, there was no change to the view that the Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%. The decision to hold rates steady was unanimous.

Figure: A Still-Clear Inflation Undershoot Even with Upside Risks

Despite market thinking being split on the matter, but as we flagged, the BoE cut Bank Rate by 25 bp to 5.0% this month taking the rate from a 16-year high and ending an above-average policy pause of 11 months. We are a little surprised that the vote (5:4) was so close as the dissent of Chief Economist Pill seems odd against the continued undershoot of the inflation outlook he overseas – even with a return to these projections encompassing upside risks (Figure). Clearly, for the rate-cutters, the decision was finely balanced and (as we expected) the cut was framed as easing the degree of policy restrictiveness. No policy guidance was offered save to say decisions ahead will be made on a meeting-by-meeting basis but with no suggestion of moving quickly or sizeable. But the cuts to around 3.7% that the main inflation projections are based on suggest more to come and we think somewhat further than this with two more moves this year and 100 bp in 2025. If there is a fresh risk, we think this comes from better real economy numbers ahead which will not stop easing but instead slow the process.

Of course, there will be more splits and the decision this month was in effect down to that of the newest MPC member. This reflects marked MPC personnel churning at the moment. Clare Lombardelli took part in her first MPC meeting this time around, her policy leanings still being unclear and her decision to cut may have been as much tactful than fundamental. Otherwise, it may be notable that policy hawk Haskel attends his final MPC meeting with his replacement yet to be named.

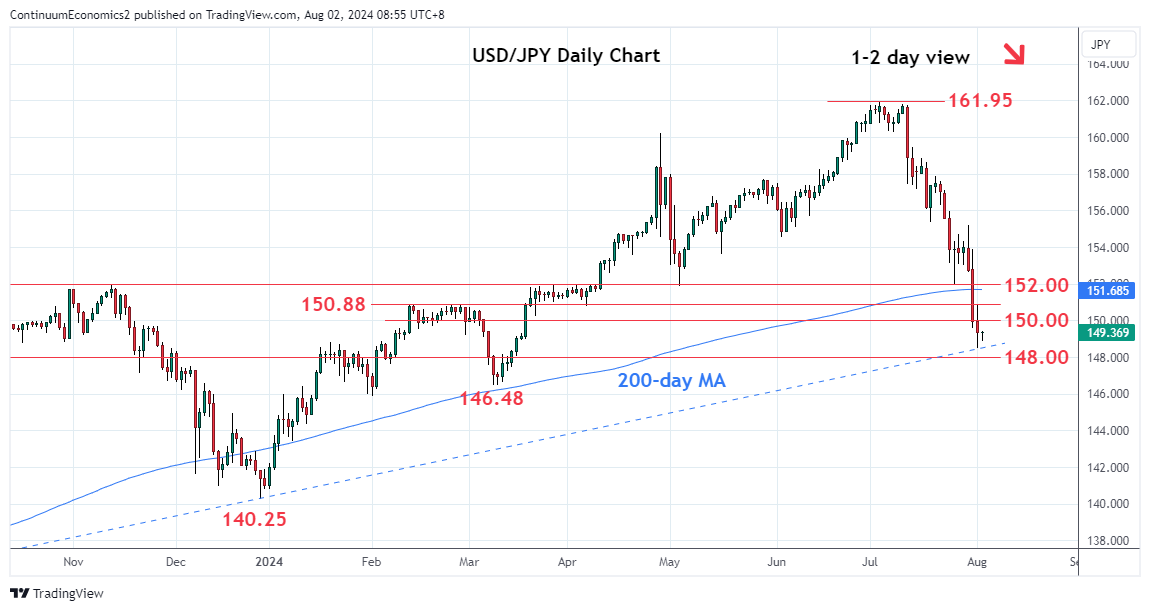

At the July 30 meeting, the BoJ announced their plans to reduce bond purchase by three trillion JPY over the coming two years and hiked interest rate to 0.25%. Bond purchase is expected to be reduced by an additional of 400 billion JPY per month, to be roughly halved in June 2026. Moreover, the BoJ is taking a hawkish tilt in the July meeting by also hiking interest rate by 0.15% to 0.25%, not only a step wider than the previous 0.1% hike but also providing a hawkish forward guidance "If outlook for economic activity and prices are realised, will continue to raise policy rates and adjust degree of monetary accommodation accordingly". With the BoJ making close to no change to their trend inflation outlook (2024 down 0.3% and 2025 up 0.2%), the policy step seems to be too fast and stance too hawkish. Despite headline labor cash earning inches closer 2%, small to medium business found it difficult to match the pace of large enterprises wage growth due to profit margin constraint and will not be contributing as much to the sustained wage growth as BoJ hoped. Combined with Japanese residents unwillingness to spend, private consumption has been sluggish for the first half of 2024 and will restrain BoJ's steps towards more tightening. Our central forecast continue to see inflation lower than BoJ's forecast and see no more tightening for the rest of 2024 unless there is a phenomenal shift in spending behavior for Japanese residents but the BoJ may insist trend inflation will be higher in the coming years and raise by at least once this year.

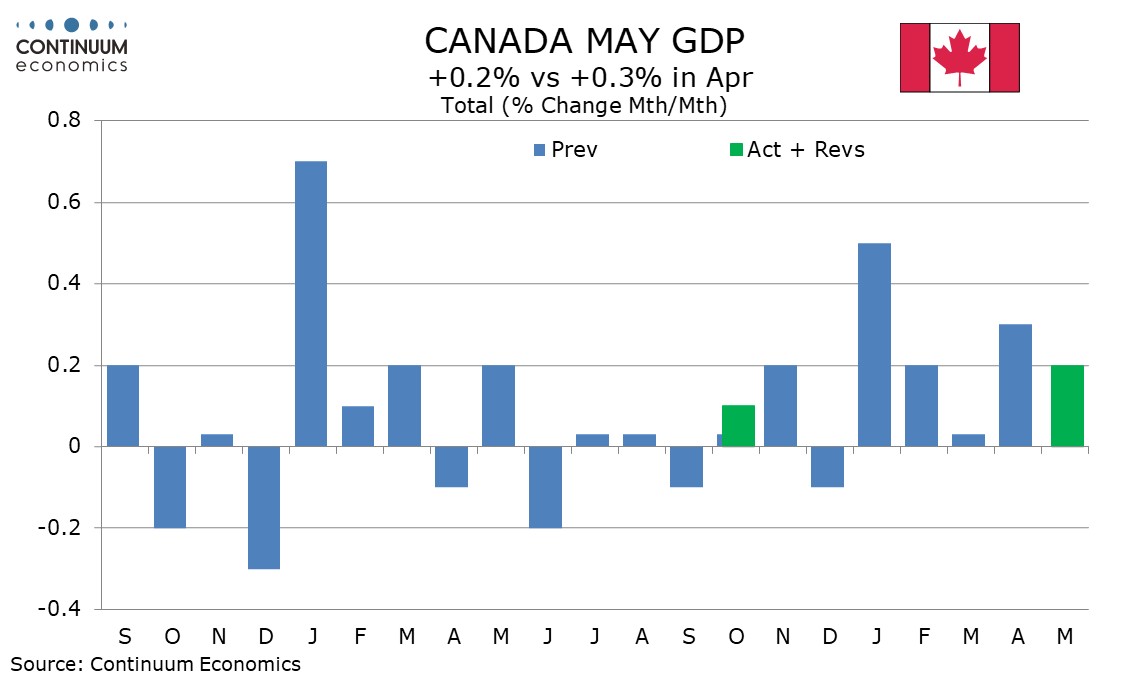

May Canadian GDP with a 0.2% increase exceeded a 0.1% preliminary estimate and extends a 0.3% rise in April. June’s preliminary estimate is for a 0.1% rise, which would leave Q2 up 2.2% annualized, above a 1.5% Bank of Canada estimate made with July’s Monetary Policy Report. The Bank of Canada has made it clear that excess supply in the economy means there is scope for the economy to growth without adding to inflationary pressure, so this data does not exclude further easing if inflation continues to lose momentum.

May detail shows goods up by 0.4% led by a 1.0% increase in manufacturing but services up a modest 0.1% restrained by dips in retail and wholesale. Accommodation and food services was an area of strength up by 0.9% after a 1.1% rise in April. June data is expected to see gains in construction, real estate/rental/leasing and finance/insurance, offset in part by slippage in manufacturing and wholesale.

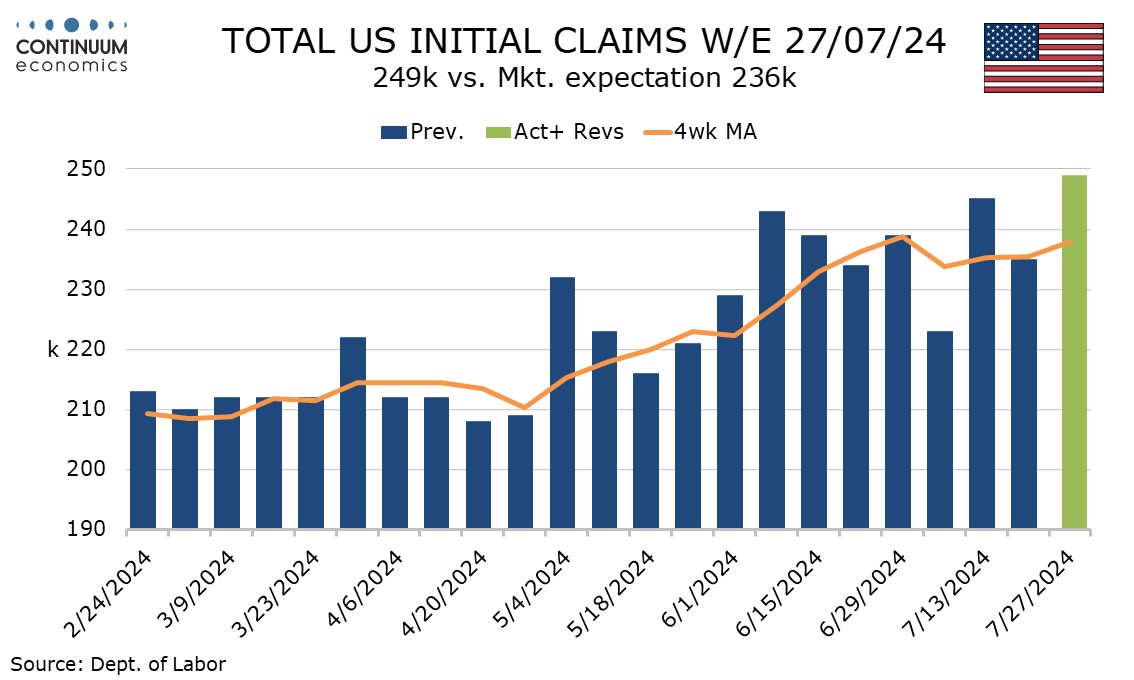

Weekly initial claims with a rise to 249k from 235k are higher than expected and the highest since August 2023, while continued claims at 1.877m from 1.844m are the highest since November 2021, both suggesting labor market cooling. Q2 productivity shows a healthy 2.3% annualized increase and until labor costs at a weaker than expected 0.9% are consistent with falling inflation. The jobless claims data comes after the survey week for July’s non-farm payroll, two weeks after for initial claims and one week after for continued claims, so should not significantly impact payroll expectations for tomorrow, but does suggest downside payroll risk heading into August.

The 14k rise in initial claims follows a 10k decline in the preceding week, but the 245k outcome two weeks ago was inflated by Hurricane Beryl. There are no obvious special factors this week, though initial claims did fall 10k before seasonal adjustment. Continued claims rose by 33k after a 16k decline, resuming an uptrend, and also rose by 29k before seasonal adjustments.