Published: 2024-10-04T14:43:27.000Z

Preview: Due October 17 - U.S. September Industrial Production - Some downside risk on temporary factors

Senior Economist , North America

5

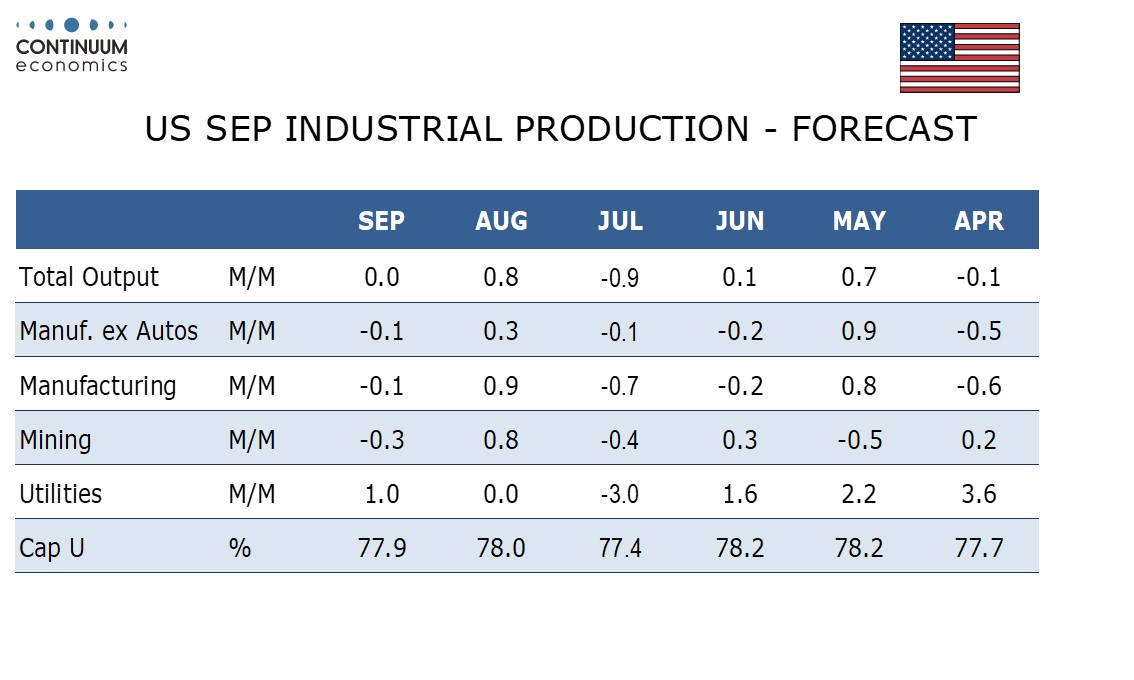

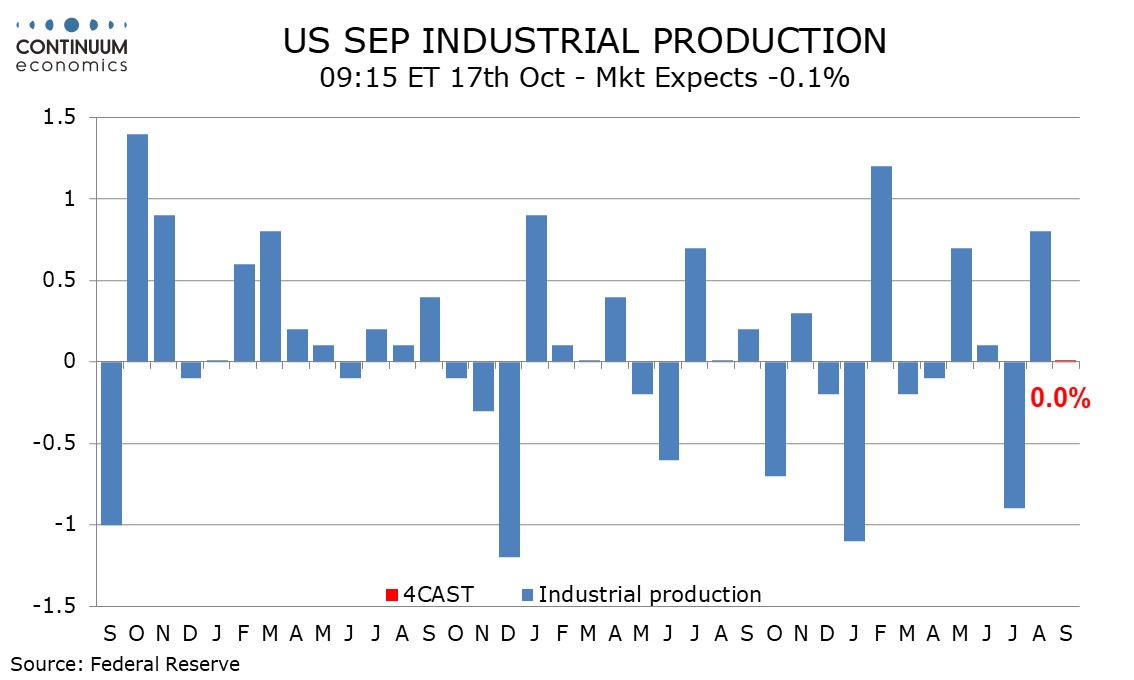

We expect unchanged September industrial production with a 0.1% decline in manufacturing. A strike at Boeing that started in mid-September and Hurricane Helene that came late in the month are downside risks.

September’s ISM manufacturing index was unchanged but its production index was less negative. September’s non-farm payroll showed aggregate manufacturing hours worked unchanged, which would normally imply a modest rise in manufacturing output, but was surveyed before the start of a strike at Boeing. Boeing is likely to have stepped up output ahead of the strike so the negative impact may be modest.

Hurricane Helene will provide modest downside risk for manufacturing and also mining. However we expect a dip in mining to be outweighed by a rise in utilities, as suggested by weekly electrical output. Autos, a source of volatility in July and August, will probably have little impact in September.