Published: 2024-10-03T07:18:20.000Z

GBP flows: GBP falls on Bailey comments

Senior FX Strategist

1

GBP falls back as Bailey indicates prospect of more aggressive easing

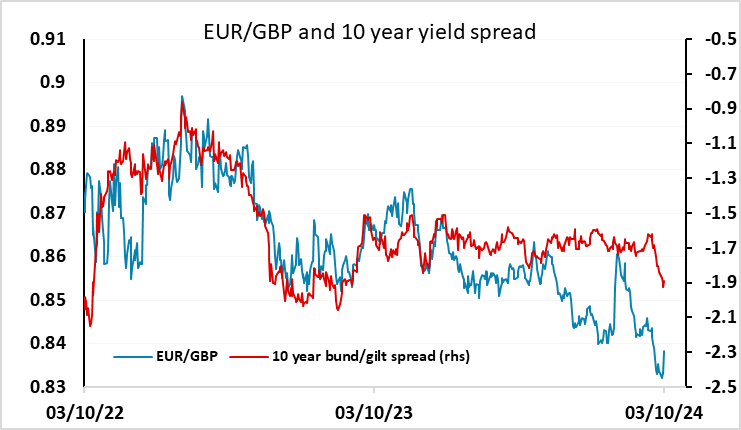

GBP is lower this morning driven by comments from BoE governor Bailey in the Guardian newspaper. Bailey said there was a chance that the BoE could become "a bit more activist" and "a bit more aggressive" in its approach to lowering rates, if inflation news continued to be good for the central bank. UK 2 year yields are down around 4bps this morning in response, and a November rate cut is now fully priced in, with 40bps priced for November. EUR/GBP is up half a figure, trading above 0.8380. Recent GBP strength had looked overdone for some time, and we do expect the BoE to cut more in line with the Fed and ECB than the market is pricing in. GBP is already at high levels against the EUR in real terms, so from here the risks should be on the GBP downside, with 0.83 looking like a base for EUR/GBP. We see 0.85 by the end of the year and 0.88 by the end of 2025.