GBP flows: GBP slightly firmer after labour market data

UK labour market data was mixed, and mild GBP strength unlikely to extend far

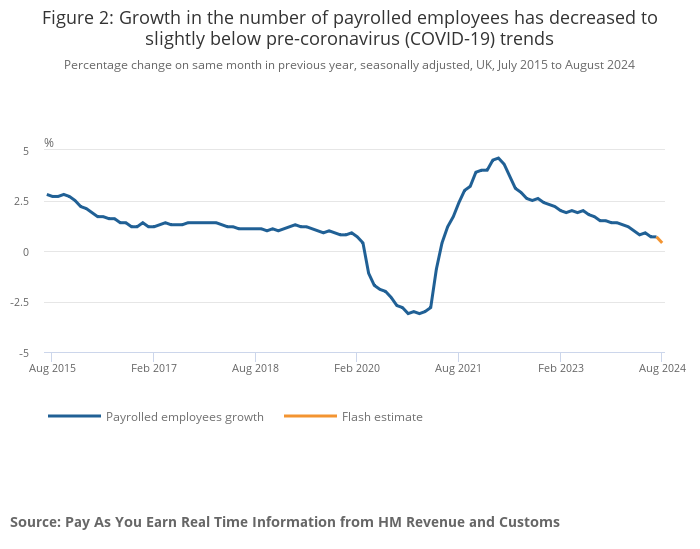

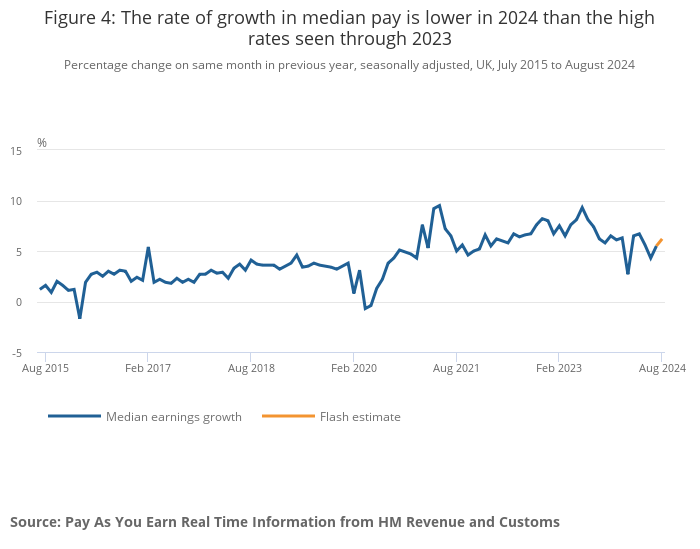

GBP is slightly firmer after the UK labour market data, although the data itself was mixed. While the official ONS data showed a larger than expected rise in employment in the 3 months to July, they also showed slightly lower than expected average earnings growth at 4.0% y/y (including bonuses). Meanwhile, the more up to date and nowadays perhaps more significant HMRC pay as you earn (PAYE) data on payrolled employment as weaker than expected, showing a provisional 59k decline in August and a downward revision to the July data to a decline of 6k from a rise of 24k in the provisional numbers. However, earnings growth rose to 6.2% y/y in August in the PAYE data from 5.5% in July.

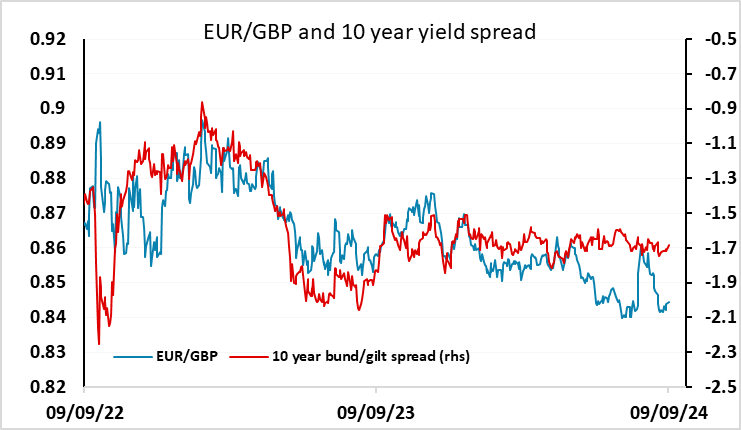

All in all the UK data looks fairly neutral, and shouldn’t have a significant effect on MPC thinking on next week’s rate decision. EUR/GBP has dipped slightly on the news, but should hold well above 0.84 and the risks still look weighted towards a move higher in the run-up to the MPC meeting.