FX Daily Strategy: Europe, September 6

All Eyes Will be on U.S. NFP

And determine USD/JPY's Next Leg

Also including all JPY pairs

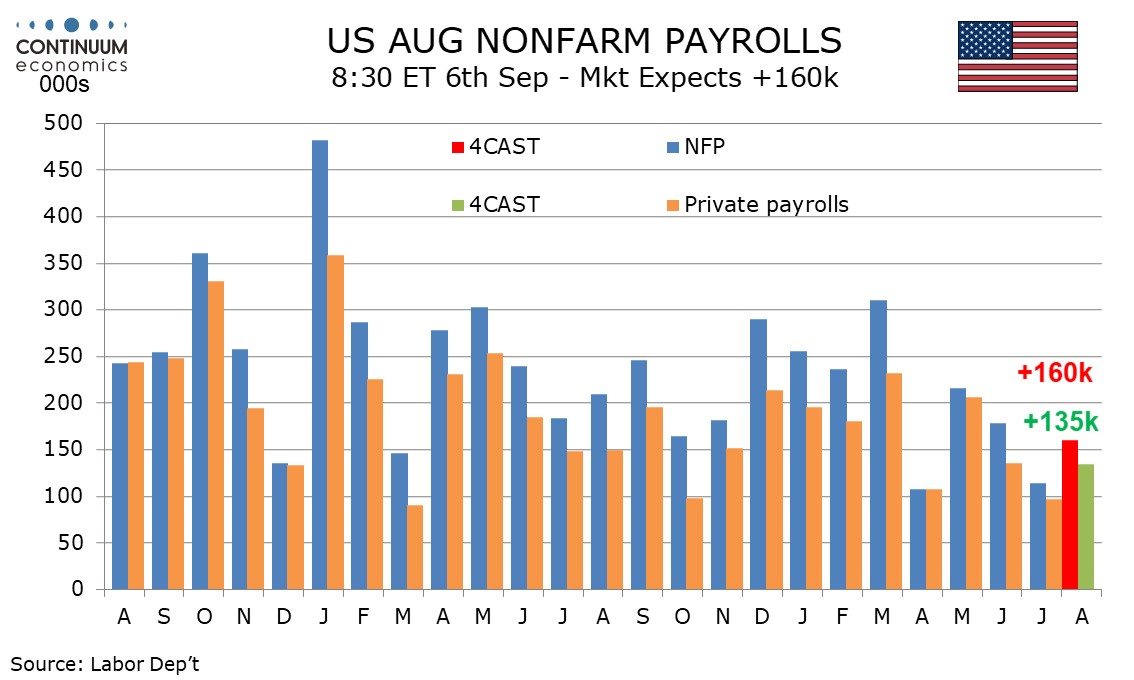

We expect August’s non-farm payroll to rise by 160k, 135k in the private sector, both slightly stronger than respective July gains of 114k and 97k that were probably restrained by weather but below 3-month averages of 170k and 146k, and thus implying a continued modest slowing in trend. We expect unemployment to correct lower to by 0.1% to 4.2% after rising by 0.2% to 4.3% in July, and a 0.3% rise in average hours earnings to follow a below trend 0.2% in July. A less weak payroll in August should help the FOMC decide to ease by 25bps on September 18 rather than by 50bps. While July’s press release saw no discernable impact from Hurricane Beryl in the data, we suspect there was a modest negative impact. State data showed a 14.5k decline in Texas, the state most impacted by the hurricane. It is also possible that unusually hot weather in the Midwest had a negative impact in July.

Initial claims data to the August survey week shows the 4-week average almost unchanged from July’s survey week, suggesting the labor market has not weakened further in August. Unemployment, having bottomed at 3.4% in April 2023, is clearly trending higher, but July’s 0.2% increase in the rate to 4.3% was steeper than trend, and caused by an above trend 420k increase in the labor force rather than job losses. We expect a 100k increase in August’s household survey estimate of employment, up from 67k in July, and an unchanged labor force to send unemployment down to 4.2%. July’s rate was 4.253% before rounding so it will not take much to see the rate correct lower. The non-farm payroll continues to outperform the household survey, which calculates the unemployment rate, even after an unusually large downward revision to the March 2024 benchmark of 818k, announced on August 21 but not due to be incorporated in the data until early 2025. The benchmark revision implies an average monthly gain of 174k in the non-farm payroll in the 12 months to March, down from 242k before the revision, but still above 71k as implied by the household survey. Since March the average non-farm payroll gain has been 154k. This may be over-estimated, but with layoffs still low we are comfortable that employment is still rising, albeit by less than the labor force.

After the U.S. NFP, there will be significant movement in the USD either way. The current rhetoric is for the Fed to cut 25bps in September with hawkish expectation of a 50bps cut. Any upside surprise in the data will likely be short lived for the underlying inflationary picture will not be changed by a single data point. Unless the survey points toward a significant stronger wage with employers willingness to sustainably hike wages, the USD bias will continue to be tilted to the downside. USD/JPY should see a break out of lower bound of consolidation range at mid 141 and search for support around 136.

On the chart, the break of the 144.00 level has seen losses through the 143.45 low of last week before stabilizing at 143.18 intraday low. Consolidation here see prices unwinding the oversold intraday studies but pressure remains on the downside. Room remains for further losses and lower will see scope to retest the 142.00 level and the 141.69, August low. Would expect reaction here but corrective bounce see resistance now at the 145.00/145.20 congestion area which is expected to cap and sustain losses from the 147.20, lower high.

The breakout in JPY bids will likely spread to other JPY pairs. Even the weakness in JPY is not as stretched against other major currencies as the USD, JPY has been weakened to historical level in the past year. The fall in USD/JPY, if any, will also trigger a correction in other JPY pairs.

On the chart, the pair is extending rejection from the 193.50 resistance and break of the 190.00 level see the 188.20/00 support now under pressure. Pullback see prices unwinding the overbought daily studies and suggest room for deeper pullback to retrace strong rally from the 180.00 low. Below the 188.20/00 area will return focus to the downside for retest of the 186.00/184.00 congestion area. Meanwhile, resistance is lowered to the 190.00 congestion and this now expected to cap and sustain losses from the 193.50 high.

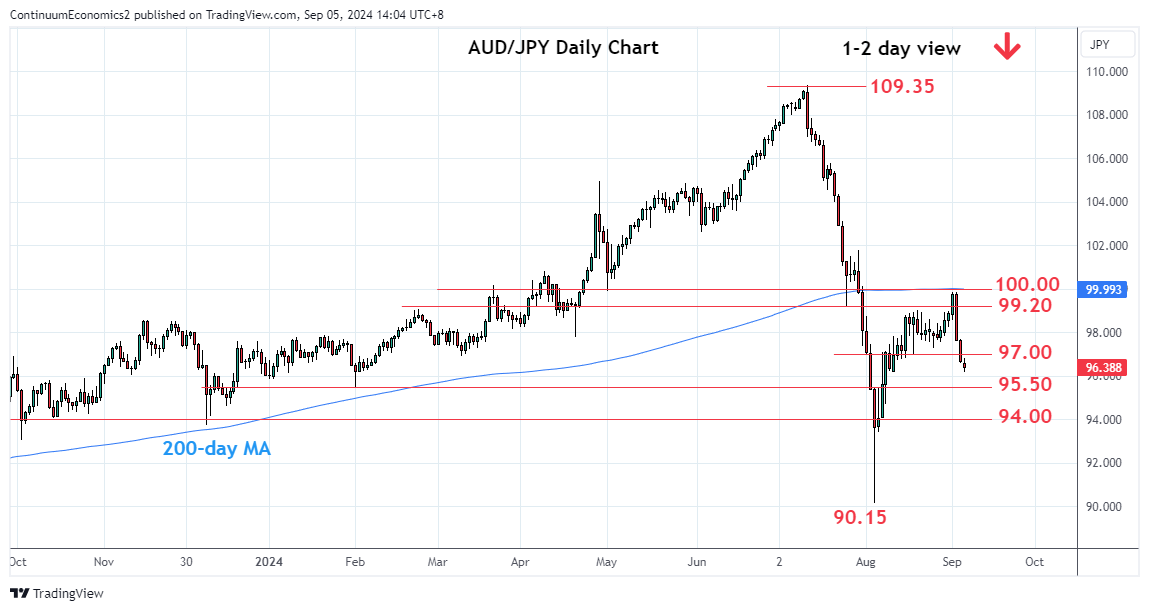

On the chart, the break of the 97.00 level further extend losses from the 99.85, 2nd September high. Lower will see room to the 96.00 level then the 95.50/95.00 congestion area. Weak daily studies suggest scope for break here to open up deeper pullback to the 94.00/93.40 support area. Lower still, will see room to the 94.00 level and 93.40 support. Meanwhile, resistance is lowered to the 97.00/98.00 congestion area which is expected to cap and sustain losses from the strong resistance at the 99.85/100.00 high and congestion.

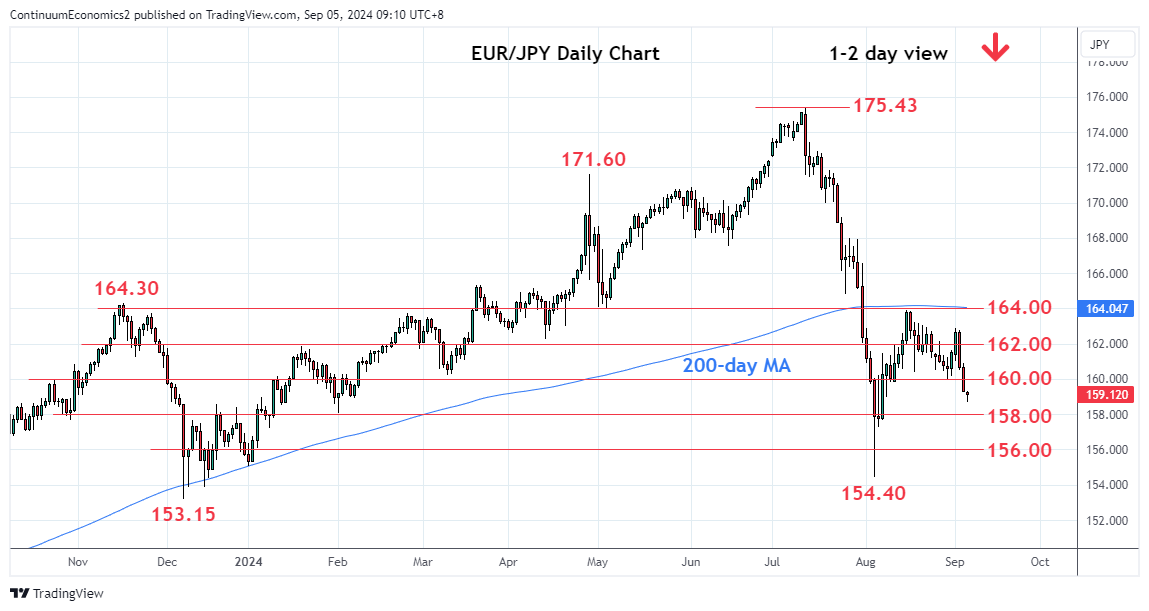

On the chart, EUR/JPY is further extending the break of the 160.00 level before stabilizing at 158.70 intraday low. Consolidation here see prices unwinding oversold intraday studies bit the downside still not firm and lower will see room to retest 158.00 level and 157.30 support. Would expect reaction here but bearish structure suggest corrective bounce likely to prove limited. Lower will see scope to the January low at 155.07 then 154.40, August YTD low. Meanwhile, resistance is lowered to the 160.00 level, now expected to cap and sustain losses from the 162.90, Monday's lower high.