FX Daily Strategy: Asia, September 5

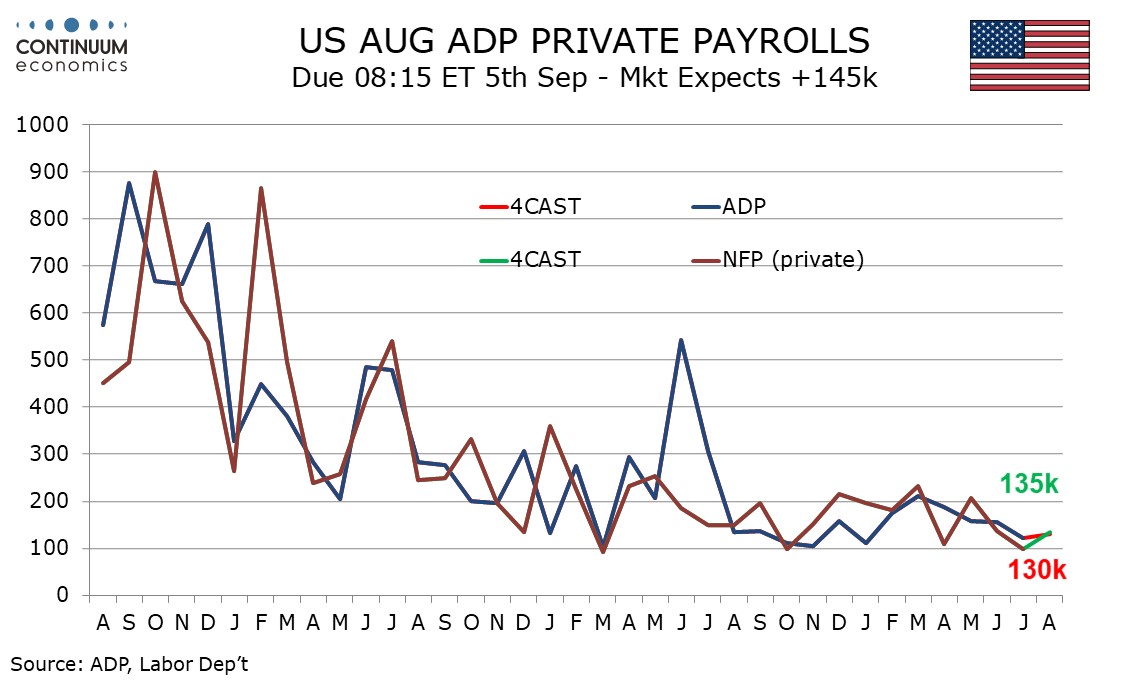

U.S. ADP Employment slowing but not sharply

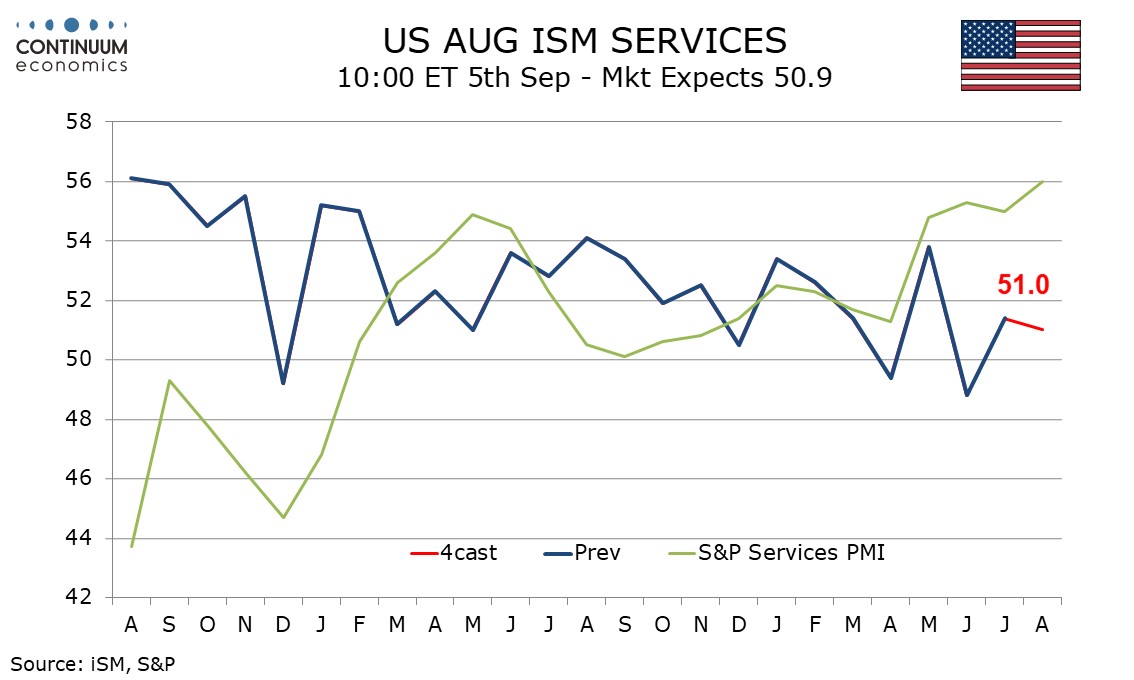

U.S. ISM Unlikely to match strong S&P Services PMI

Growth in Labor Cash Earning Should Support JPY

Bullock Will Likely Buffer Aussie Weakness

We expect a 130k increase in August’s ADP estimate for private sector employment growth, slightly below the 135k we expect for private sector non-farm payrolls. The two series have become more consistent with each other in recent months. We expect overall non-farm payrolls to rise by 160k. Trend in both ADP and non-farm payroll data appears to be losing momentum, but not sharply. We are forecasting a modest ADP underperformance in August after two straight modest outperformances, of 19k in June and 25k in July. July’s ADP outperformance may reflect non-farm payrolls being mote sensitive to bad weather than the ADP report. July’s ADP data was less consistent with July’s non-farm payroll in its detail, with most of the growth coming from a 61k rise in trade, transport and utilities and a 39k rise in construction. Education and health with a rise of 22k and leisure and hospitality with a rise of 24k were both below trend. Overall July ADP data saw an acceleration in goods and a slowing in services. We expect August to see slower gains from goods but stronger growth in services, even with a likely slowing in trade, transport and utilities.

We expect August’s ISM services index to slip marginally to 51.0 from 51.4. This would be consistent with a gentle underlying slowing in trend that has been visible over the last two years, albeit with plenty of volatility around the gentle slowing in trend. This would contrast a stronger S and P services PMI for August which the ISM services index does not have a good relationship with. The S and P index is currently trending higher in what appears to be a response to rising expectations for Fed easing. Regional Fed service sector surveys for August are mixed, but on balance subdued, with modest positives from Kansas City, Dallas and the Empire State surveys, but significant negatives from the Richmond and Philly Feds. In the ISM services detail we expect new orders at 52.5 and business activity at 54.5 to be almost unchanged from July. However employment is unlikely to sustain a July move above neutral for the first time since January and we expect a correction lower in employment to outweigh a correction higher in delivery times. Prices paid do not contribute to the composite. Here we expect a modest slowing to 55.0 from 57.0 which would be the slowest since March, though trend has little direction

The Japan Labor Cash Earning has went past the 2% mark for May and June, July's consensus is also higher than 2%. It would be supportive for BoJ's hawkish policy take if we see another round of strong wage growth but we doubt there maybe more downside surprise than upside as small to medium business have found it difficult to match the magnitude of wage hikes seen in large enterprises. Yet, in a short run, it is likely we will be seeing elevated labor cash earning growth above 2% and may trigger more bids for the JPY, in hope of another round of tightening.

On the chart, the pair is extending rejection from the 147.20 high and break of the 146.50/146.00 area return focus to the downside. Prices now weighing the on 145.00 level and clear break here will open up the strong support at the 144.00/143.45 area to retest. Oversold intraday studies suggest reaction at the latter likely though the bearish structure highlights risk for eventual break. Lower will return focus to the 142.00 congestion and the 141.69 low. Meanwhile, resistance is lowered to the 146.00/50 area which is expected to cap and sustain losses from the 147.20, lower high.

RBA's governor Bullock will be delivering a speech on Thursday and will likely reinforce RBA's previous rhetoric. The Aussie has been depressed lately with data confirming softer economic growth, sparking speculation the RBA will cut before 2025. But the focus of RBA has been on the inflation figure and thus we do not see the latest soft data to affect RBA's mind. However, we believe RBA has been to pessimistic about inflationary development and should see the beginning of easing by year end 2024, rather than mid 2025.

On the chart, the consolidation above the .6760/50 support has given way to sharp break lower to approach the .6700 level. Daily studies are trackinjg lower and see risk for break of the latter to further extend losses from the .6824 high to retrace the strong August rally. Lower will open up the .6650/.6640 congestion and 38.2% Fibonacci retracement. Meanwhile, previous support at .6750 now turned resistance and should cap corrective bounce attempt. Regaining this will fade the downside pressure and open up the .6800 level and .6824 high to retest.