FX Daily Strategy:N America, September 4

A Third Straight 25bps Easing for Bank of Canada

U.S. July Trade Deficit to resume deteriorating trend

Australian Q GDP Likely To Disappoint

USD/JPY Waiting for Breakout

The Bank of Canada meets on September 4 and a third straight easing, by 25bs to 4.25%, looks likely. This meeting will not see a quarterly Monetary Policy Report so the BoC will not update its forecasts from those made in July. However continued progress in reducing inflation and GDP growth, while improved, still leaving the economy in excess supply gives the BoC scope to continue easing.

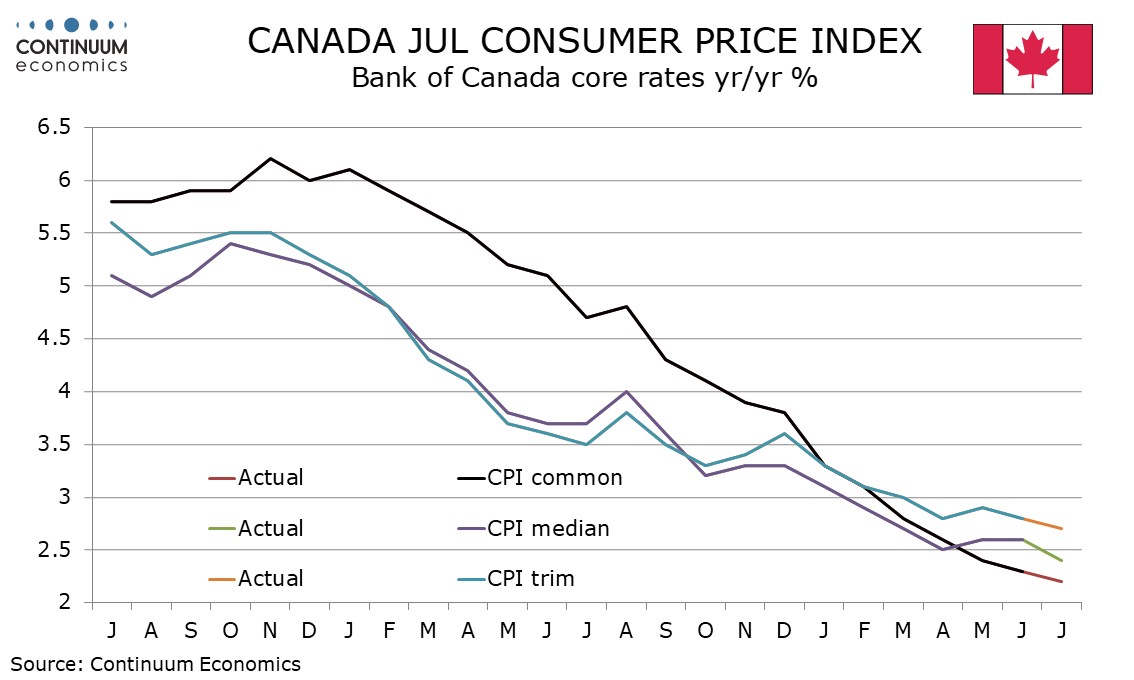

With the economy seen as in excess supply, the BoC sees the economy as having scope to increase without adding to inflationary pressures, meaning that their primary focus will be on inflationary data. July CPI data released since the last meeting showed continued progress in reducing inflation, including the core rates. The BoC easing in July came despite one of the two CPI releases released since it started easing in April, for May, having disappointed, though June data saw progress resuming. Progress on inflation looks a little more convincing going into this meeting, than it did going into July’s, which still delivered an easing.

Q2 GDP at 2.1% annualized was a little firmer than a 1.5% forecast made by the BoC in July, but the detail, showing much of the strength due to government, with consumer spending subdued at 0.6%, was less impressive. That monthly data showed a flat GDP in June with the preliminary estimate for July also flat suggests limited momentum entering Q3. August employment data will be released on September 6, two days after the rates decision, but June and July employment were both almost unchanged, and unemployment is trending higher.

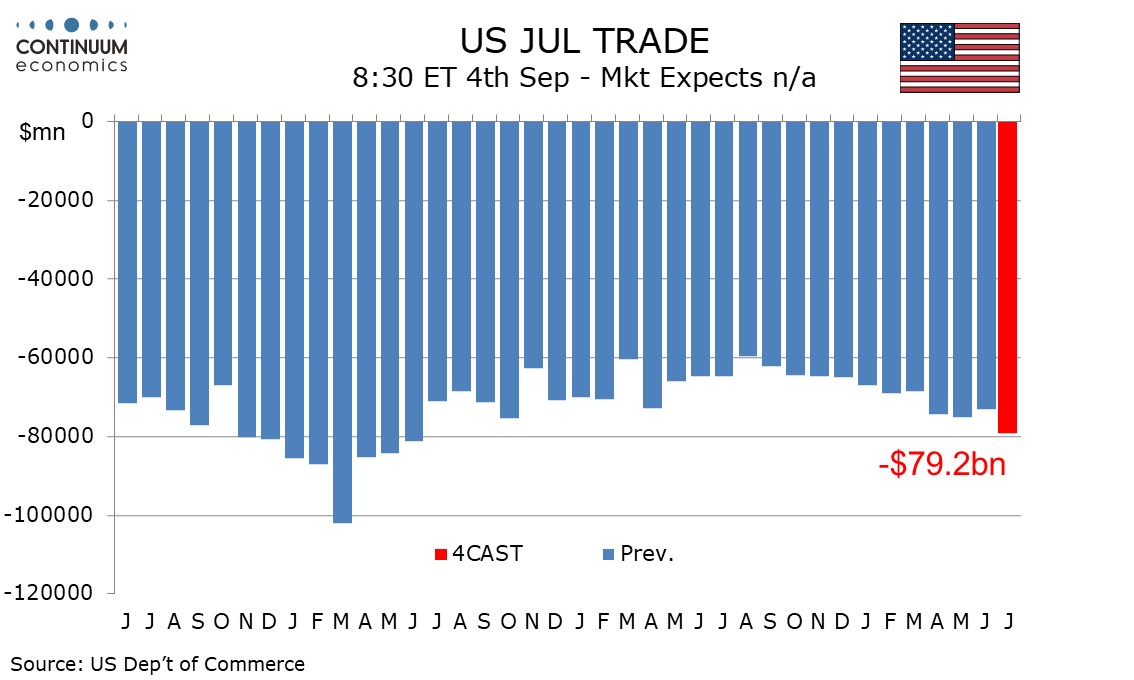

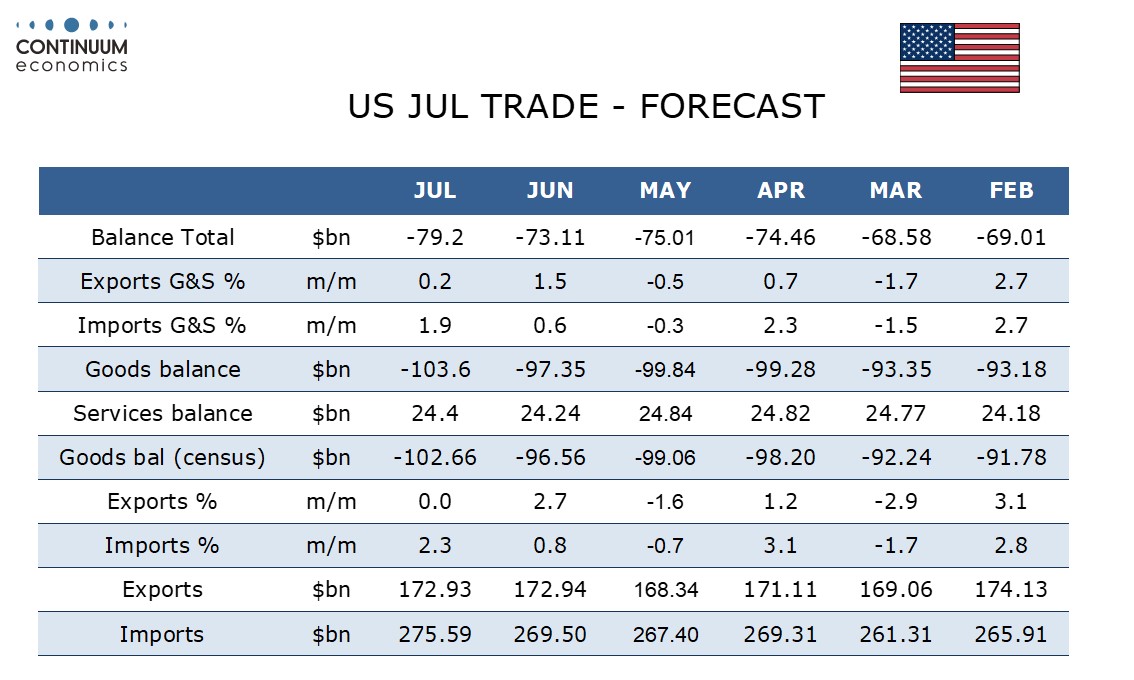

We expect July’s trade deficit to increase to $79.2bn from June’s $73.1bn, resuming a deteriorating trend after a modest improvement seen in June with the deficit reaching its highest level since June 2022. We expect exports to rise by 0.2% and imports to rise by 1.9%. We expect goods to be consistent with advance data which showed exports unchanged, restrained by weakness in autos, and imports up by 2.3%. We expect services to show both exports and imports up by 0.5%, exports reversing a 0.5% June decline but imports extending a 0.2% June increase.

The Q2 GDP would likely be disappointing after the soft slate of preliminary Australian economic data for Q2. However, the RBA is prioritizing keep inflation back to target range rather than ease to support the local economy. In fact, while we are expecting a softer Australian Q2 GDP, the Australian economy is still healthy and should not prompt the RBA to come in for the rescue. The softer economic activity will feed into the inflationary picture and should allow the RBA to ease by end of 2024 instead of mid 2025 in their forecast.

On the chart, there is little change, as prices holds steady above support at the .6760/50 congestion. Daily studies have turned mixed but remains overbought and suggest scope for corrective pullback. Break will see room to the strong support at the .6700 level. Correction is expected to give way to renewed buying interest later and clear break of the .6800 level and .6824 high will further extend gains from the .6348, August low. Clearance will see room to retest the 2 Jan YTD high at .6840 with potential seen for extension to the .6871, December 2023 high.

As the day come closer where the BoJ and Fed be crossing paths, USD/JPY is tilted towards the downside, waiting for a trigger to break out of the consolidation. This week's NFP could be a trigger for a down move but realistically we will need to see a rise in JGB yields and further moderation of U.S. T-yields to allow a sustained bid in the JPY.

On the chart, the break above resistance at the 146.00/146.50 area extending bounce from the 143.45 low as prices unwind the oversold intraday and daily studies. Higher will see room to the 147.35 resistance then the 148.00 congestion. However, gains are seen corrective and expected to give way to renewed selling pressure later. Meanwhile, support is raised to the 146.50/146.00 area and break here will see room for retest of the 145.00/144.00 congestion area and the 143.45 low. Below the latter will return focus to the 141.69 low.