FX Daily Strategy: N America, September 3

U.S. ISM Manufacturing higher but still subdued

USD/JPY Gains in Asia but to Consolidate pre U.S. employment report

Antipodeans to Fresh Yearly High

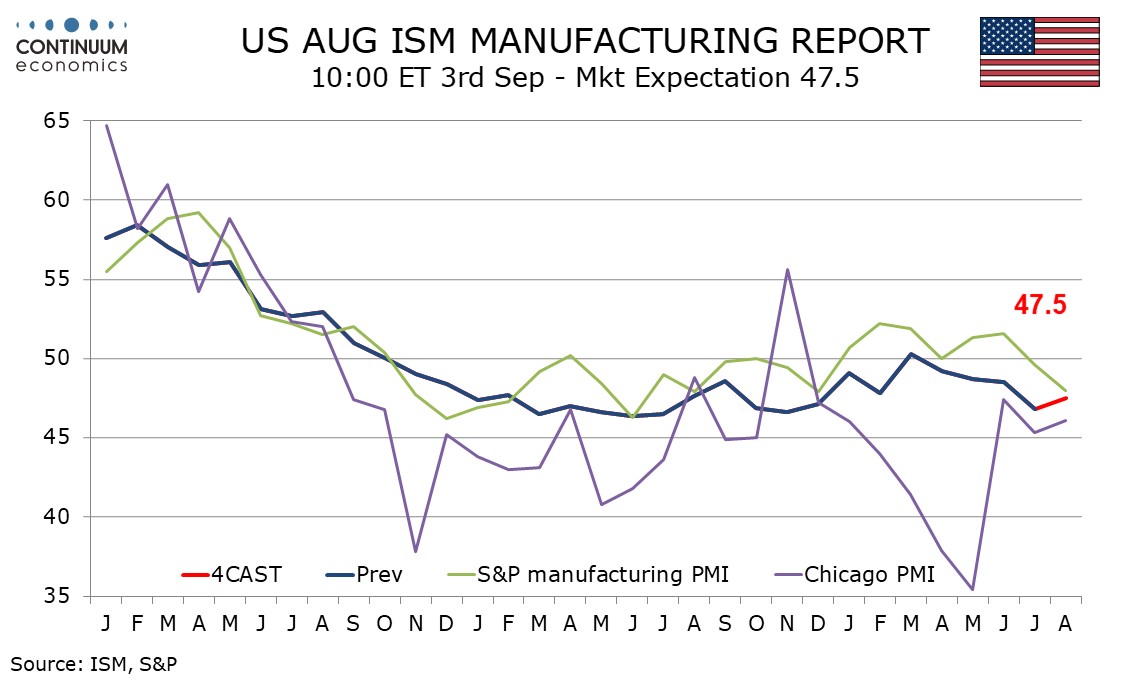

We expect an August ISM manufacturing index of 47.5, which would be a correction higher from July’s weaker 46.8 but still weaker than each index seen in the first half of 2024. There are not many strong signals coming from other surveys. The S and P manufacturing PMI of 48.0 was weaker than expected but coming off recent outperformance of the ISM data. Most regional Fed manufacturing surveys are moderately negative and on balance little changed from July. In the ISM detail we expect new orders to be almost unchanged at 47.5 from 47.4. We expect 47.5 readings from production and employment too, both corrections higher from below trend respective July readings of 45.9 and 43.4. Completing the breakdown of the composite we expect deliveries to slip to 50.0 from a stronger July reading of 52.8 while inventories rise to 45.0 from 44.5.

JPY gains have occurred Tuesday after BOJ Ueda hinted strongly at more rate hikes. Bigger picture USD/JPY is unlikely to break out of consolidation range until key U.S. data on Friday. USD/JPY has been consolidating in the range of mid 141-149 for a month, waiting for fresh impetus before another leg lower. All things considered the path of least resistance seems to be south as the BoJ takes a hawkish policy stance while the Fed is open to bigger cut in September. It is not impossible for the USD/JPY to correct multiple big figures in the coming month.

On the chart, USD/JPY is extending bounce from the 143.45 low as prices unwind the oversold intraday and daily studies to retest resistance at the 146.50, March low. Clearance here will see room to the 147.35 resistance then the 148.00 congestion. However, corrective bounce are expected to give way to renewed selling pressure later and clear break of the 144.00 level and 143.45 low will further extend losses from the 149.40, mid-August corrective high. Lower will see room for extension to the 143.45/143.00 area.

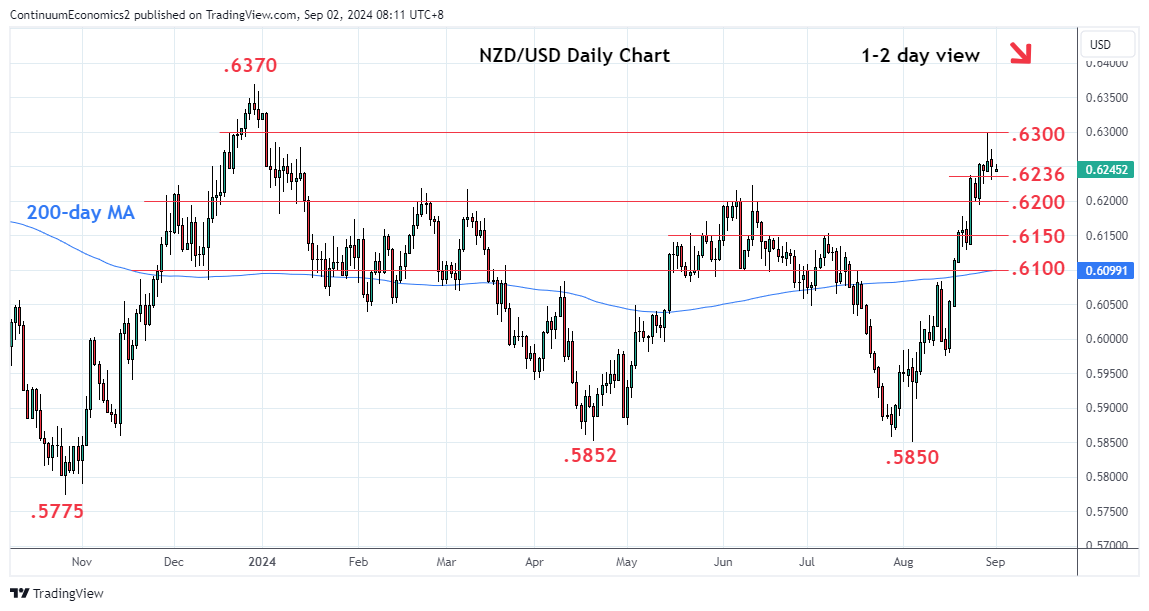

The antipodeans are both challenging yearly high as USD retreats and risk asset steady for now. The policy in Australia maybe more supportive for Aussie strength with the RBA pushing back rate cut till next year and Australian inflationary picture aligns with decision while the RBNZ already announced they will be on an easing cycle and expected to ease almost every meeting. Fed's choice in magnitude of cutting will also be a critical factor.

On the chart, AUD/USD is leaning lower in consolidation below the .6800 level after failing to sustain break gains to .6824 high. Daily studies have turned lower from overbought areas and suggest scope test lower through support at the .6760/50 congestion. Below here will open up deeper pullback to the strong support at the .6700 level. Correction is expected to give way to renewed buying interest later and clear break of the .6800 level will further extend gains from the .6348, August low. Higher will see room to retest the 2 Jan YTD high at .6840 with potential seen for extension to the .6871, December 2023 high.

On the chart, NZD/USD is lower in consolidation from test of the .6300 level with the resulting long pin bar weighing and suggesting scope for pullback. Daily studies have turned lower from overbought readings and suggest room for corrective pullback. Break of the .6236 support will see room for deeper correction to the .6200 level then the .6150 congestion. However, losses are seen corrective of the strong run-up from the .5850 YTD low and expected to give way to buying interest later. Break of the .6300 high will see room to the .6330, January YTD high. Beyond this will see scope for retest of the .6370/.6412, December and July 2023 highs.