FX Weekly Strategy: Europe, Sep 2nd-6th

Geopolitical Risk Lingers

U.S. August NFP To be Less weak

And a slate of U.S. Data

Could Sway the DXY

Strategy for the week ahead

Geopolitical Risk Lingers

U.S. August NFP To be Less weak

And a slate of U.S. Data

Could Sway the DXY

After Russia executed strong counteroffensive operations in Ukraine this summer, and recently advanced northeast of Kharkiv City, north of Chasiv Yar, southeast of Pokrovsk, and west of Donetsk City aiming to seize more territory before the U.S. presidential elections in November, Ukraine’s cross-border offensive inside Russia, which started on August 6, surprised Russians tactically. According to sources, Ukrainian forces recently advanced near Sudzha, and have taken almost as much territory in Russia in August (some 1,200 square kilometers by their own estimates) as the Russians have won inside Ukraine all year. Ukrainian officials continue to highlight how Ukrainian forces can leverage tactical and technological advantages to offset Russian materiel advantages as they aim to demonstrate that Russian victory is not inevitable.

In response, the Russian military reportedly continues to deploy forces from lower priority sectors of the frontline in Ukraine to the frontline in Kursk Oblast as the operation pushed Russia to draw some of its forces, and forced Russia to the defensive positions. As we envisaged, Russia already started stronger missile and drone attacks into Ukraine territory, as it conducted one of the largest combined series of drone and missile strikes against Ukrainian critical infrastructure to date on August 26 while the use of any tactical nuclear weapons remains unlikely for now.

We continue to think the U.S. presidential elections would finally set the scene in Ukraine, and we envisage the former U.S. President Trump will likely not provide firm backing for Ukraine, if elected. President Putin continues to wait for the possibility of a Trump win and splits western support and leading to a Russia friendly peace deal with current territories, but the impacts of the incursion could moderately change the game, likely less land to Russia in 4 occupied regions. The key will be how the incursion goes, and how fast and strong Russia responds back.

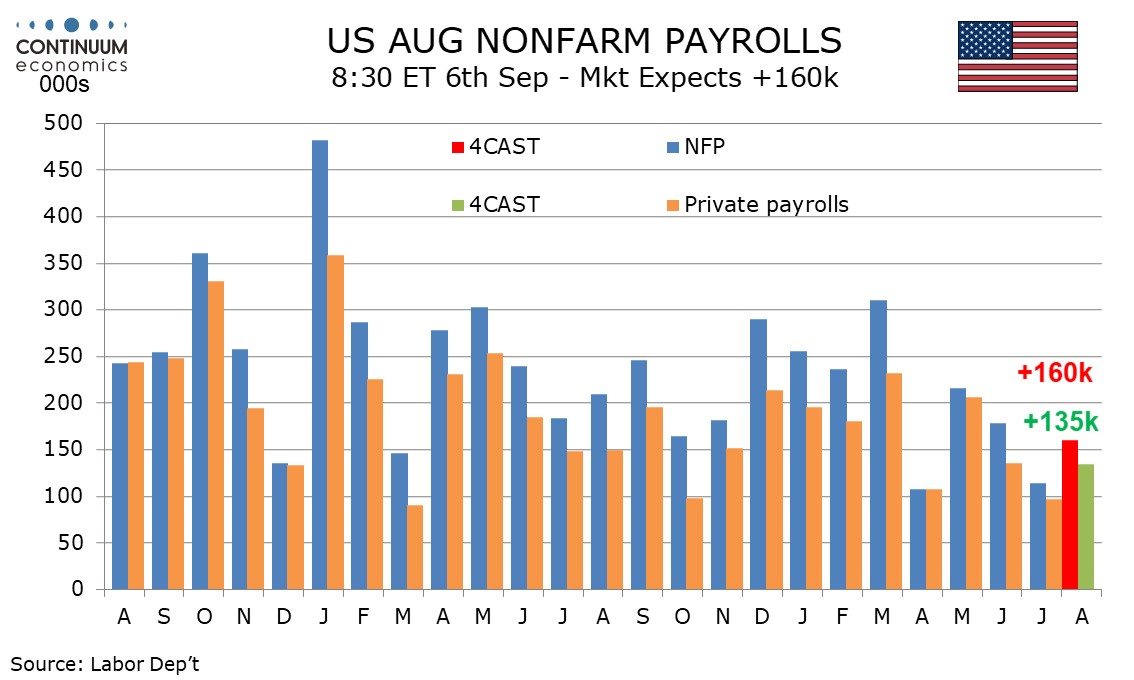

We expect August’s non-farm payroll to rise by 160k, 135k in the private sector, both slightly stronger than respective July gains of 114k and 97k that were probably restrained by weather but below 3-month averages of 170k and 146k, and thus implying a continued modest slowing in trend. We expect unemployment to correct lower to by 0.1% to 4.2% after rising by 0.2% to 4.3% in July, and a 0.3% rise in average hours earnings to follow a below trend 0.2% in July. A less weak payroll in August should help the FOMC decide to ease by 25bps on September 18 rather than by 50bps.

While July’s press release saw no discernable impact from Hurricane Beryl in the data, we suspect there was a modest negative impact. State data showed a 14.5k decline in Texas, the state most impacted by the hurricane. It is also possible that unusually hot weather in the Midwest had a negative impact in July. Initial claims data to the August survey week shows the 4-week average almost unchanged from July’s survey week, suggesting the labor market has not weakened further in August. Unemployment, having bottomed at 3.4% in April 2023, is clearly trending higher, but July’s 0.2% increase in the rate to 4.3% was steeper than trend, and caused by an above trend 420k increase in the labor force rather than job losses. We expect a 100k increase in August’s household survey estimate of employment, up from 67k in July, and an unchanged labor force to send unemployment down to 4.2%. July’s rate was 4.253% before rounding so it will not take much to see the rate correct lower. The non-farm payroll continues to outperform the household survey, which calculates the unemployment rate, even after an unusually large downward revision to the March 2024 benchmark of 818k, announced on August 21 but not due to be incorporated in the data until early 2025. The benchmark revision implies an average monthly gain of 174k in the non-farm payroll in the 12 months to March, down from 242k before the revision, but still above 71k as implied by the household survey. Since March the average non-farm payroll gain has been 154k. This may be over-estimated, but with layoffs still low we are comfortable that employment is still rising, albeit by less than the labor force.

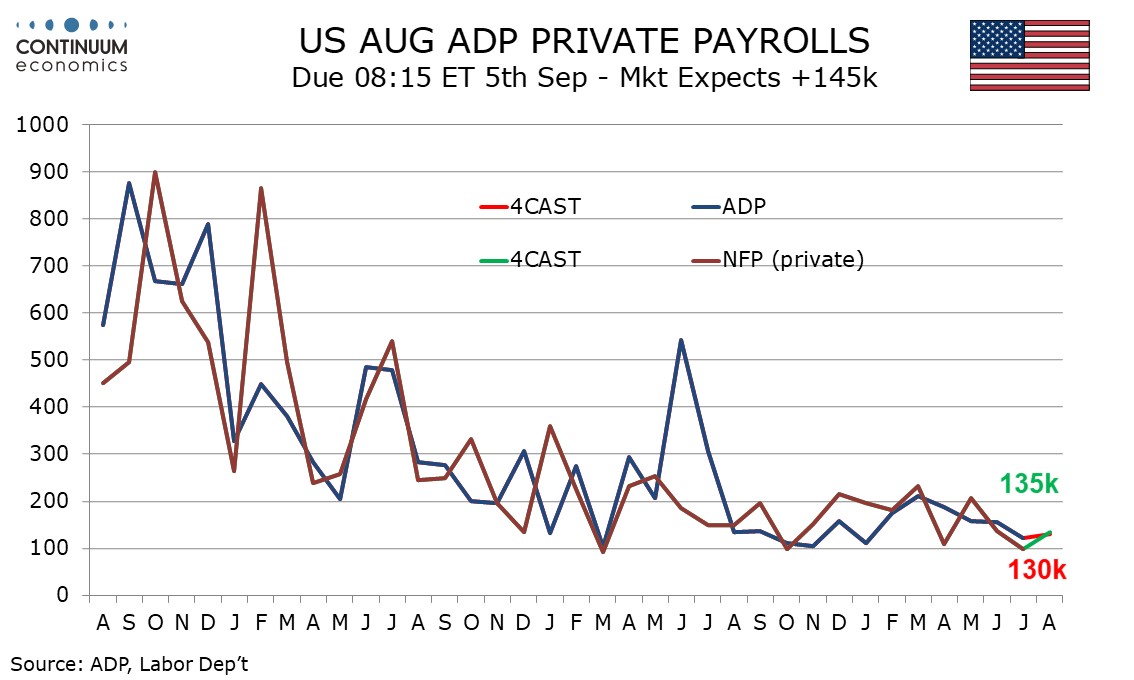

We expect a 130k increase in August’s ADP estimate for private sector employment growth, slightly below the 135k we expect for private sector non-farm payrolls. The two series have become more consistent with each other in recent months. We expect overall non-farm payrolls to rise by 160k. Trend in both ADP and non-farm payroll data appears to be losing momentum, but not sharply. We are forecasting a modest ADP underperformance in August after two straight modest outperformances, of 19k in June and 25k in July. July’s ADP outperformance may reflect non-farm payrolls being mote sensitive to bad weather than the ADP report.

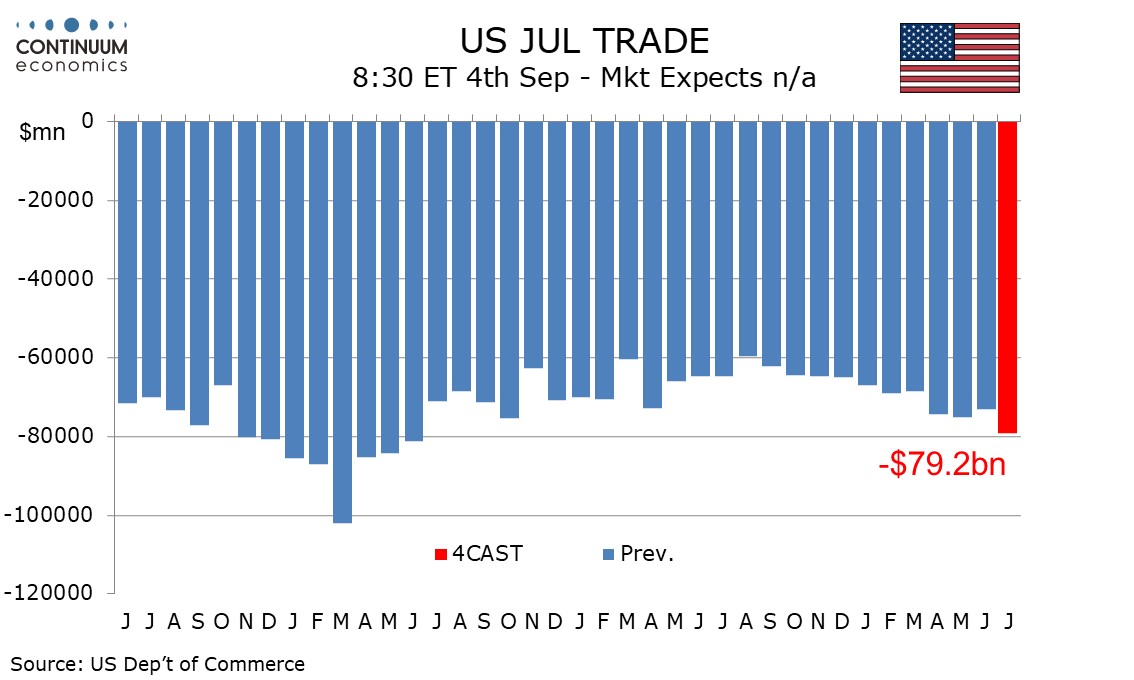

We expect July’s trade deficit to increase to $79.2bn from June’s $73.1bn, resuming a deteriorating trend after a modest improvement seen in June with the deficit reaching its highest level since June 2022. We expect exports to rise by 0.2% and imports to rise by 1.9%. We expect goods to be consistent with advance data which showed exports unchanged, restrained by weakness in autos, and imports up by 2.3%. We expect services to show both exports and imports up by 0.5%, exports reversing a 0.5% June decline but imports extending a 0.2% June increase.

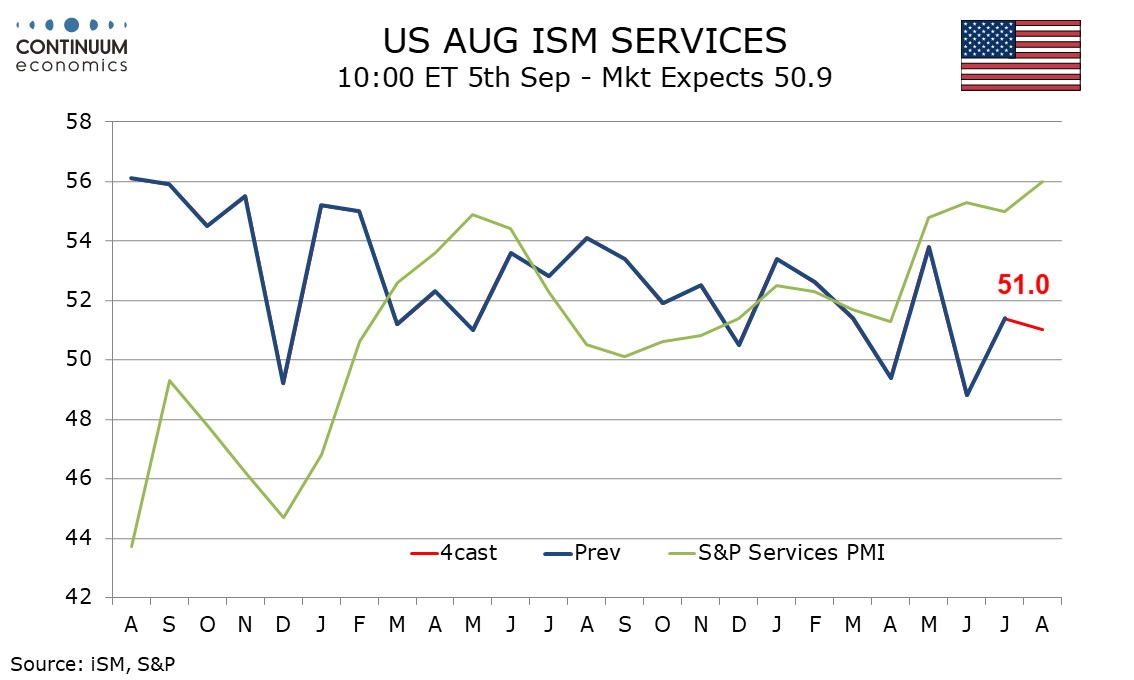

We expect August’s ISM services index to slip marginally to 51.0 from 51.4. This would be consistent with a gentle underlying slowing in trend that has been visible over the last two years, albeit with plenty of volatility around the gentle slowing in trend. This would contrast a stronger S and P services PMI for August which the ISM services index does not have a good relationship with. The S and P index is currently trending higher in what appears to be a response to rising expectations for Fed easing. Regional Fed service sector surveys for August are mixed, but on balance subdued, with modest positives from Kansas City, Dallas and the Empire State surveys, but significant negatives from the Richmond and Philly Feds.

In the ISM services detail we expect new orders at 52.5 and business activity at 54.5 to be almost unchanged from July. However employment is unlikely to sustain a July move above neutral for the first time since January and we expect a correction lower in employment to outweigh a correction higher in delivery times. Prices paid do not contribute to the composite. Here we expect a modest slowing to 55.0 from 57.0 which would be the slowest since March, though trend has little direction.

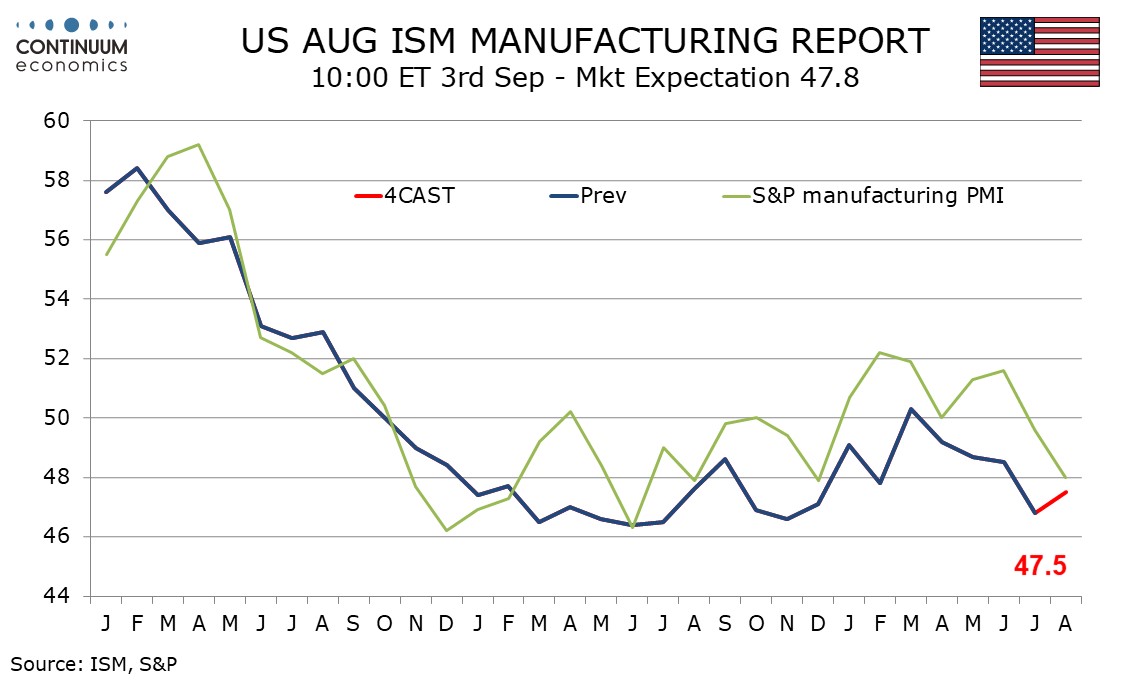

We expect an August ISM manufacturing index of 47.5, which would be a correction higher from July’s weaker 46.8 but still weaker than each index seen in the first half of 2024. There are not many strong signals coming from other surveys. The S and P manufacturing PMI of 48.0 was weaker than expected but coming off recent outperformance of the ISM data. Most regional Fed manufacturing surveys are moderately negative and on balance little changed from July.

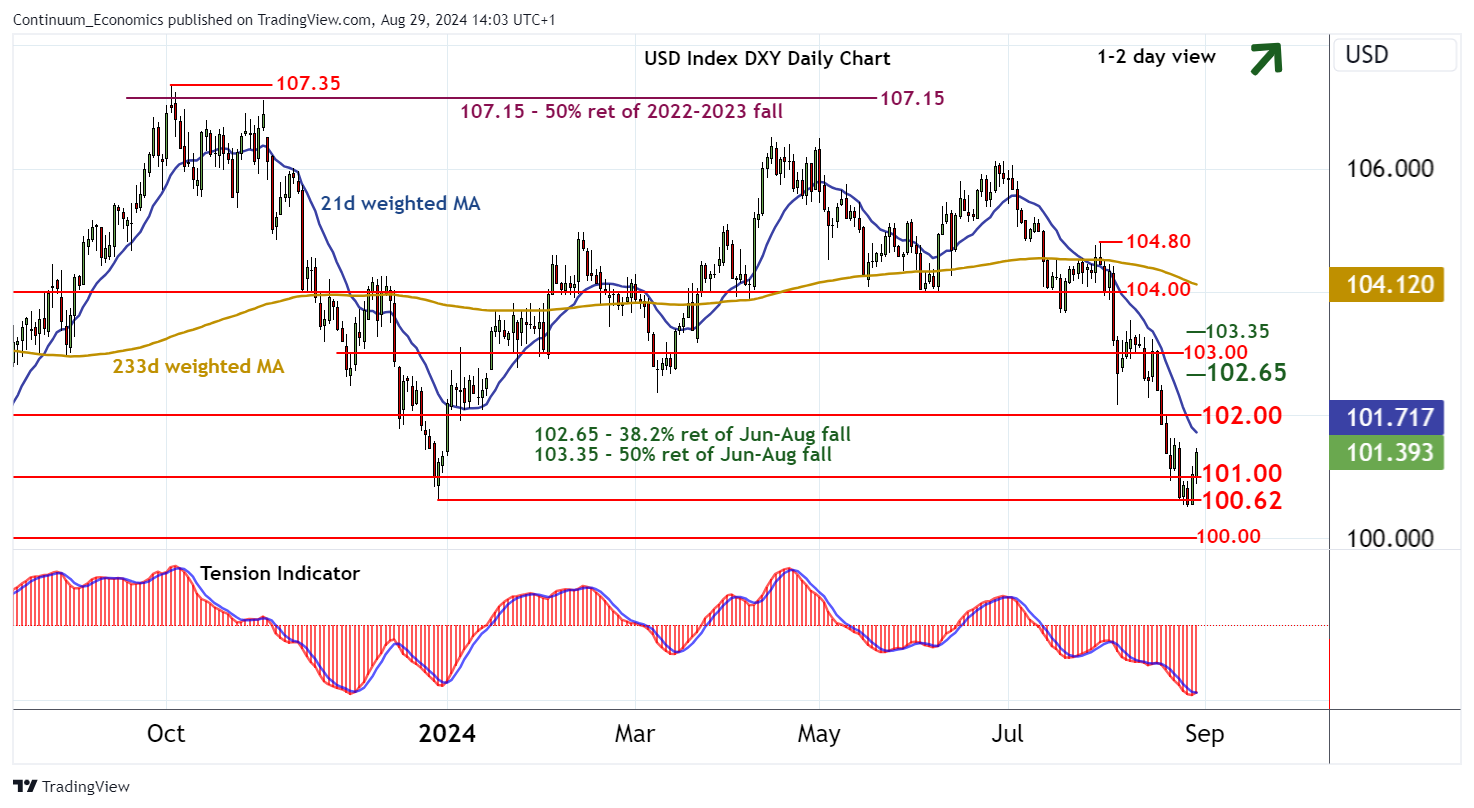

USD has been on retreat for months as the market expect the Fed to cut interest rate. The last trigger from Powell being open to 50bps in September pushed DXY closer to 100, where it rebounded as the market cannot be more dovish at that point. In reality, DXY has been in consolidation between sub 100-107 area since Feb 2023. What is more to interest rate after the Fed begin cutting in September is the health of U.S. economy. After considering rate changes, market will turn their focus to the U.S. economic details to gauge the direction of USD. The performance of other risk asset would also affect USD and we will have to wait and see the impact of rate to the physical economy beforehand.

On the chart, cautious trade has given way to anticipated gains, with the break above 101.00 currently trading around 101.40. Intraday studies have ticked higher and daily readings are improving, highlighting room for continuation towards congestion resistance at 102.00. However, mixed/negative weekly charts are expected to limit any initial break in selling interest beneath the 102.65 Fibonacci retracement. Meanwhile, an unexpected close back below 101.00 would turn price action neutral once again and give way to consolidation above strong support within the 100.56 current year low of 26 August and the 100.62 monthly low of 28 December 2023.

Data and events for the week ahead

UK

There is precious little for markets to digest this week save for the final PMI numbers (Mon/Wed) which will be examined for any more signs of recovery and where we see the message of the flash namely, the highest com positive reading since April being repeated. This apparently upbeat picture may be buttressed by the construction PMI figures (Thu) but where the BoE DMP survey may be more equivocal. Otherwise, the BoE issues a report on its APF (Tue).

Eurozone

Datawise, it is not a very busy week for more high-profile survey numbers, Admittedly, there may be more weak retail sales (Thu) and PPI (Wed) numbers which may be followed by more construction sector weakness in the sector PMI numbers, these coming on Thursday, ie after final PMI survey data arrive (Mon/Wed). German industrial production (Fri) is likely to see perhaps a fresh m/m fall as may manufacturing orders numbers the day earlier, both having recovered in the last set of data. Otherwise, we will be looking at official services production data, to see if they chime with the softer signal see in survey data for the sector, these arriving alongside Q2 GDP/employment data which will reveal the breakdown for the first time. There are ECB updates from both camps on the Council – Holzmann (Thu) and Villeroy (Wed)

Rest of Western Europe

There are no key events in Sweden, but with the Prospera inflation survey likely to underscore that price expectations are well anchored. But amid what may be a market reassessment of the policy outlook Riksbank Governor Thedéen talks about his views on the economic situation and current monetary policy (Tue). Switzerland sees CPI data (Tue with a stable 1.3% headline reading envisaged and a result consistent with a possible undershoot of SNB thinking. Q2 GDP should chime with the flash estimate of 0.5% q/q.

USA

The key release from the US is August’s non-farm payroll on Friday. While trend is slowing, we expect the data will be less weak than July’s report that was probably impacted by weather. We expect a 160k increase in payrolls, 135k in the private sector, with a correction lower in unemployment to 4.2% from 4.3% and an on trend 0.3% rise in average hourly earnings to follow July’s 0.2% increase. Other labor market indicators to watch are ADP’s estimate of August private sector payrolls on Thursday, where we expect a 130k increase, weekly jobless claims on Thursday and on Wednesday July’s JOLTS report on job openings.

August ISM surveys ae due. We expect manufacturing on Tuesday ot correct higher to 47.5 from 46.8 but services on Thursday to slip to 51.0 from 51.4. July construction spending is due on Tuesday. On Wednesday we expect July’s trade deficit to rise to $79.2bn from $73.1bn. July factory orders and the Fed’s Beige Book are also due on Wednesday. Thursday sees Q2 productivity and cost revisions. Fed’s Williams will speak on Friday. Monday sees US markets closed for Labor Day.

CANADA

Canada’s calendar highlight is Wednesday’s Bank of Canada meeting. With inflation continuing to fall, a third straight 25bps easing, to 4.25%, looks likely. The BoC is likely to signal further cuts are likely but will stress that decisions will be taken meeting by meeting. The data calendar sees August’s S and P manufacturing PMI on Monday with the services PMI following on Thursday. Wednesday sees July’s trade balance and Thursday Q2 productivity. The most significant data release will be August employment on Friday.

JP

On Thursday, we will have the Labor Cash earning. It is important for its pace determines the possible magnitude of conversion into CPI, which BoJ is expected to be sustainably higher. A low read would be in conflict with BoJ’s hawkish policy take. On Friday, there will be household spending. Consumption has been a laggard for the past two quarters in japan as real wage stays negative from inflationary pressure. BoJ would like to see a high read to prove Japanese consumption behaviour has changed amid higher prices.

AU

We have a slate of Australian data but mostly tier two. GDP on Wednesday would carry the most weight. Q1 GDP has been dismay and reported minimal growth. It is hard to see a strong Q2 with consumption showing weakness in preliminary data. Trade Balance would be on Thursday, along with RBA’s Bullock speech.

Recap for the week

Ukraine’s surprise cross-border offensive inside Russia's western Kursk region continues with pace as Ukrainians recently advanced near Sudzha. In response, Russian military deploys forces from lower priority sectors of the frontline in Ukraine to the frontline in Kursk Oblast. We foresee it is still unlikely that Russia will allow Ukrainian forces to go too far, but deploying more men and material to Kursk region will take time and will be slower than expected. As we envisaged, Russia already started stronger missiles and drone attacks into Ukraine territory, as it conducted one of the largest combined series of drone and missile strikes against Ukrainian critical infrastructure to date on August 26 while the use of any tactical nuclear weapons remains unlikely for now. It will likely be hard for Ukraine to sustain the operation whilst Russia continues to bring more artillery and aviation, and it is uncertain whether the operation will be a game changer. The incursion is expected to increase Ukraine’s bargaining position at any negotiations in the future and will likely work as a hedge should Trump is reelected as U.S. president, splits western support and leading to a probable Russia-friendly peace deal, likely in 2025.

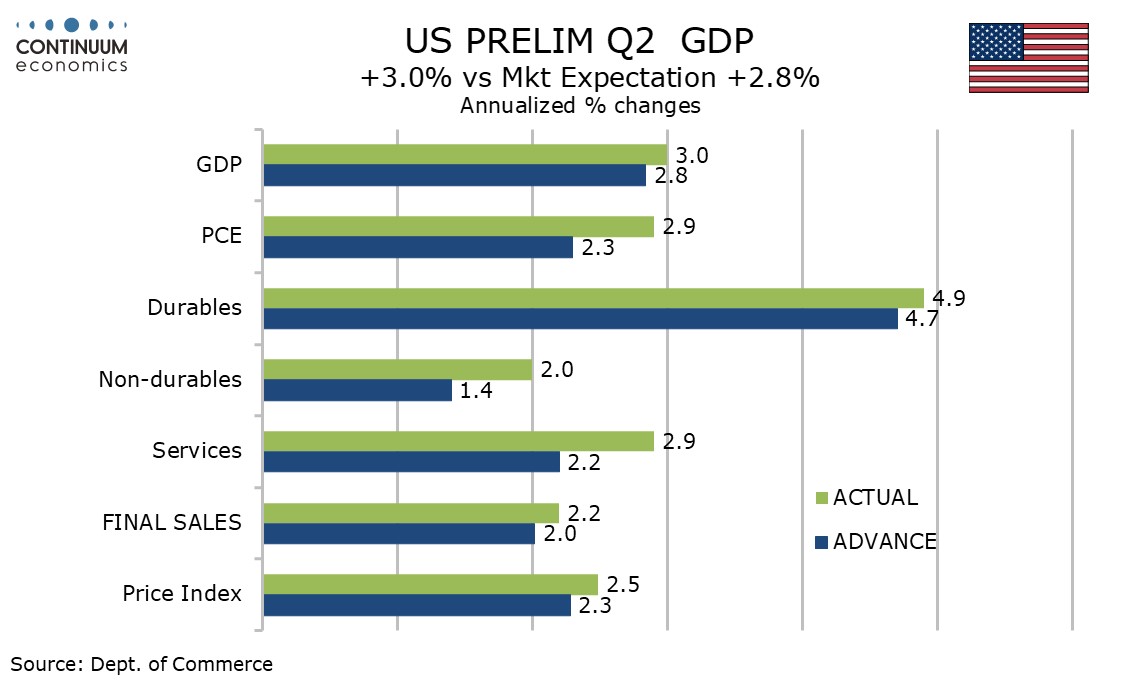

Q2 has seen a marginal upward revision to 3.0% from an already strong 2.8% with the revision due to consumer spending, now at 2.9% from 2.3% and maintaining a picture of surprising resilience. Core PCE prices were revised slightly lower to 2.8% from 2.9%. While Q2 GDP is strong a wider advance July goods trade deficit of $102.7bn from $96.6bn is negative for Q3. Initial claims at 231k are slightly down from 233k and do not suggest any further weakening in the labor market.

The upward revision to consumer spending was broad based and unexpected, goods to 3.0% from 2.5% and services to 2.9% from 2.2%. This puts consumer spending well ahead of real disposable income, which was unrevised at 1.0% and that raises questions over how long consumer resilience can persist. Gross domestic income at 1.3% in Q2 (this the first estimate) matched the gain in Q1 and significantly underperformed GDP in Q2. Excluding the revision to consumer spending, GDP revisions were modestly negative, with business investment at 4.6% from 5.2%, housing at -2.0% from -1.4%, and government at 2.7% from 3.1%. Exports were revised down to 1.6% from 2.0% and imports revised up to 7.0% from 6.9%. Inventories also saw a small downward revision.

Figure: Inflation at Target?

Source: German Federal Stats Office,

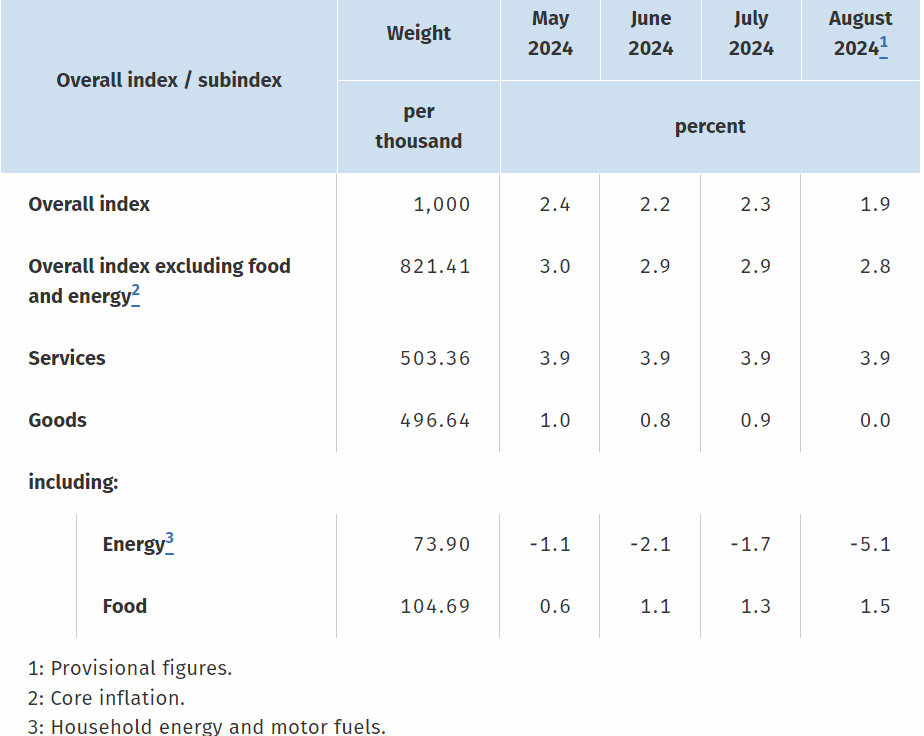

Germany’s disinflation process has not been smooth due to swings in base effects and this was again clearly the case in the August data. After July saw the headline HICP rate rise an unexpected 0.1 ppt to 2.6%, unwinding a third of fall seen in June, it plummeted this month to a 41-month low of 2.0%, ie consistent with the ECB target and well below expectations. Indeed, the CPI counterpart actually fell a notch below 2%, albeit with the core rate on this basis down just 0.1 ppt. Details show stable services and with more negative energy and slightly higher food inflation causing the higher headline outcome.

This German data mirrors weaker than expected Spanish figures today and hints that the EZ HICP flash due tomorrow could also hit the 2% target, a full year earlier than ECB projections suggest. Perhaps the last mile for inflation is not the hardest, after all, for middle distance runners the last mile is often the quickest!

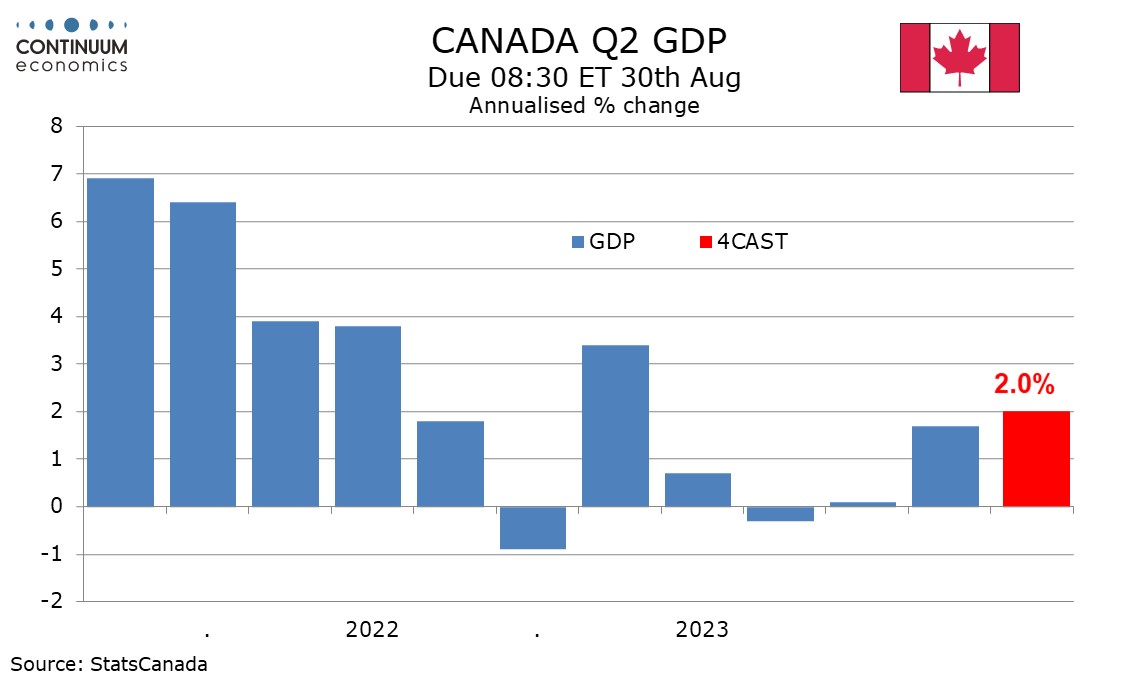

We expect Q2 Canadian GDP to rise by 2.0% annualized, a little above a 1.5% estimate made with the Bank of Canada’s July Monetary Policy Report and s second straight quarter of moderate growth after a near flat second half of 2023. We expect a 0.1% increase in June GDP, in line with a preliminary estimate made with May’s GDP report. We expect domestic demand to also rise by 2.0% annualized, slightly slower than Q1’s 2.9% despite GDP seen marginally accelerating from 1.7% in Q1. We consumer spending also rising by 2.0%, with the gain in investment set to be slightly stronger but government to rise by slightly less. We expect a negative contribution of 0.7% from net exports, with Q2 data showing exports slightly down in real terms but imports slightly higher. We expect the negative from net exports to be offset by a matching positive from inventories, correcting a larger negative contribution in Q1.

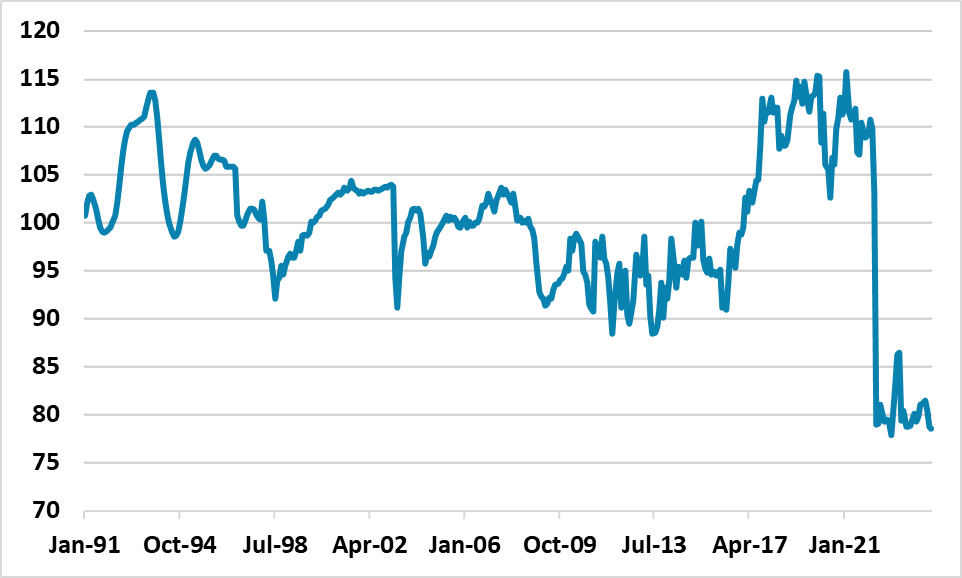

Figure: NBS China Consumer Confidence (1991 = 100)

Source Datastream/Continuum Economics

China consumption patterns are divergent; slowing and becoming more volatile at a sub sector level. Less certainty over new employment and wage growth, plus wealth worries over housing are some of the causes. We forecast GDP to slow in H2 and be 4.0% in 2025.

China’s consumption is vital to growth when production is transitioning from old economy dependency on residential investment, steel, cement and other industries. The problem is that China consumer are in a volatile mood. The breakdown of the retail sales numbers suggest that post COVID pent up demand is still providing a boost helped by restaurant services and tourism. However, furniture and household appliance sales are weak, auto sales soft and the luxury industry not seeing the same buying demand from China’s consumers. PDD a major e commerce provider has just reported weak revenue and profits (here), despite targeting budget focused consumers. Finally, consumer confidence is weak (Figure 1). One issue is income for China consumers, where consumers views have deteriorated. This is a combination of private sector companies slowing hiring; some construction related wages stalling or falling plus unevenness in rural to urban migration (that traditionally boosts income and consumption for a sub sector).