Published: 2024-08-28T13:57:45.000Z

Preview: Due September 3 - U.S. August ISM Manufacturing - A correction higher but still subdued

0

2

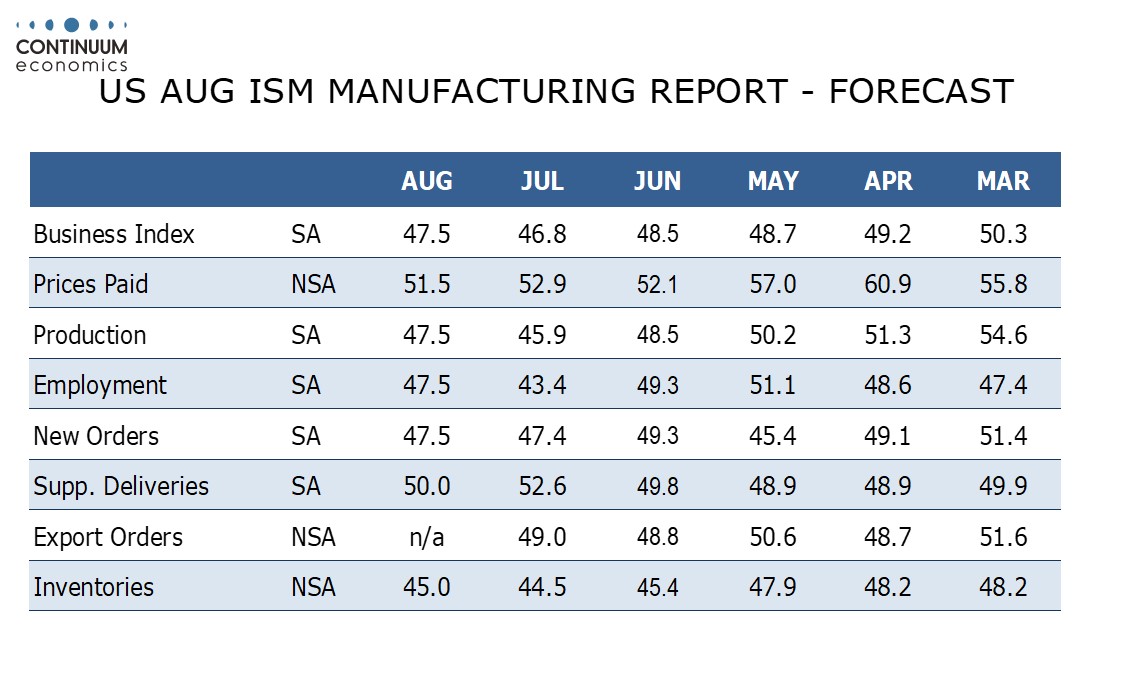

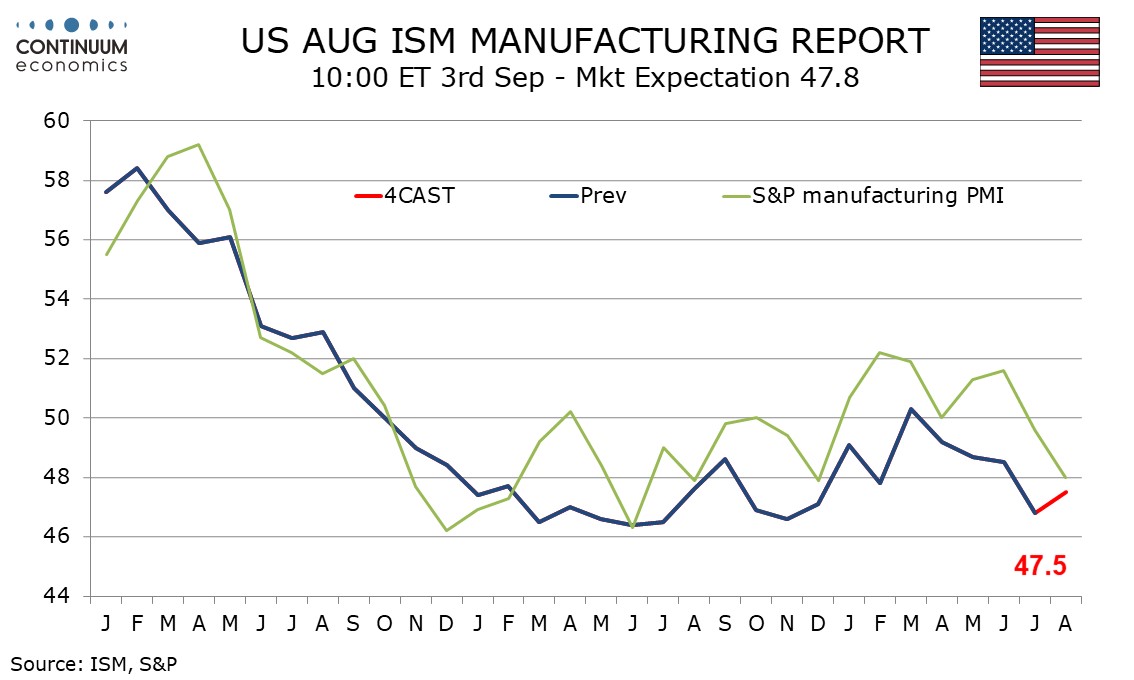

We expect an August ISM manufacturing index of 47.5, which would be a correction higher from July’s weaker 46.8 but still weaker than each index seen in the first half of 2024.

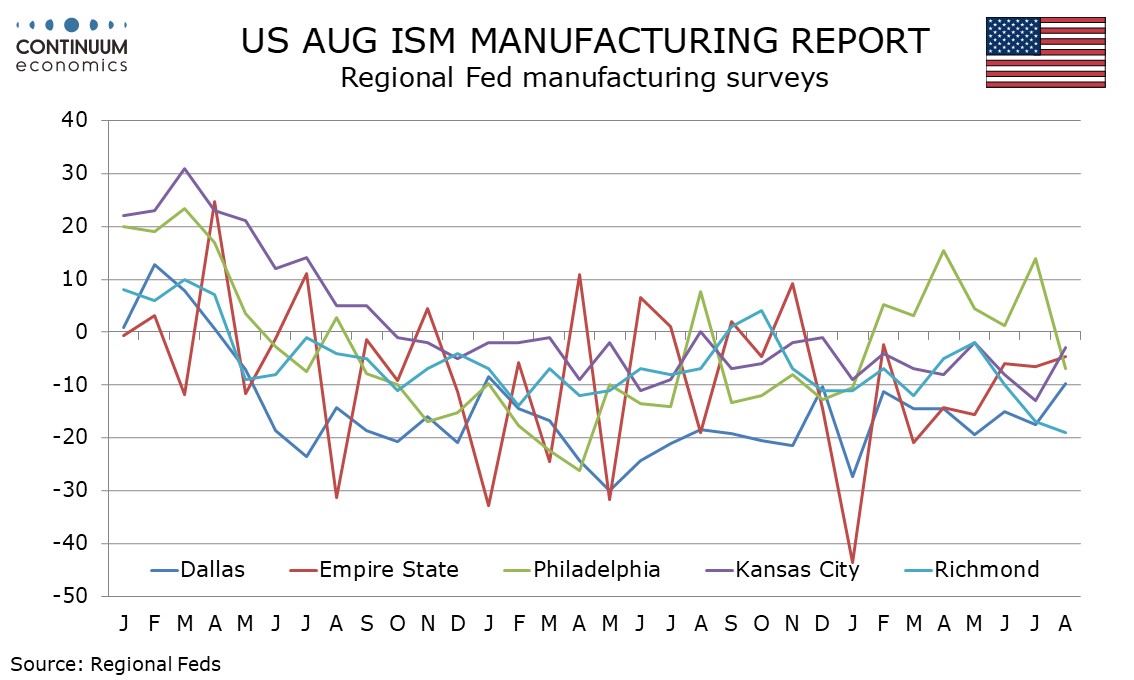

There are not many strong signals coming from other surveys. The S and P manufacturing PMI of 48.0 was weaker than expected but coming off recent outperformance of the ISM data. Most regional Fed manufacturing surveys are moderately negative and on balance little changed from July.

In the ISM detail we expect new orders to be almost unchanged at 47.5 from 47.4. We expect 47.5 readings from production and employment too, both corrections higher from below trend respective July readings of 45.9 and 43.4. Completing the breakdown of the composite we expect deliveries to slip to 50.0 from a stronger July reading of 52.8 while inventories rise to 45.0 from 44.5.

Prices paid do not contribute to the composite. Here we expect the index to slip to 51.5 from 52.9, which would leave the index at its lowest since December 2023.