Preview: Due February 4 - U.S. January ADP Employment - To slow, and underperform payrolls

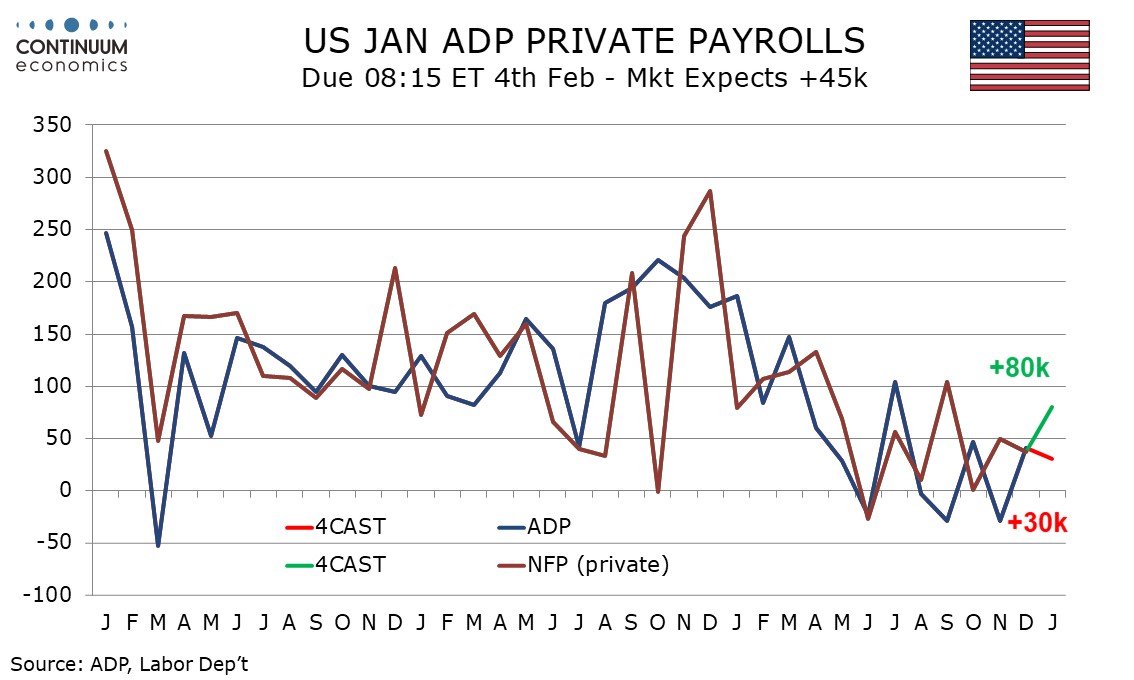

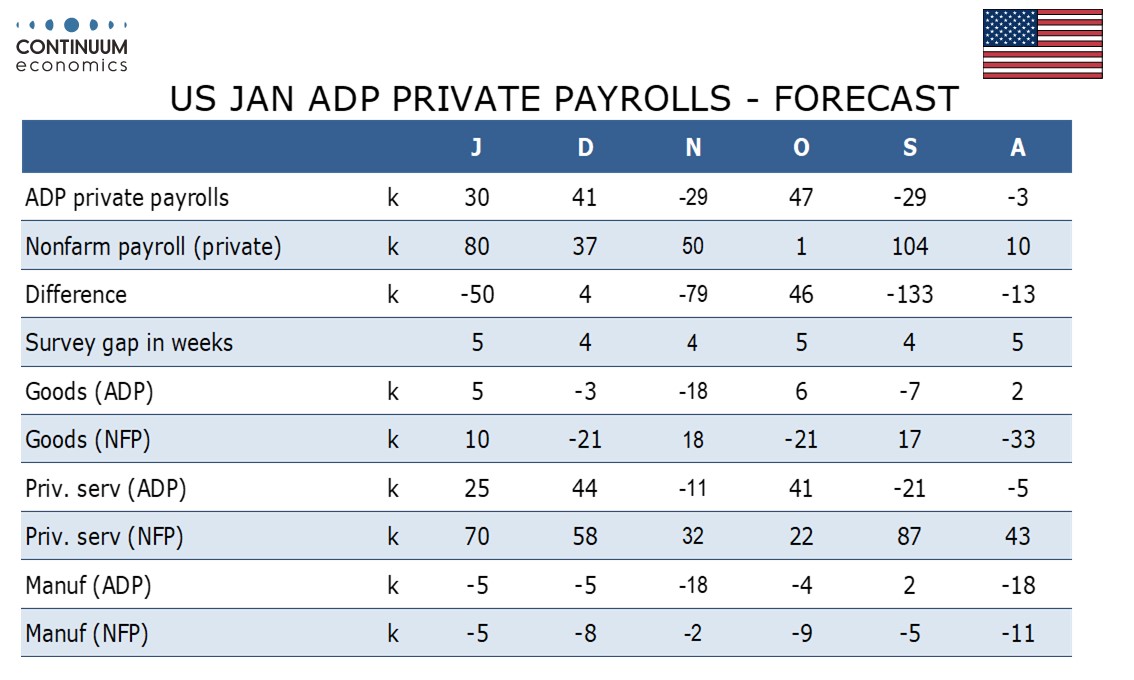

We expect a 30k increase in January’s ADP estimate for private sector employment, which would be a slowing from 41k in December. We expect the ADP report to significantly underperform January’s non-farm payroll, where we expect a rise of 80k in the private sector, and 85k overall.

Weekly ADP data, showing an average weekly job increase of 7.75k in the four weeks to January 3 looks to be on a slowing trend, with the four weeks to December 13, December’s payroll survey week, showing an average gain of 10.5k, which was consistent with December’s 41k ADP outcome. The latest weekly data is still two weeks prior to the survey week for January’s monthly data, and low initial claims suggest no further deterioration, while bad weather in late January came after the survey week. However it is likely that January’s ADP data will show a slower rise than December’s.

December’s ADP data was close to consistent with December’s non-farm payroll but the recent tendency has been for ADP data to underperform, with the average ADP underperformance over the last six months being 22k. We expect a 50k underperformance in January, still a narrower gap than seen in September and November. Payrolls in January look due for a rebound from recent weakness in retail, which is less of a risk in the ADP data.

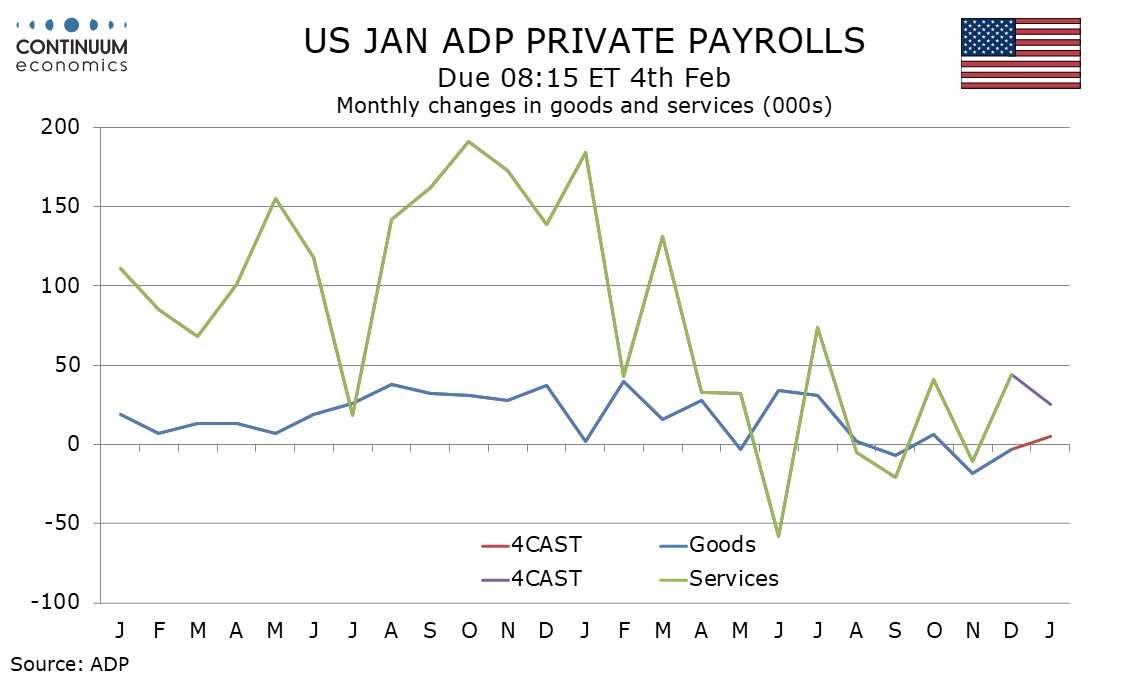

We expect January’s ADP detail to show a modest improvement in goods, led by construction, but a slowing in services, after December’s ADP report showed the strongest rise in services since July. It is in services where the recent tendency for ADP data to underperform payrolls has most visible. Most prominent in the contrast has been education and health, though the gap narrowed in January, leaving the two series more consistent, but it is too soon to conclude that this will become a trend.