U.S. Initial Claims rebound from a dip but July Philly Fed looks positive

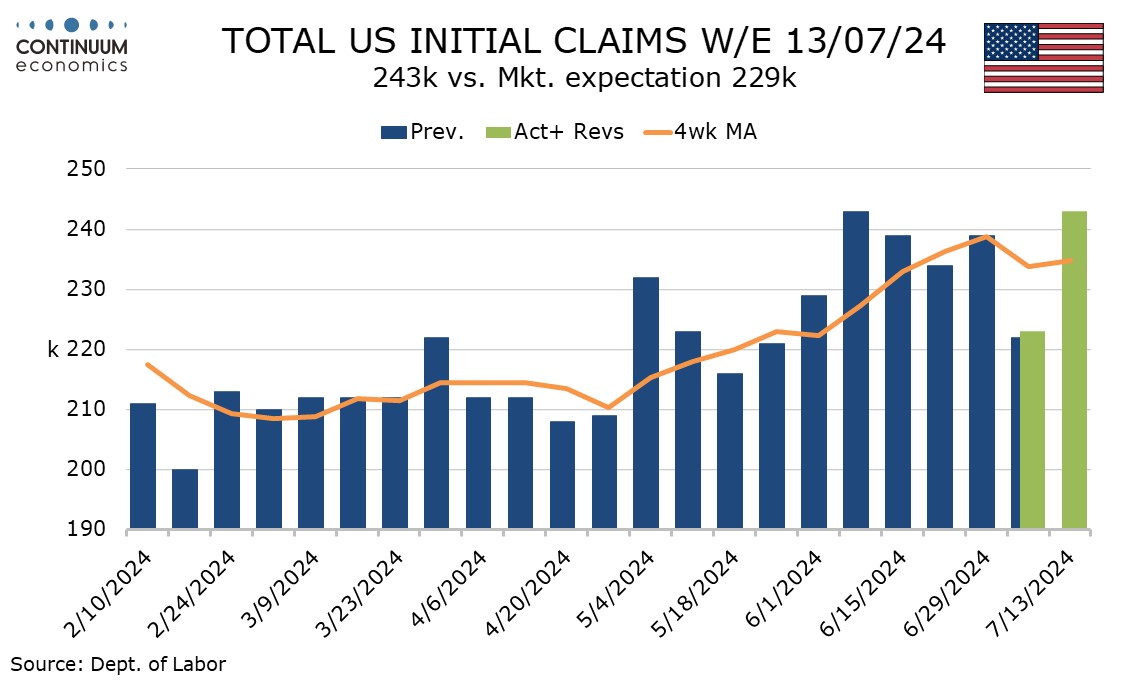

Initial claims at 243k have bounced to the highest level since a matching number five weeks ago from last week’s 223k which was a six week low, restoring signs of labor market slowing. However July’s Philly Fed manufacturing index at 13.9 versus 1.3 is stronger than expected and backs some positive recent manufacturing signals.

Initial claims data needs to be treated cautiously in early July due to the first week including the 4 July holiday and the first two weeks seeing annual auto retooling shutdowns, both of which make seasonal adjustments difficult.

This week is the survey week for June’s non-farm payroll. The 4-week average of 234.75k has come off a high seen two weeks ago but is marginally higher than the 233k seen in May’s payroll survey week.

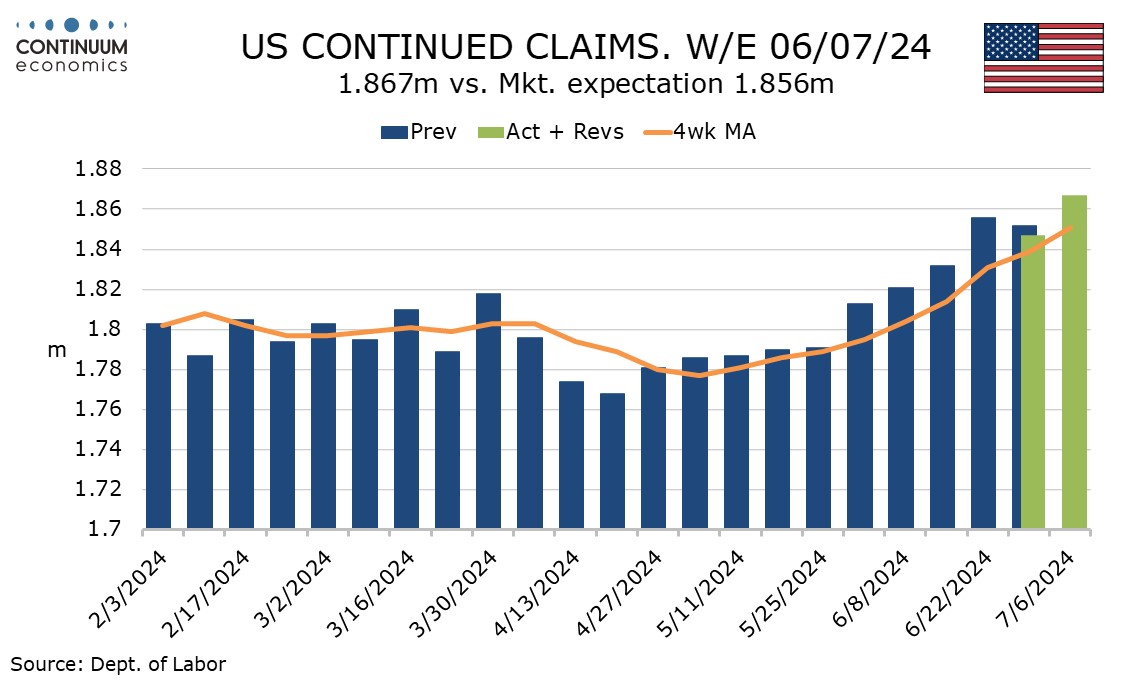

Continued claims, which cover the week before initial claims, also renewed a rising trend, up by 20k to 1.867m after a preceding fall of 9k which was the first decline in ten weeks. The 4-week average of 1.851m is the highest since December 2021.

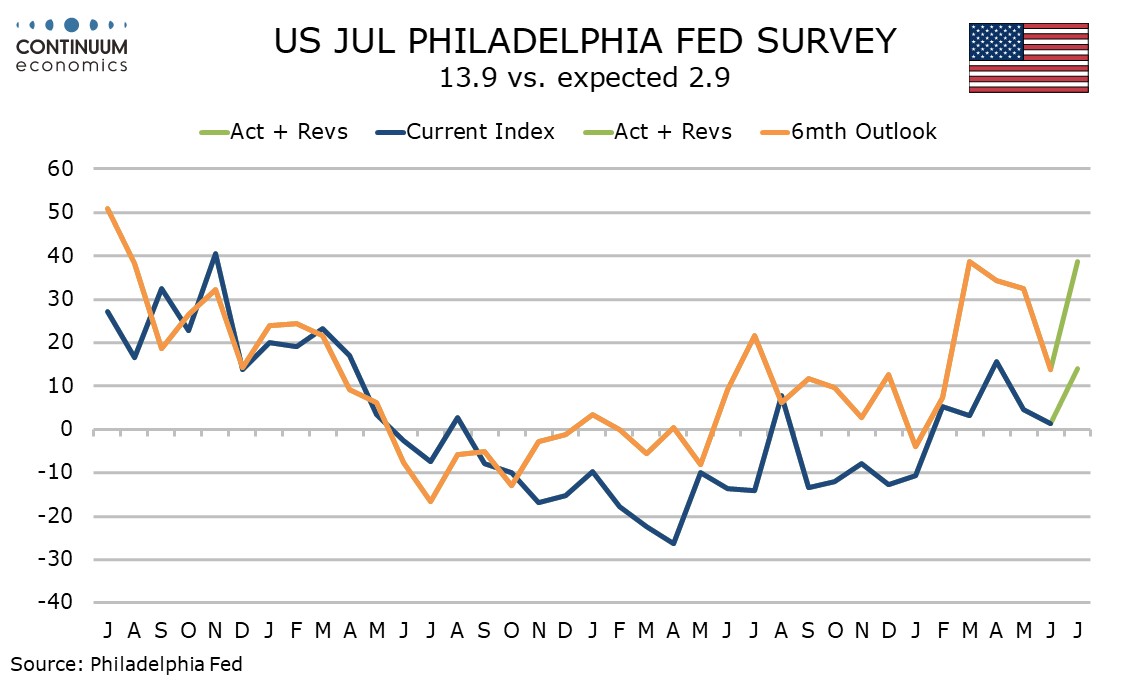

July’s Philly Fed index of 13.9 from 1.3 is the sixth straight positive and in recent months has been outperforming most manufacturing surveys. However manufacturing output gained momentum in Q2 and the S and P manufacturing PMI has been giving positive readings, outperforming the ISM’s.

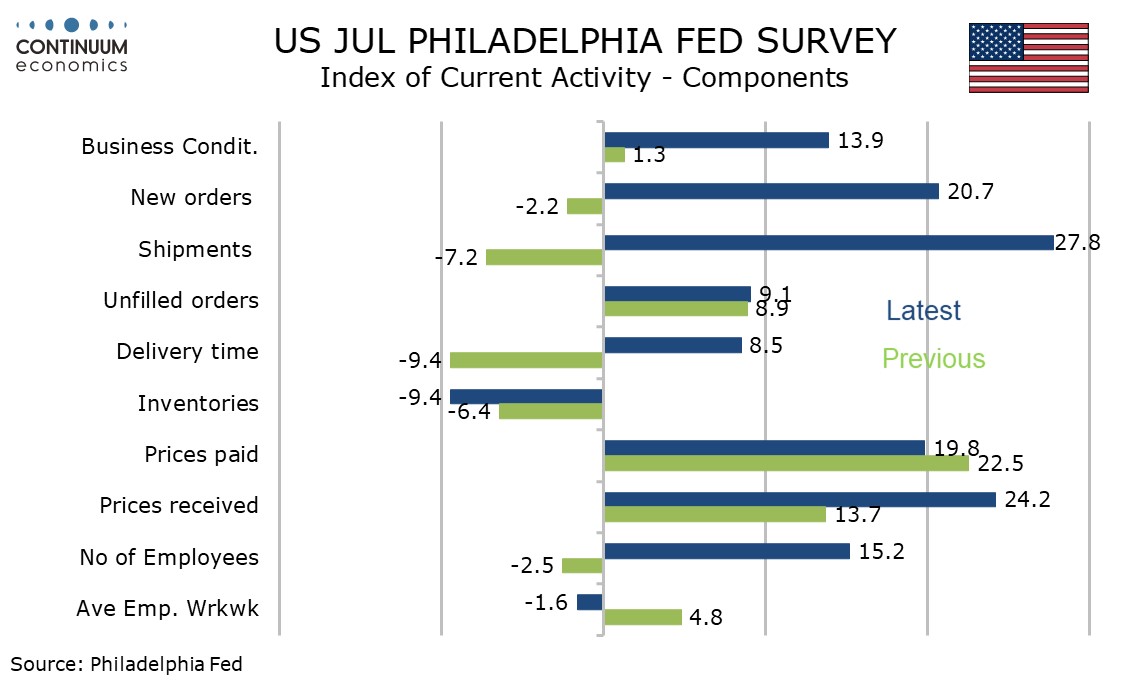

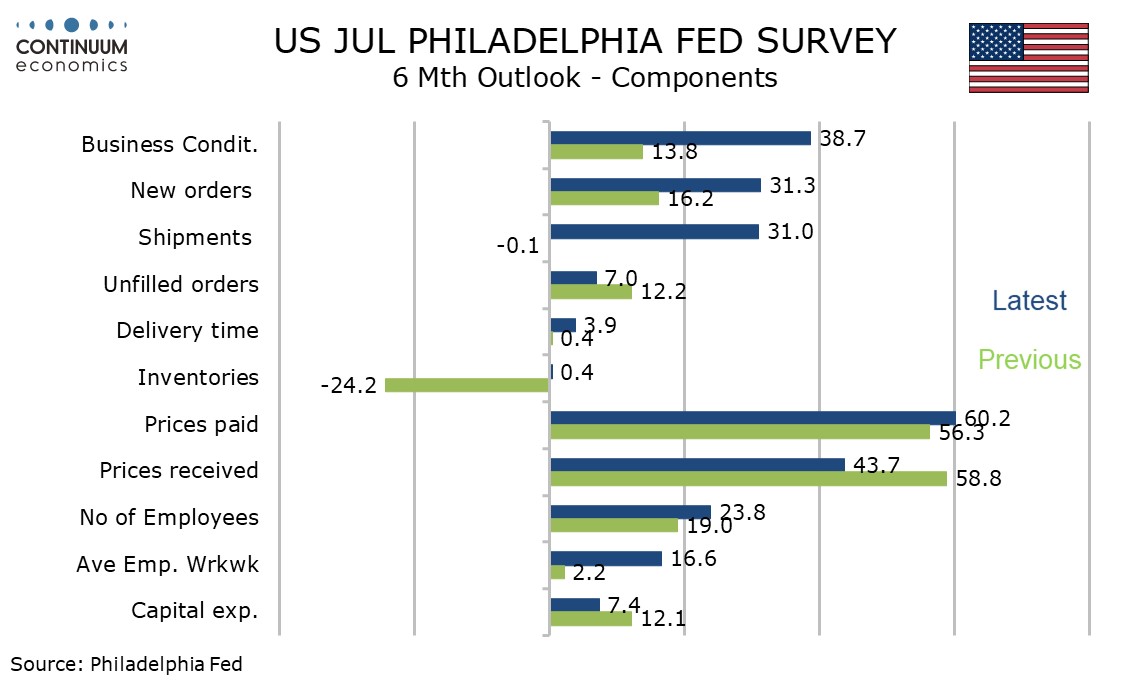

July’s Philly Fed detail shows strong gains in new orders to 20.7 from -2.2, employment to 15.2 from -2.5 and six month expectations, to 38.7 from 13.8, the latter the highest since July 2021, so the signals are clearly positive in the key components.

Prices data is mixed. Prices paid slipped to 20.6 from 24.1 erasing most of a June bounce but prices received were almost unchanged at 11.8 from 12.0. Six month expectations saw prices paid modestly higher at 45.4 from 34.1, reaching their highest since August 2023. If activity sustains its renewed momentum, this could boost inflationary pressures.