GBP flows: GBP little changed after GDP, but...

GBP little changed as GDP rises 0.2% in August as expected, but high level of GBP looking harder to justify

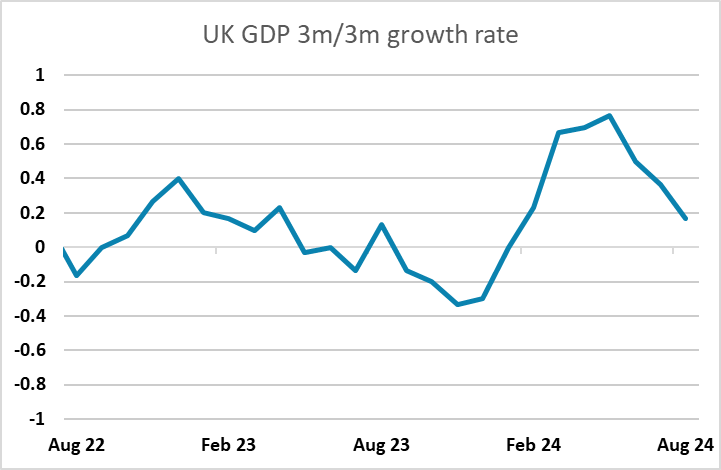

UK August GDP data has come in in line with expectations at 0.2% m/m, and there has been no significant impact on GBP. The August rise follows two flat months, and it does seem that the strength of H1, which saw growth pick up unexpectedly, is waning, with the 3m/3m growth rate running at 0.2%.

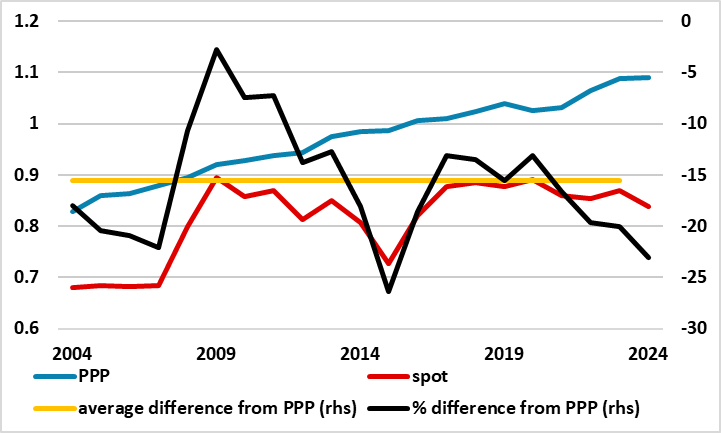

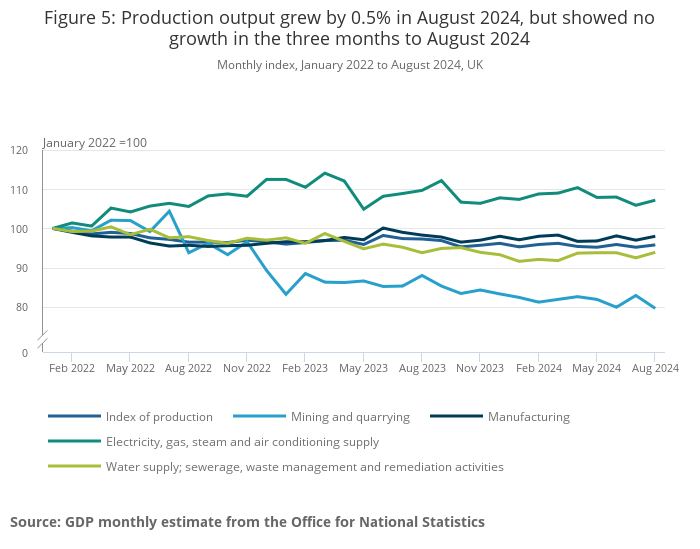

It is also notable that in spite of the sharp rise we have seen in then UK manufacturing PMI this year, manufacturing output remains weak in the official data. While there has been little impact on GBP from the numbers, the strength of then pound this year has been based to some extent on UK growth outperformance, and if this is waning the high level of GBP is hard to justify, especially if the BoE are about to start easing more aggressively, as the recent comments from governor Bailey suggest. EUR/GBP remain at levels that are close to the highs seen since the Brexit referendum in real terms, and as UK growth slows and rates are cut we would expect EUR/GBP to start to move up above 0.84.