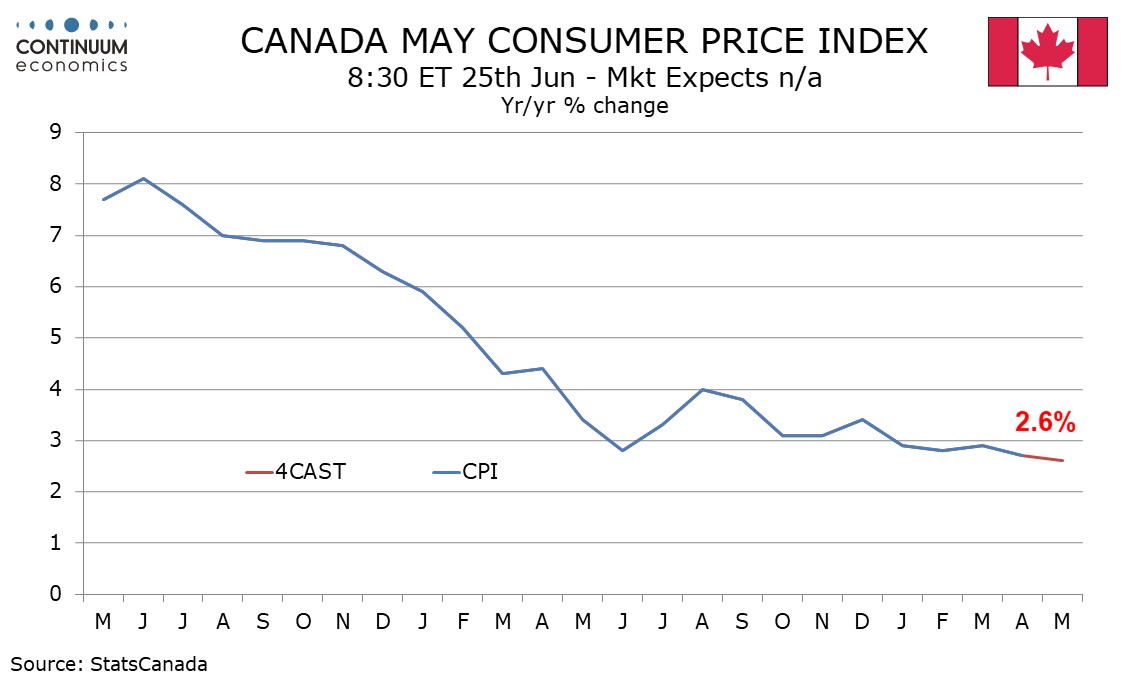

Preview: Due June 25 - Canada May CPI - Still slowing if less steeply than in April

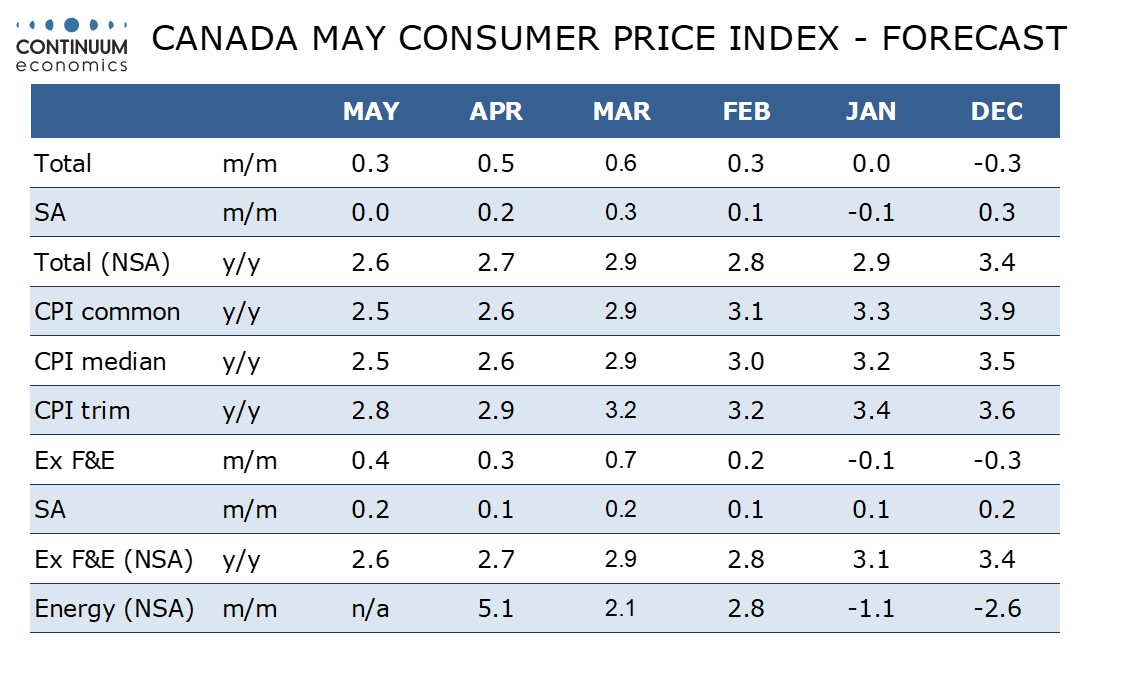

We expect May CPI to maintain downward progress, overall and in the BoC’s core rates, though less sharply than was the case in April. We expect overall CPI, and the average of the BoC’s three core rates, to slip to 2.6% yr/yr from 2.7%, which would be the lowest overall CPI since March 2021. We expect the core rates to also fall by 0.1% from their April paces.

On the month we expect gains of 0.3% overall and 0.4% ex food and energy. Some of these gains will be seasonal. Seasonally adjusted we expect overall CPI to be unchanged while ex food and energy CPI rises by 0.2%. The preceding four months have also seen unadjusted data outpace the seasonally adjusted data. This may be helping to deliver the recent string of soft seasonally adjusted numbers.

The last five months have produced three 0.1% seasonally adjusted ex food and energy gains, and two gains of 0.2%. After a 0.1% increase in April we lean towards a 0.2% outcome for May, though there are no components in April’s breakdown that look due for a sharp rebound. Gasoline prices slipped in May after three straight gains and the decline will look steeper after seasonal adjustment.

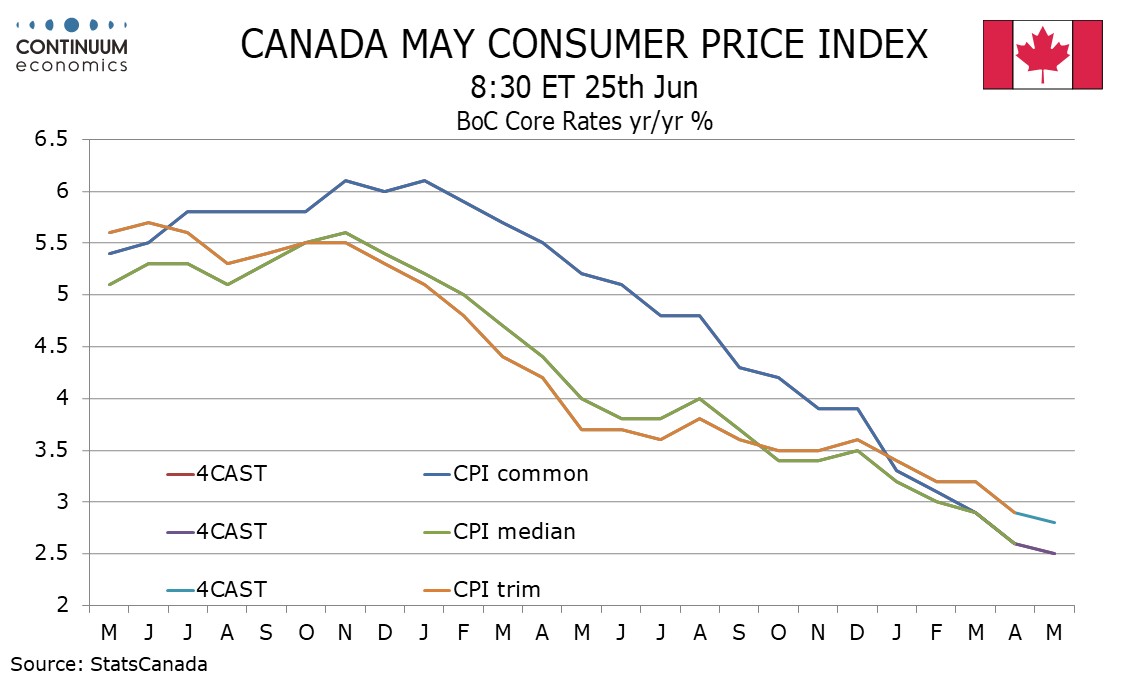

While we expect the yr/yr ex food and energy pace, like the headline, to slip to 2.6% from 2.7%. This is not one of the BoC’s core rates, which we expect to see similar slowings, with CPI-common falling to 2.5% from 2.6%, CPI-median falling to 2.5% from 2.6% and CPI-trim falling to 2.8% from 2.9%. These slowings would be less steep than in April, when each core rate was 0.3% below its March outcome.