Preview: Due June 13 - U.S. May PPI - Following a strong April

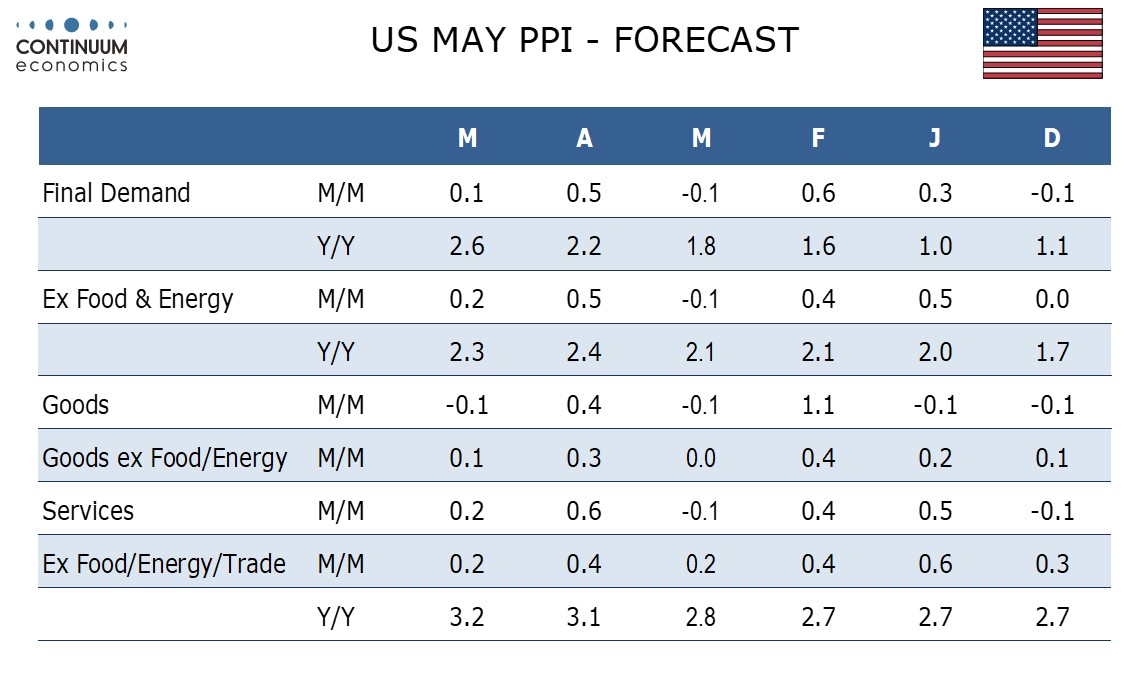

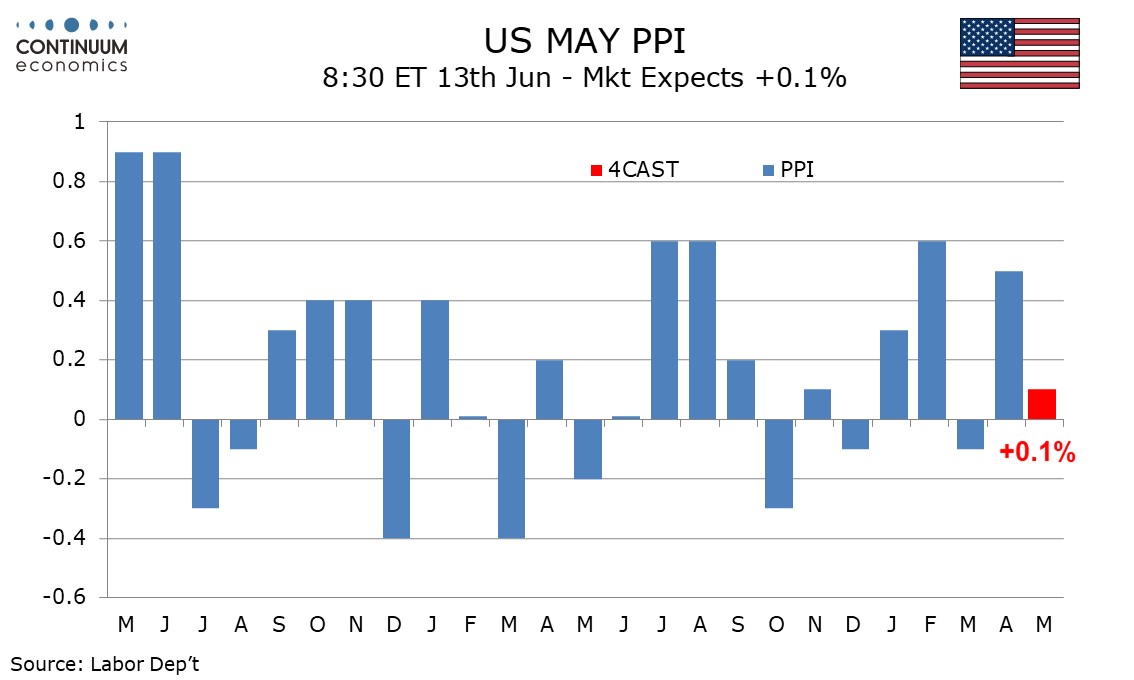

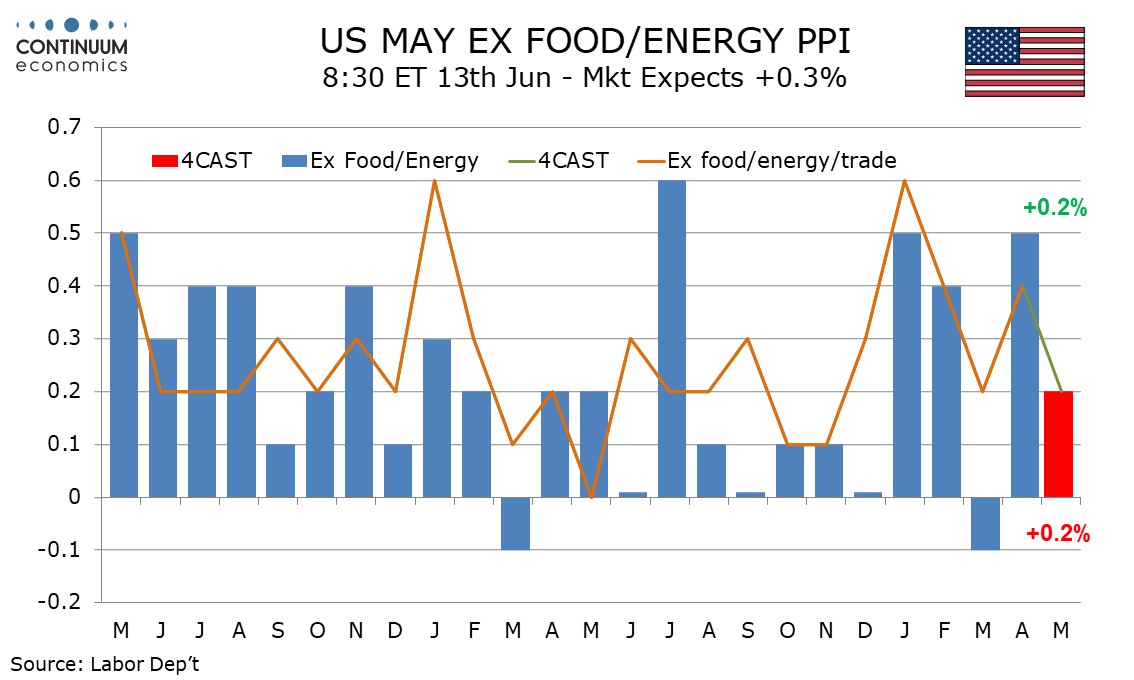

We expect a 0.1% increase in May’s PPI, with gains of 0.2% in the core rates ex food and energy and ex food, energy and trade. This would follow above trend April data, meaning that should May not produce the subdued data we expect, it would be cause for concern.

PPI data was generally subdued through 2023, even before CPI lost momentum in the second half of the year. The start of 2024 however delivered strong data in January and February, which we suspected reflected one-time pricing decisions taken at the start of the year. Strong data in April can be seen as corrective from weak data in March, and we expect May data to be mostly subdued.

Energy prices look set to see a modest decline after increasing in April though the impact on PPI is likely to be modest, while we expect food to correct higher after declining in April. We expect trade prices to be more neutral after a strong April corrected a weaker March. A 0.2% rise ex food, energy and trade would be a little softer than trend seen in 2024 to date but consistent with the picture seen through 2023 apart from a sharp bounce in January.

We expect yr/yr growth to rise to 2.6% from 2.2% overall, reaching its highest since April 2023, but ex food and energy PPI slow to 2.3% from March’s 8-month high of 2.4%. Ex food, energy and trade we expect a 13-month high yr/yr pace of 3.2% versus 3.1% in April.