Preview: Due June 12 - U.S. May CPI - Slower overall, another 0.3% for the core

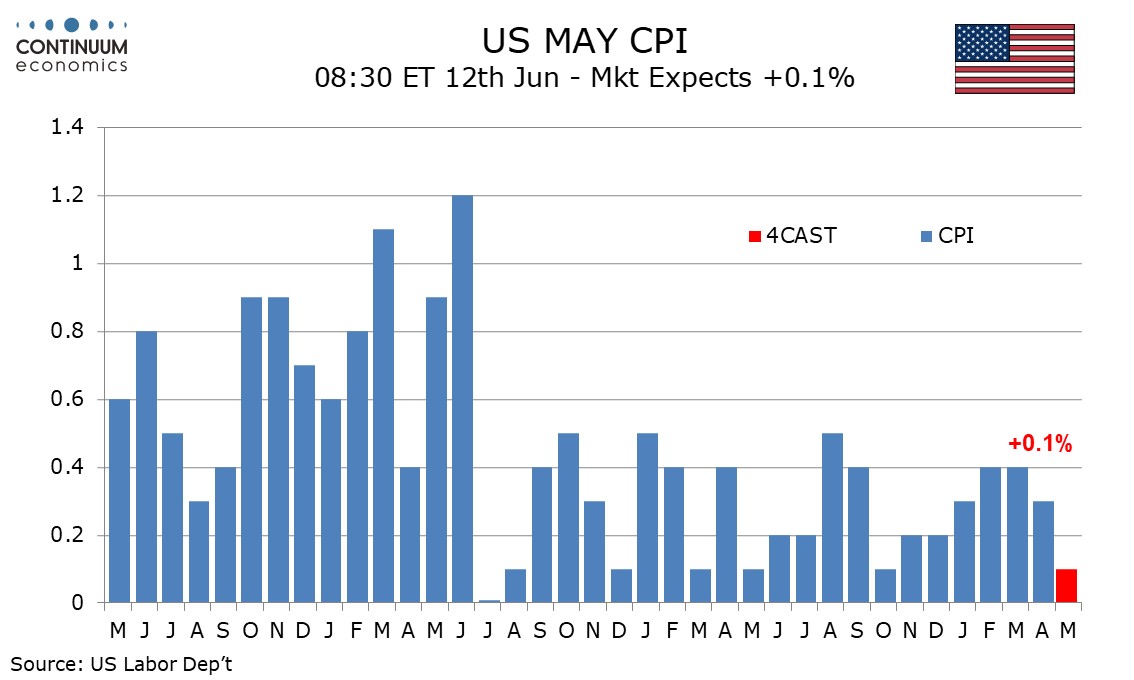

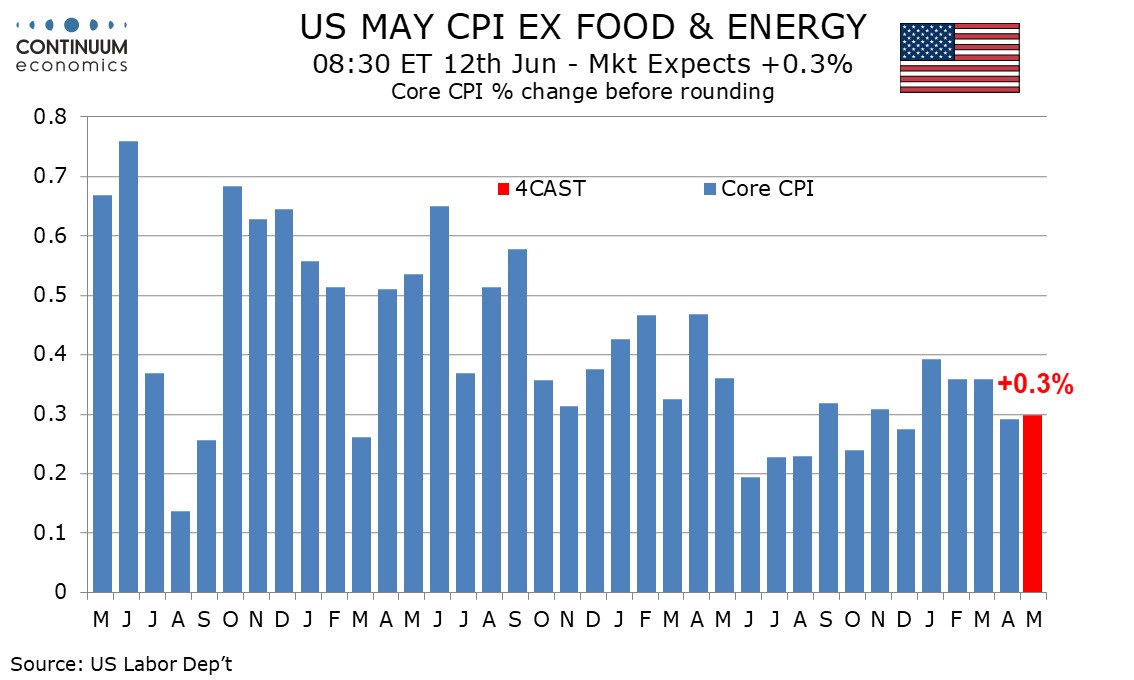

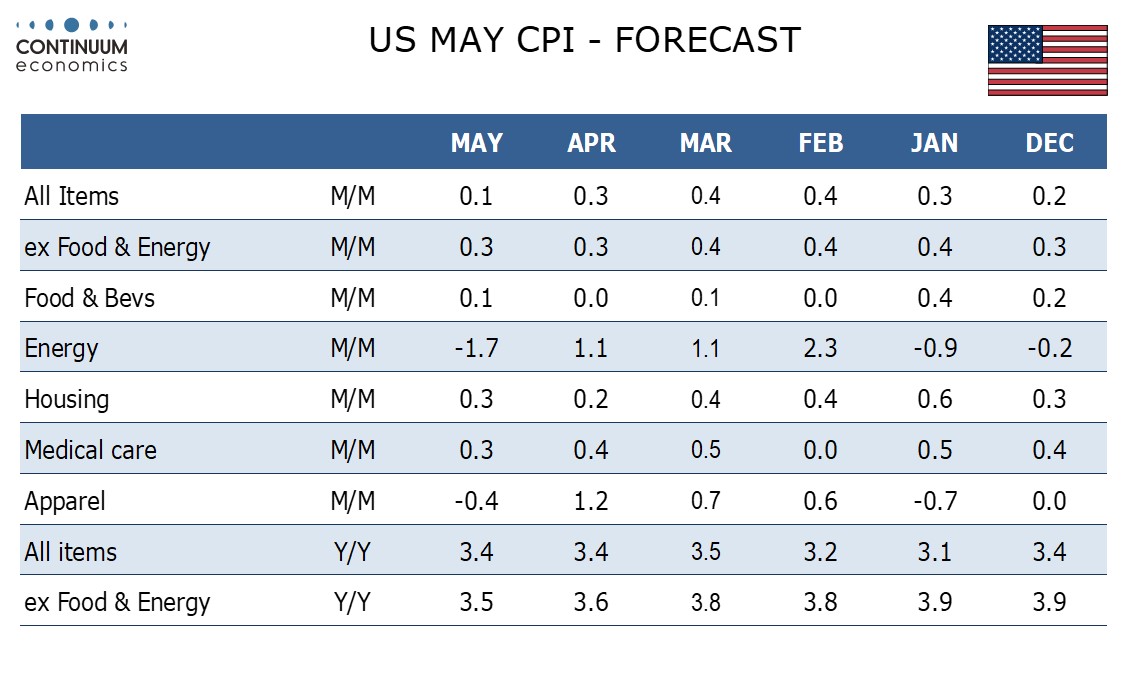

We expect May CPI to rise by 0.1% overall, which would be the slowest since October 2023, but with a second straight 0.3% increase ex food and energy, to follow three straight gains of 0.4% during Q1. Before rounding we expect the core rate to be very close to 0.3% but the headline to be on the firm side of 0.1%.

In 2023 CPI started the year strong before fading, but was still quite strong in the core rate in May at 0.4%, though overall CPI slowed to 0.1% in May 2023. This means that yr/yr growth would remain stable at 3.4% overall under our May 2024 forecast, but the core rate will slow to 3.5% from 3.6%, reaching its slowest since April 2021.

We expect the core rate to be slightly stronger in May than in April when the core rate rose by 0.29% before rebounding. Volatile components that may be a little less soft in May than April include lodging away from home and air fares, while auto services paused in April after a particularly strong March and may regain some momentum in May. However we expect a correction lower in apparel after a particularly strong April.

Gasoline prices were little changed before seasonal adjustment in May but are likely to fall after seasonal adjustment, leading a 1.7% decline in energy, after three straight gains. Food prices are likely to see a fourth straight subdued month with a rise of only 0.1%.

.