FX Daily Strategy: N America, June 7th

U.S. May Employment Should be Stronger than April

May Lead to a Knee-Jerk Rally in DXY

Japan Household Spending Should Rebound on higher wage

Canada Employment to support further easing

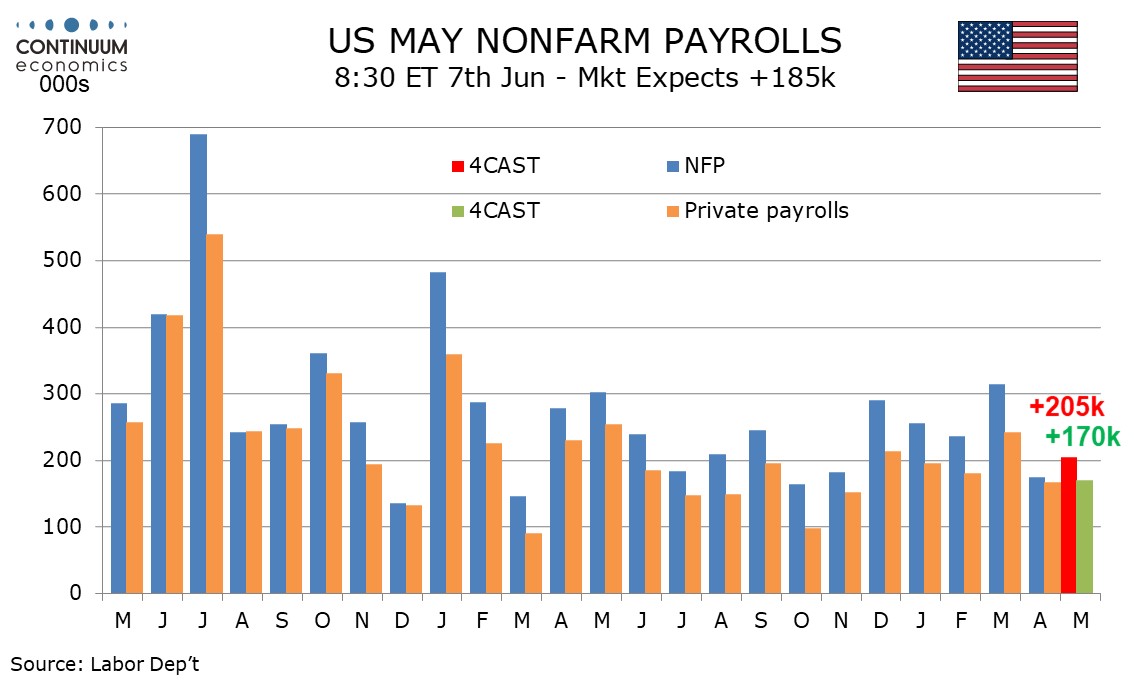

We expect a 205k increase in May’s non-farm payroll, a little stronger than April’s below trend 175k but closer to that than March’s above trend 315k. We expect average hourly earnings with a 0.3% increase to also be a little stronger than in April, when a below trend 0.2% increase was seen, but we expect unemployment to be unchanged at 3.9%, sustaining an increase from March’s 3.8%. We believe the economy is losing momentum and seasonal adjustments are negative in May, compensating for improving weather, though cooler than usual weather in early May this year may prevent some of the usual seasonal hirings taking place. This argues for a below trend payroll, though most evidence, including initial claims, suggests any easing of the labor market is likely to be marginal.

April’s slower 175k payroll increase was not a clear signal for a slowdown, coming after a 315k increase in May putting the 2-month average at 245k, similar to the 6-month average of 242k. We expect May’s rise to marginally exceed April’s despite believing trend will soon start to show clearer signs of slowing. We expect private payrolls to rise by 170k, similar to April’s 167k but below March’s 243k. April’s 8k increase in government was well below the 6-month average of 50k and we expect a stronger May. Average hourly earnings rose by 0.20% in April after a 0.35% March increase that was rounded down to 0.3%, and trend now appears to be a little below 0.3% per month. We however expect May’s gain to be rounded up to 0.3% after the below trend April, and leave yr/yr growth at the 3.9% pace seen in April that was the slowest since June 2021.

The DXY has seen a small rebound from weekly low after the U.S. Treasury Yields take a breather from the recent drop and ECB & BOC began to cut rates. A stronger than expected NFP may gave the greenback a boost it needed to stall the fall. The expectation of a later rate cut due to strong NFP numbers may also lead to another round of correction in equities and attract USD bids for haven seeking.

On the chart, there is still little change, as prices extend cautious trade within support at the 104.25 Fibonacci retracement and congestion around 104.00. Daily readings remain under pressure and broader weekly charts are bearish, highlighting potential for a later break and extension of May losses, initially to the 103.55 Fibonacci retracement. Meanwhile, resistance remains at 105.00 and the 105.18 weekly high of 30 May. This area should cap any immediate tests higher.

The domestic demand in Japan has been weak given the negative real wage and other inflationary pressure on low savings. The overall household spending figure has been drifting lower for months and could see a revival as wage pick up in April after the historic negotiation result. Still, the expansion if any, could be limited for real wage remain very close to neutral and Japanese residents may be unwilling to spend on such high prices and rather turn to replenish household saving.

On the chart, the anticipated test above 156.00 is giving way to short-term consolidation. A tick higher in intraday studies and unwinding oversold daily stochastics highlight potential for a test higher congestion around 157.00. However, the bearish daily Tension Indicator and mixed/negative weekly charts are expected to limit any further strength in selling interest towards the 157.71 high of 29 May. Meanwhile, support is down to congestion around 155.00. A further break beneath here will add weight to sentiment and open up 154.00.

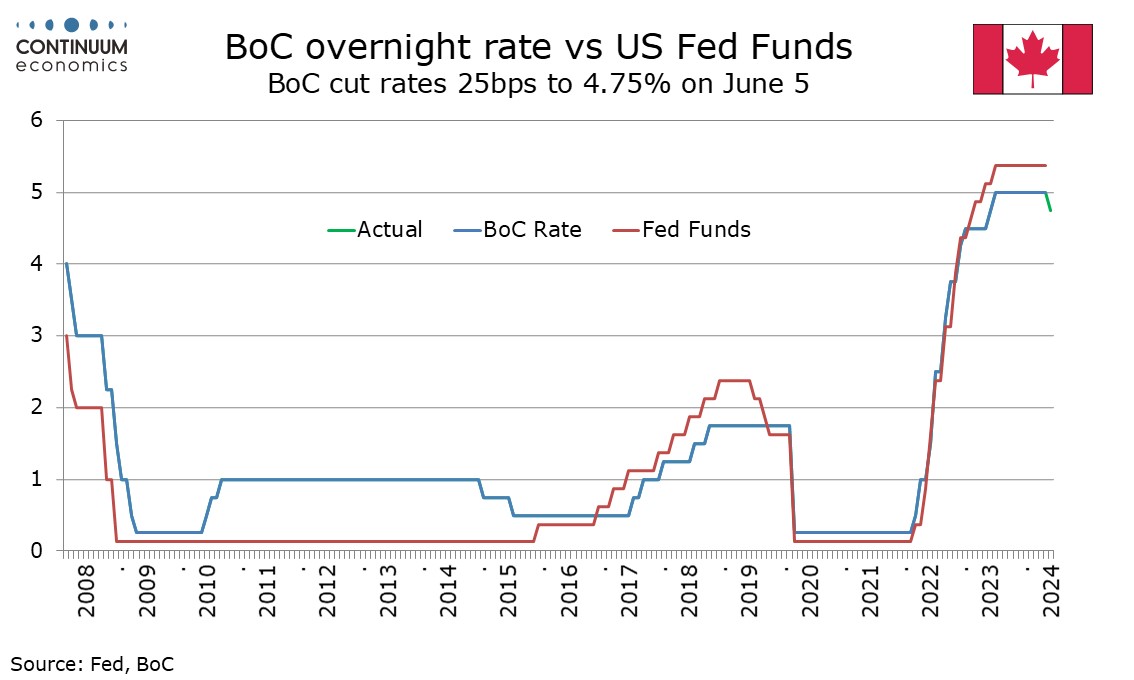

The BoC press conference was dovish but easing at each of the remaining four meetings this year looks unlikely. We continue to expect 25bps moves in September, October and December, after a pause in July. The headline employment change ofr Canada is expected to be still in positive territory while unemployment rate will be ticking up and participation rate should be stable. The slowing in labor market could support the BoC's next rate decision.

On the chart, there is little change as mixed intraday studies keep near-term sentiment cautious and extend choppy trade within resistance at congestion around 1.3700 and the 1.3743 weekly high of 23 May. Daily readings have ticked higher, suggesting potential for fresh gains, but a close above 1.3743 is needed to turn sentiment cautiously positive and prompt extension towards congestion around 1.3800. Meanwhile, support remains at the 1.3590 Fibonacci retracement and 1.3600. A break beneath here would turn price action cautiously negative and extend mid-April losses towards 1.3550.