FX Weekly Strategy: Asia, June 10th -14th

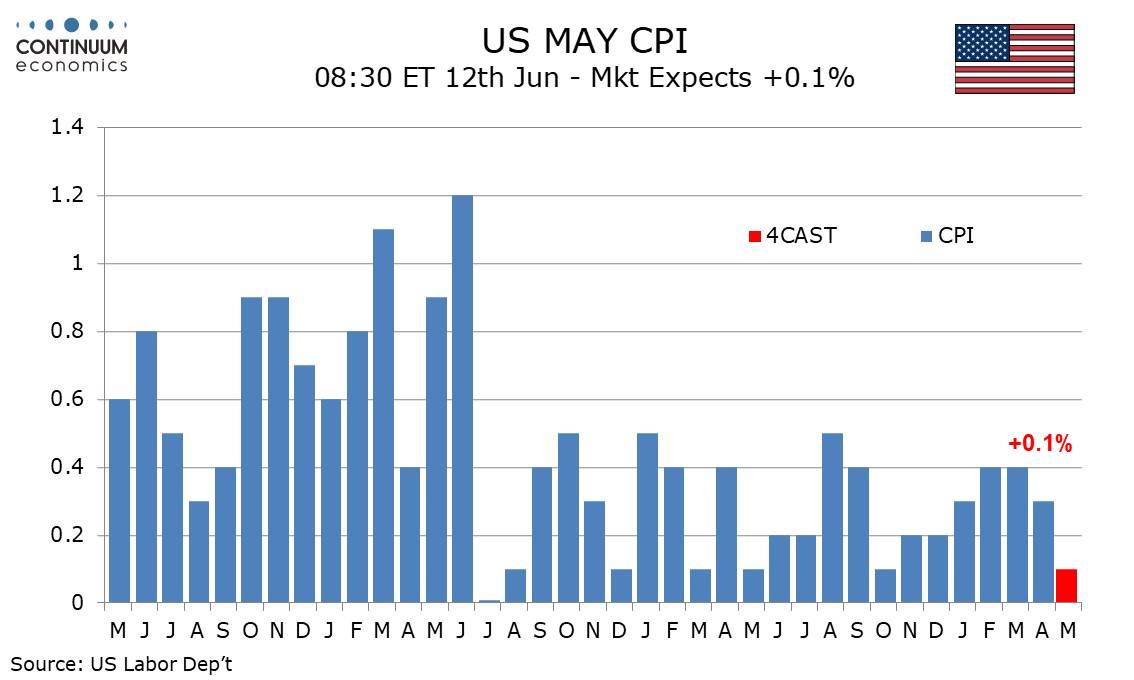

U.S. CPI To Be Slower overall

U.S. PPI Following a strong April

UK GDP Fresh Correction on the Cards?

USD/JPY to Strengthen on any BoJ Surprise

Weekly Strategy

U.S. CPI To Be Slower overall

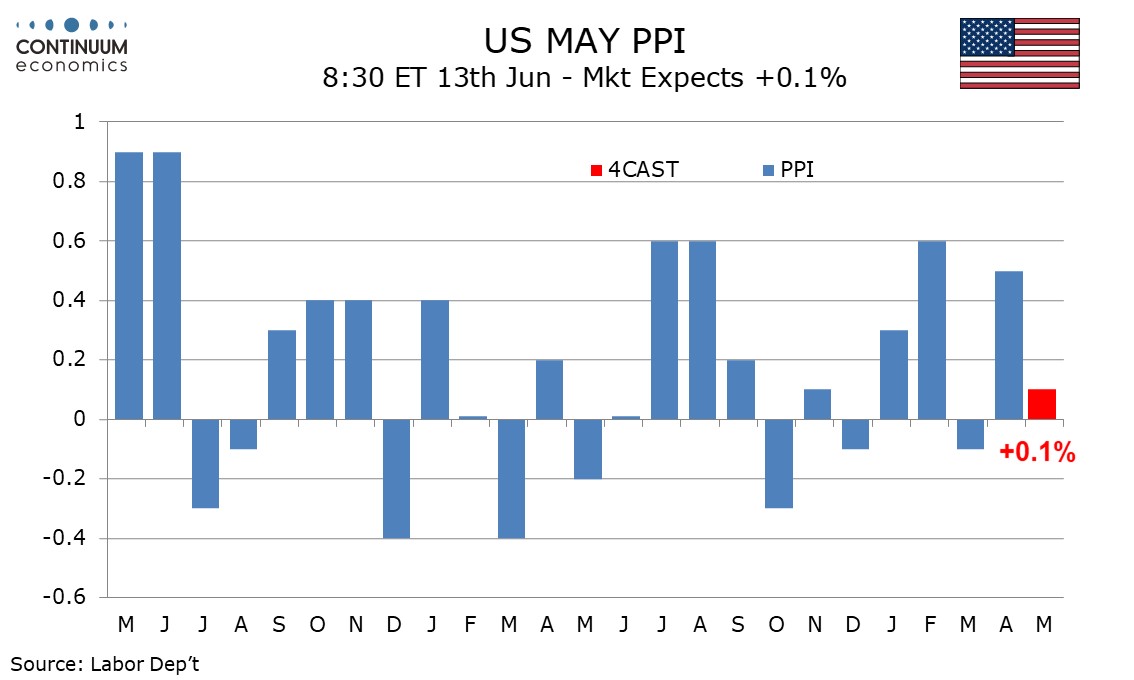

U.S. PPI Following a strong April

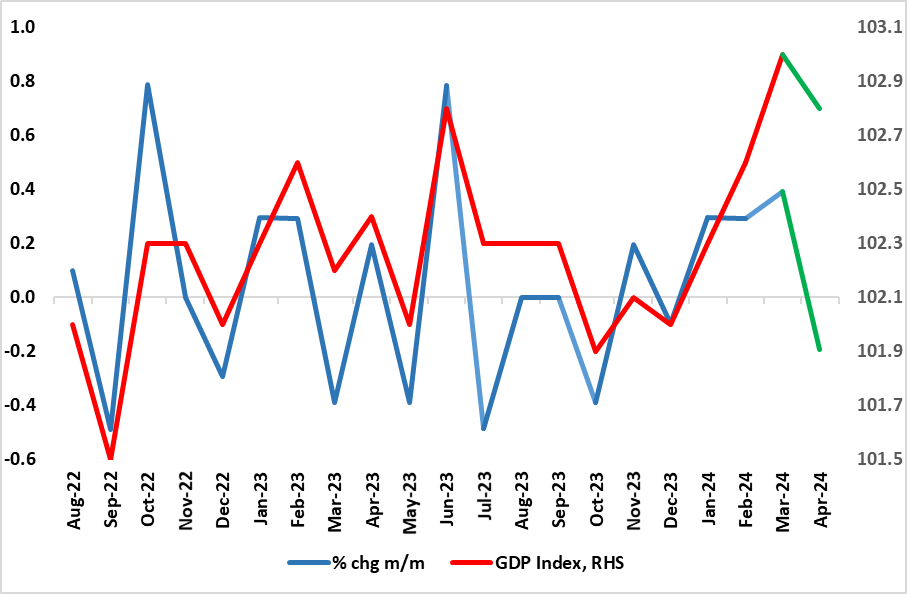

UK GDP Fresh Correction on the Cards?

USD/JPY to Strengthen on any BoJ Surprise

We expect May CPI to rise by 0.1% overall, which would be the slowest since October 2023, but with a second straight 0.3% increase ex food and energy, to follow three straight gains of 0.4% during Q1. Before rounding we expect the core rate to be very close to 0.3% but the headline to be on the firm side of 0.1%. In 2023 CPI started the year strong before fading, but was still quite strong in the core rate in May at 0.4%, though overall CPI slowed to 0.1% in May 2023. This means that yr/yr growth would remain stable at 3.4% overall under our May 2024 forecast, but the core rate will slow to 3.5% from 3.6%, reaching its slowest since April 2021. We expect the core rate to be slightly stronger in May than in April when the core rate rose by 0.29% before rebounding. Volatile components that may be a little less soft in May than April include lodging away from home and air fares, while auto services paused in April after a particularly strong March and may regain some momentum in May. However we expect a correction lower in apparel after a particularly strong April.

We expect a 0.1% increase in May’s PPI, with gains of 0.2% in the core rates ex food and energy and ex food, energy and trade. This would follow above trend April data, meaning that should May not produce the subdued data we expect, it would be cause for concern. PPI data was generally subdued through 2023, even before CPI lost momentum in the second half of the year. The start of 2024 however delivered strong data in January and February, which we suspected reflected one-time pricing decisions taken at the start of the year. Strong data in April can be seen as corrective from weak data in March, and we expect May data to be mostly subdued. Energy prices look set to see a modest decline after increasing in April though the impact on PPI is likely to be modest, while we expect food to correct higher after declining in April. We expect trade prices to be more neutral after a strong April corrected a weaker March. A 0.2% rise ex food, energy and trade would be a little softer than trend seen in 2024 to date but consistent with the picture seen through 2023 apart from a sharp bounce in January.

Figure: Clearer Recovery But Still Fragile?

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is much clearer than any expected with GDP growth notably positive. Indeed, coming in more than expected, and despite industrial action, GDP rose by 0.4% m/m in March accentuating the upgraded bounce in the two previous months, a result that is seemingly a move away from of the monthly swings seen of late. But that conclusion may be premature as April data (on the back of a slump in retail sales and weak car production) may see a fresh correction back of 0.2%, this accentuated by more unseasonable weather. This projection would be consistent with a circa-zero Q2 q/q outcome, a clear contrast to the strong but possibly misleading Q1 jump and would also be below BoE thinking for the current quarter.

The March data resulted in a very clear end to the modest recession seen in H2 last year and also exceeded BoE thinking as Q1 growth jumped by 0.6%, an outcome dominated by a boost from net trade, mainly a sharp fall in imports, hardly indicative if firmer demand. Regardless, there are still areas of concern, with the latest BoE Agents survey pointing to weakness in consumer spending on goods and services in Q1 and as a result revising down their expectations of growth for 2024.

As for the last set of monthly GDP numbers, GDP is estimated to have grown by 0.4% in March 2024, following growth of 0.2% in February 2024 (revised up from 0.1%) and an unrevised growth of 0.3% in January 2024. Services output was the largest contributor to the growth in GDP on both the month and the three months to March 2024. Production output grew by 0.2% in March 2024, following growth of 1.0% in February 2024 (revised down from 1.1% in our previous publication), and grew by 0.8% in the three months to March 2024. Construction output fell by 0.4% in March 2024, following a fall of 2.0% in February 2024 (revised down from a 1.9% fall in our previous publication), and fell by 0.9% in the three months to March 2024.

This, alongside some better business survey readings, may be something that the BoE hawks use as a rationale to argue for no near-term rate cut, especially given the lection’s proximity and the higher-than-expected last set of CPI data. But any fresh weakness in March data due just a week before he next MPC decision may have some impact on MPC thinking, especially if the May CPI data due on June 19 correct the upside Aril surprise. .

It is definitely going to be a wild wide after BoJ's decision on Friday but market participants may take some time to digest before reacting and repositioning. Our central forecast remains for the BoJ to hike by 0.1% as trend inflation will be pushed higher from wage in the short run. The market is only pricing in a full hike by September, with some speculations of reducing JGB purchase in the June meeting. Thus, any surprise from the BoJ will see a swing in the JPY market.

On the chart, there is little change as prices remains locked within the Tuesday's 156.49/154.55 range. Mixed daily studies suggest further ranging action here but consolidation is expected to give way to selling pressure later to retest the 154.80/154.55 support. Break here will see room to extend losses from the 157.71 high to target the 153.60 support though potential would be seen for retest of the critical support at the 152.00 congestion. Meanwhile, resistance at the 156.00 level and extend to the 156.78, 14 May high, is expected to cap and sustain losses from the 157.71 high.

The Week Ahead

USA On Monday the Fed will be watching the New York Fed’s survey of inflation expectations while Tuesday sees May’s NFIB survey of Small Business Optimism. The key day however will be Wednesday, when we will see the release of May’s CPI, which could have a significant influence on the FOMC statement due later in the day, though a change in rates is very unlikely.We expect lower gasoline prices to restrain overall CPI to a 0.1% increase, though ex food and energy we expect a second straight gain of 0.3%, which while slowing from three straight gains of 0.4% in Q1 would still be consistent with inflation above the Fed’s 2.0% target. It would take a significant downside surprise to have the Fed altering its April assessment that in recent months there has been a lack of further progress to the 2% objective, and even with a downside surprise the FOMC is likely to repeat that it does not expect easing to be appropriate until there is greater confidence of inflation falling sustainably to 2%. If there are limited changes to the statement focus may be on the dots, which look sure to be more hawkish than those in March which expected three 25bps easings in 2024. We expect only one is more likely than two, unless CPI surprises significantly to the downside. While this could be seen as hawkish we expect Powell at the press conference will downplay the significance of the dots, and leave the door open to easing more than the dots imply should the tone of data soften. He is also likely to suggest that the bar for further tightening is quite high, if not ruled out.On Thursday we expect a 0.1% increase in May’s PPI with a 0.2% increase ex food and energy, slowing from a strong April. Weekly initial claims are also due and Fed’s Williams will speak. Friday sees May import and export prices, June’s preliminary Michigan CSI while Fed’s Goolsbee will speak.

CANADA In Canada April building permits are due on Tuesday. Friday sees April manufacturing and wholesale sales, for which preliminary estimates were for substantial gains of 1.2% and 2.8% respectively.

UKA busier week sees April GDP data (Wed). On the back of a slump in retail sales and weak car production) we see a fresh correction back of 0.2% m/m, this accentuated by more unseasonable weather. This projection would be consistent with a circa-zero Q2 q/q outcome, a clear contrast to the strong but possibly misleading Q1 jump and would also be below BoE thinking for the current quarter. The day before sees key labor market data, still presented amid continuing concerns over the accuracy of figures. The numbers may show a further rise in the jobless rate and higher inactivity, but there will be as much weight on HMRC numbers regarding job dynamics which have suggested clearer slowing in private sector employment, if not an actual contraction. However, the average earnings figures will be the most closely watched especially after the upside surprise last time around. We see a more discernible slowing in both regular pay growth (3 mth mov avg) at just below 6% and the headline rate down to 5.5%. Regardless, with even the BoE (belatedly) casting doubt on the validity of these numbers, more attention may be paid to the PAYE pay data where a clear(er) slowing may be on the cards. Notably, this PAYE data also chimes with weaker activity backdrop highlighted by the ONS which showed a marked fall in vacancies alongside increased signs of employment contracting and not just in terms of self-employment. Indeed, the jobs data conflict with the headline pick-up in Q1 GDP growth, albeit more in line with the soggy domestic demand picture those national account data nevertheless highlighted. Otherwise, more positive housing market signs may be seen in the RICS survey (Thu) while contained outcomes may be evident in updated BoE compiled household inflation expectations. BoE insights are still short on the ground given the effective purdah ahead of the general election.

EurozoneThe ECB decision comes under more scrutiny in the coming week with a wide array of Council member speeches and commentary, most notably from both President Lagarde and ECB Chief Economist Lane on Friday. Beforehand come some second-tier data, including what may be a fresh fall in industrial output (Wed) and clearer signs of import recovery in visible trade data (Fri).

Rest of Western EuropeThere are key data in Sweden, with CPI data (Fri) and where we see stable readings for the key CPIF figure even with adverse base effects. Monday sees the monthly GDP indicator, likely to see marked revisions. Finally, CPI data in Norway may see these May numbers fall even further below the Norges Ban’s projections with a drop to 4.3% for CPI-ATE, which would be a 22-mth low. There is also the Norges Bank regional survey (Thu).

JP The Q1 GDP will be released on Monday, June 10. The preliminary data has shown a contraction of 2% annualized, any revision is unlikely to be positive with latest data points to depressed domestic demand. But the key release remains on Friday, June 14, when we forecast the BoJ to hike rates by another 0.1% and potentially reduce bond purchase.

AU Only the employment change would be the market moving economic release on Thursday, June 13. The Australian labor market is expected to modestly drift lower but remain healthy. It would be a surprise if employment continue to be strong and could further delay RBA’s easing. We also have consumer inflation expectation on Friday, June 14.

NZBusiness PMI and Food Price Index on Friday, June 14, are tier two data.

Recap from this week

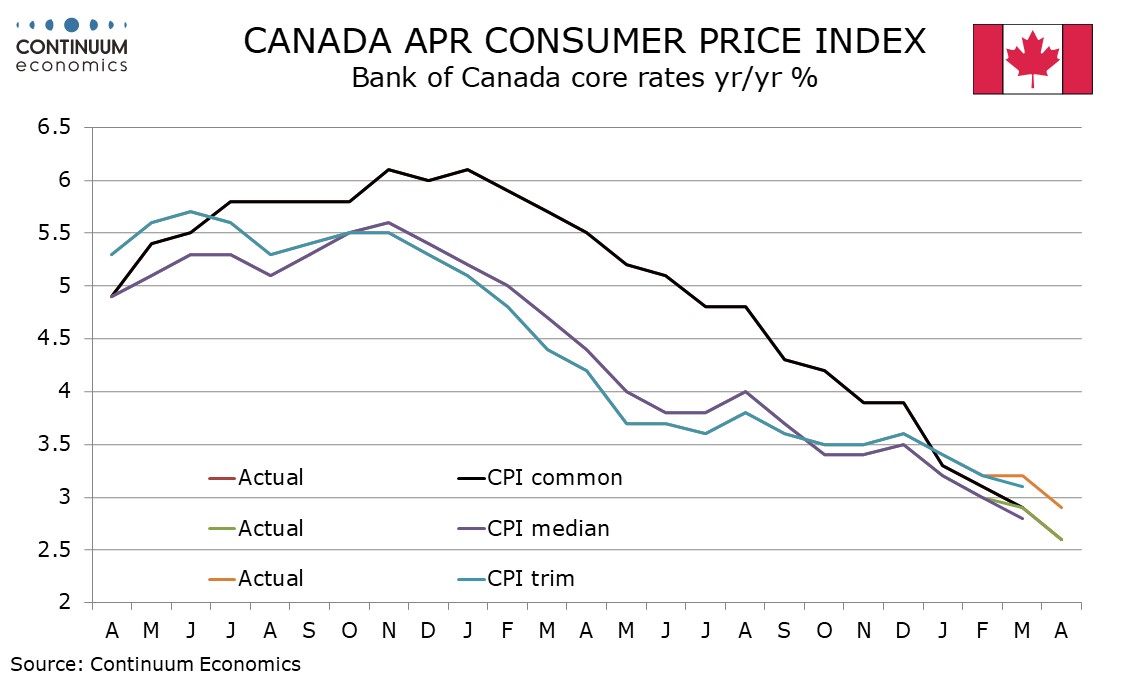

Bank of Canada Eases by 25bps on Improved Inflation Picture

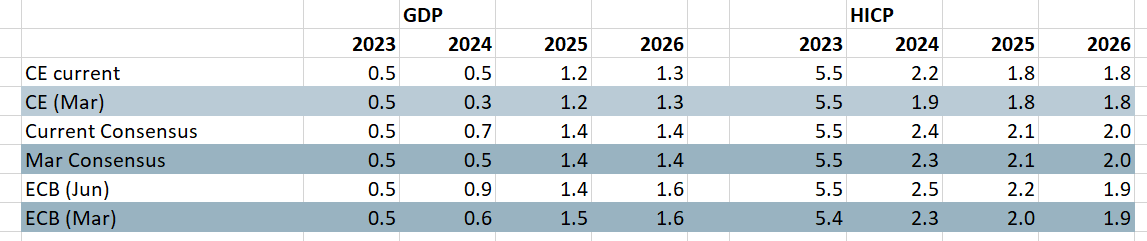

ECB Clearly No Policy Pre-Commitment But Policy Entering New Phase

U.S. May Employment trend may be starting to slow

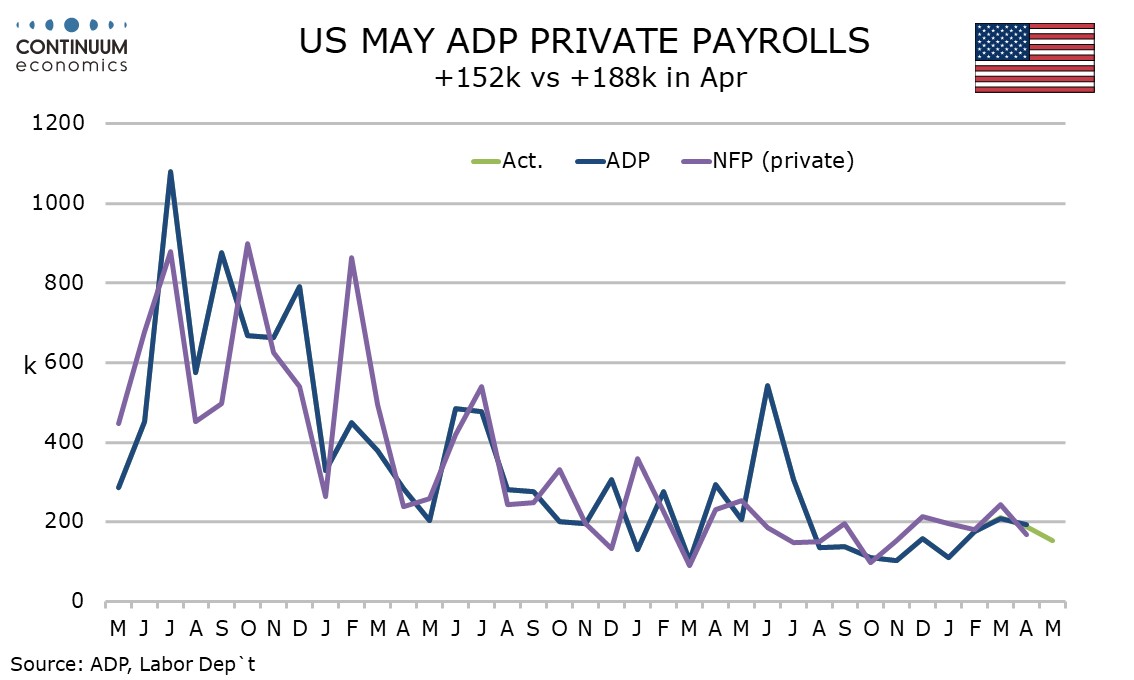

Previewed by Slower U.S. May ADP Employment

Other U.S. Economic Release

The Bank of Canada delivered a 25bps easing to 4.75% as expected and the tone of the statement and particularly the press conference was somewhat dovish, giving some detail on why it is pleased with progress on inflation. However easing at each of the remaining four meetings this year looks unlikely. We continue to expect 25bps moves in September, October and December, after a pause in July. In his opening statement to the press conference Governor Tiff Macklem outlined first the declines in headline CPI (to 2.7% in April from 3.4% in December) and the core measures (to around 2.75% from around 3.5%). Less obviously he stated three month rates had fallen below 2% from about 3.5% in December and the proportion of components increasing above 3% is close to the historical average. However, the statement noted that shelter inflation remains high and that risks to the inflation outlook remain.

Macklem stated that if inflation continues to ease and confidence that it is headed to the 2% target continues to increase it is reasonable to expect further cuts in rates. However he warned that lowering rates too quickly could jeopardize the progress made. The BoC will be aware of the recent history in the US, where two straight target-consistent quarters from core PCE prices were followed by disappointment in early 2024. That 3-month Canadian core measures have fallen below 2% on an annualized basis could be similarly overstating how much progress has been made. Macklem said rate decisions would be taken meeting by meeting and the pace of rate cuts was likely to be gradual. Macklem expects further progress on inflation to be uneven and if so the path of easing is unlikely to be smooth. Which of the future meetings will see easings and which will see pauses is likely to be dependent on incoming data and forecasts for individual meetings should be treated cautiously. There are two more CPI releases (for May and June) due before the July 24 meeting and if both are subdued we could see a further easing, but disappointment on one of the releases could bring a pause, and that is our current leaning. Only one further CPI (for July) is due before the September 4 meeting, so if July sees an ease we would expect September to see a pause, though if July sees a pause easing would likely to resume in September, provided the majority of the inflation releases were moving in the right direction. We expect that by Q4, progress on inflation will be sufficiently clear to allow easing in both October and December.

Figure: Little Change in the Real Economy Outlook?

As has been the case with many recent ECB verdicts, markets are keener to hear what is being said by the Council rather than what has been done. In regard to the latter, and given the almost unanimous hints from Council members, all policy rates were cut by the expected 25 bp, with the key deposit rate falling from at an unprecedented 4.0% for the first reduction since 2019. But markets were more focused on hints on the speed and timing of further moves. Given splits within the ECB Council, it was no surprise that no formal guidance was forthcoming, save to underline that policy will be data dependent and clearly not pre-committing to a particular rate path not least alongside upgraded forecasts for this year and next and to ‘keep policy rates sufficiently restrictive for as long as necessary’. But those updated and possibly optimistic (GDP) forecasts (Figure) do corroborate market thinking of rates falling well below 3%, even given the slightly later, but still clear, undershoot of the inflation target being flagged. ECB Lagarde also appeared to back ECB Lane’s clearer guidance in a speech earlier this week. We still see two more 25 bp moves this year and even the anticipated four further cuts in 2025 will hardly take policy out of a restrictive stance.

Repeating the theme offered at its last meeting in April, the ECB Council made it clear that, after what have been nine months since the last hikes, it is now appropriate to ‘moderate’ the current level of monetary policy restriction. Admittedly, while this view was unanimous save for one, others on the Council may have had reservations, but not steadfast enough to scupper market expectations that had been fed a clear message from the ECB itself.

Even so, there is probably still a view that policy has been hiked relatively aggressively in both speed and extent in what Lagarde referred as the first policy phase. This is something we have underlined by suggesting that recent monetary tightening (which also encompasses unconventional moves) has not only been extensive, but possibly excessive. Supporting this notion is a chart offered in a recent presentation by Chief Economist Lane which shows not only the unprecedented speed of recent (conventional) hikes but the even-more unprecedented repercussions in terms of credit growth weakness

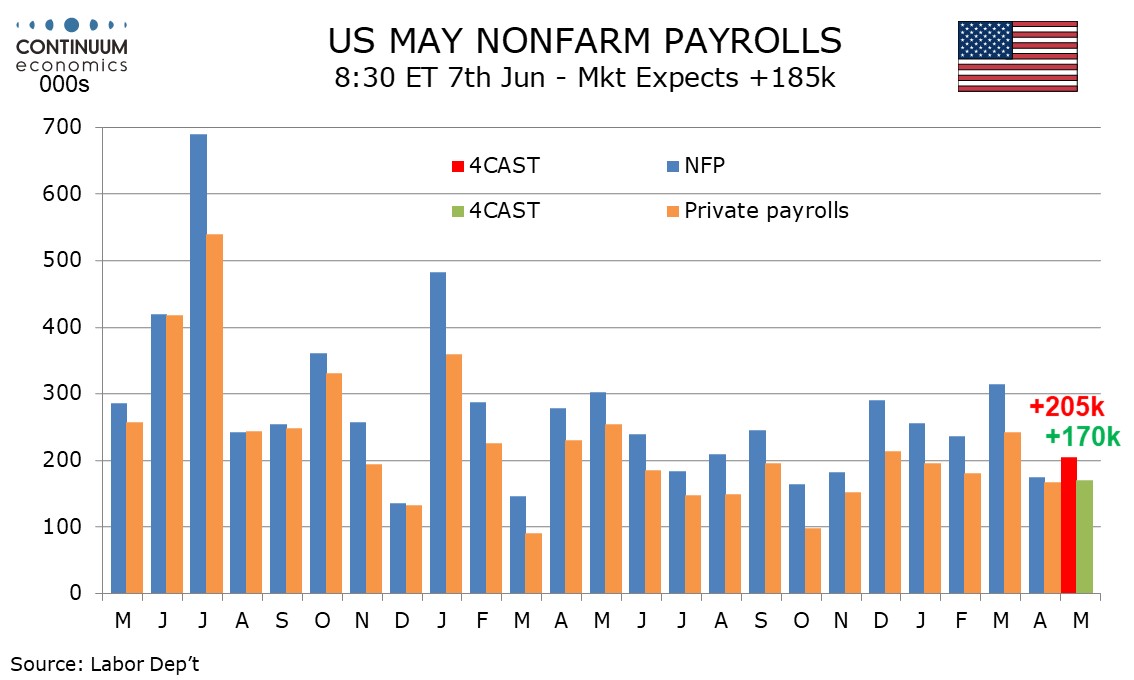

We expect a 205k increase in May’s non-farm payroll, a little stronger than April’s below trend 175k but closer to that than March’s above trend 315k. We expect average hourly earnings with a 0.3% increase to also be a little stronger than in April, when a below trend 0.2% increase was seen, but we expect unemployment to be unchanged at 3.9%, sustaining an increase from March’s 3.8%. We believe the economy is losing momentum and seasonal adjustments are negative in May, compensating for improving weather, though cooler than usual weather in early May this year may prevent some of the usual seasonal hirings taking place. This argues for a below trend payroll, though most evidence, including initial claims, suggests any easing of the labor market is likely to be modest.

ADP’s April estimate for private sector employment growth of 152k is on the low side of expectations and if matched by private sector non-farm payrolls would be consistent with a loss of labor market momentum. However, the data is in line with the ADP trend. ADP data in April with a rise of 188k (revised only marginally from 192k) outperformed a below trend 167k rise in private sector non-farm payrolls, breaking a recent tendency for ADP data to underperform non-farm payrolls. We expect ADP to underperform in May, with our private sector payroll forecast being 170k, with overall payrolls at 205k. These would be slightly firmer than seen in April payroll data but still consistent with trend starting to lose momentum.

Most recent months have shown leisure and hospitality as the strongest sector in the ADP breakdown, but in May the sector rose by only 12k, with trade transport and utilities leading with 55k, with education and health at 55k (below where that sector has been trending in payroll data) and construction at 32k. Manufacturing was weak with a 20k decline. Wage data showed a 5.0% rise for job stayers for a third straight month but for job changers the data slowed for a second straight month to 7.8%. This is consistent with a moderate slowing in the labor market which is what we also expect payroll data to imply.

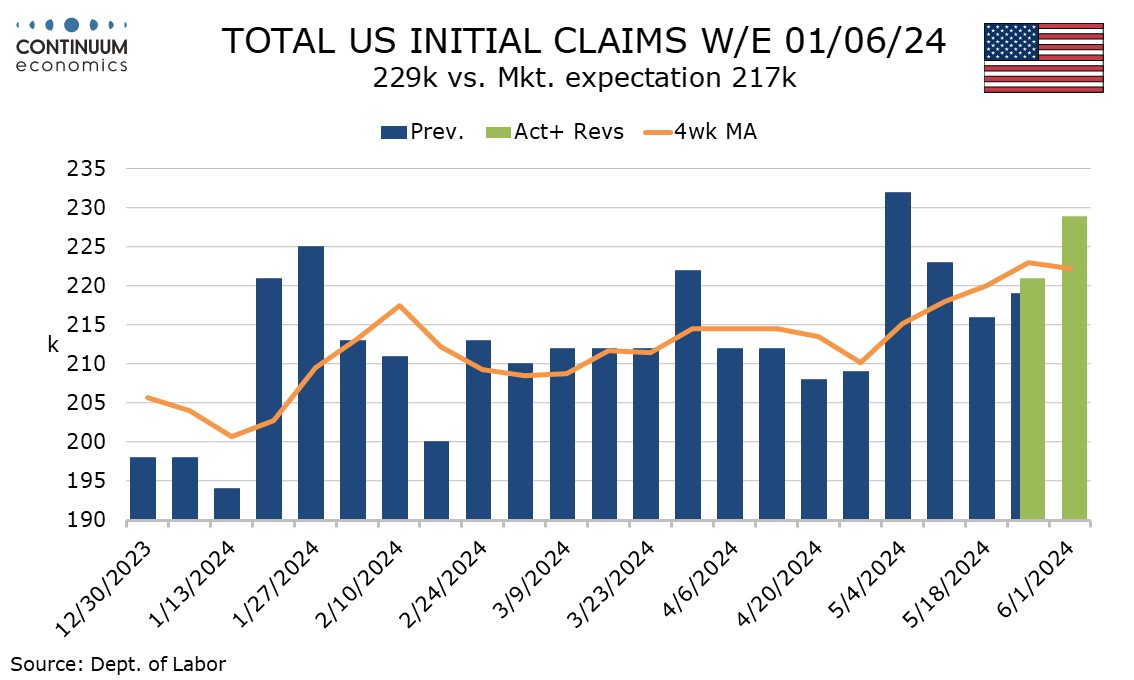

Initial claims are a little higher at 229k in the week to June 1 (two weeks after May’s payroll was surveyed) hinting at some labor market slowing. A downward revision to Q1 unit labor costs to 4.0% from 4.7% was unexpected while April’s trade deficit of $74.6bn from $68.6bn deteriorated a little less than expected. While the initial claims rise is moderate and fully explained by seasonal adjustments trend does appear to be moving higher, though the 4-week average of 222.25k is slightly down from 230k in the preceding week, which was the highest since the highest September 2023.

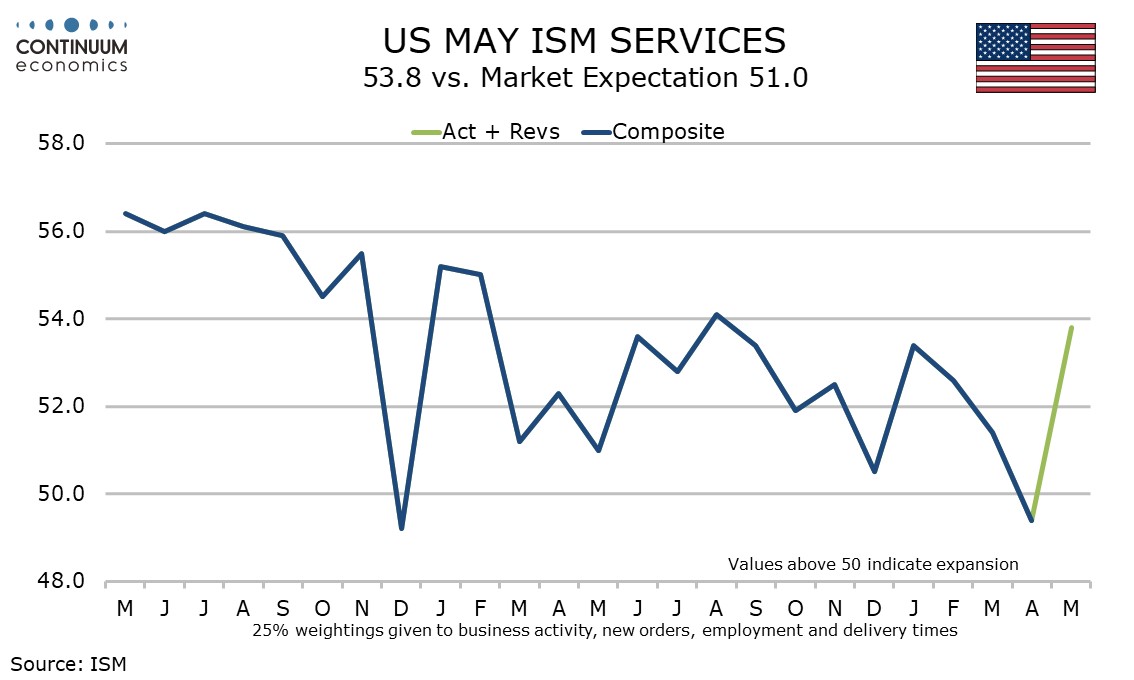

Like May’s S and P services index (unrevised at 54.8), May’s ISM services index has also exceeded expectations, rising to 53.8, its highest since August 2023, from a weak 49.4 in April. Probably not too much should be made of an above trend number in May or the below trend number in April. April’s outcome as the weakest since December 2022. The biggest contrast was business activity, weak in April at 50.9 but strong in May at 61.2.