Published: 2024-04-22T18:40:09.000Z

Preview: Due May 1 - U.S. April ADP Employment - Underperforming payrolls

Senior Economist , North America

-

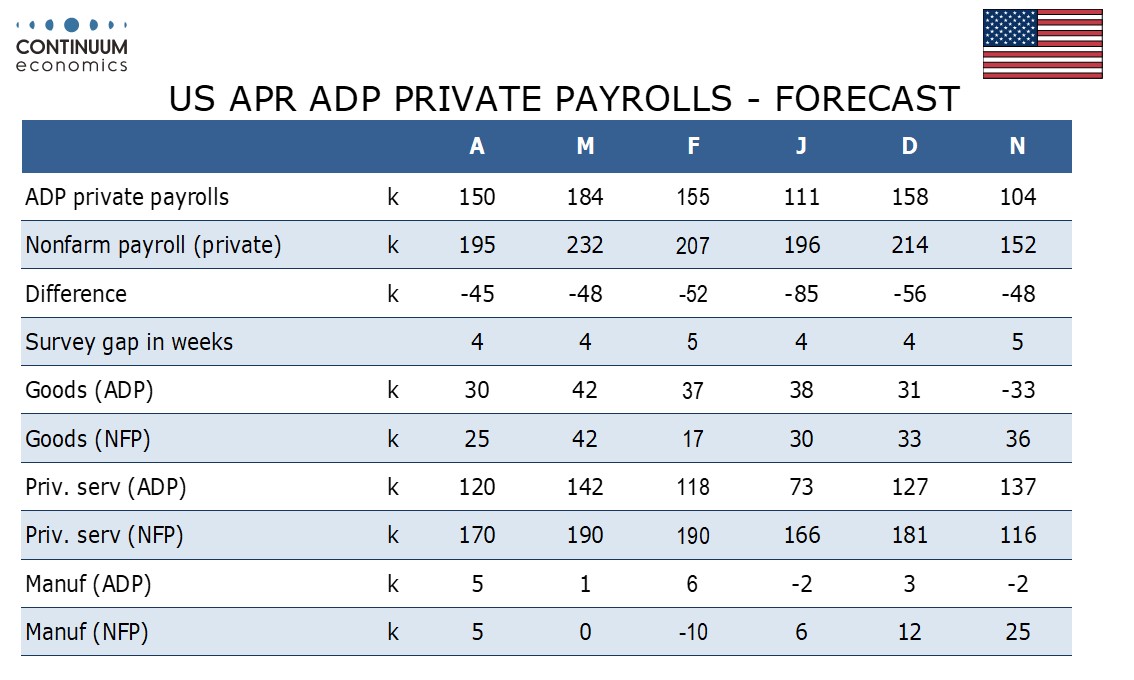

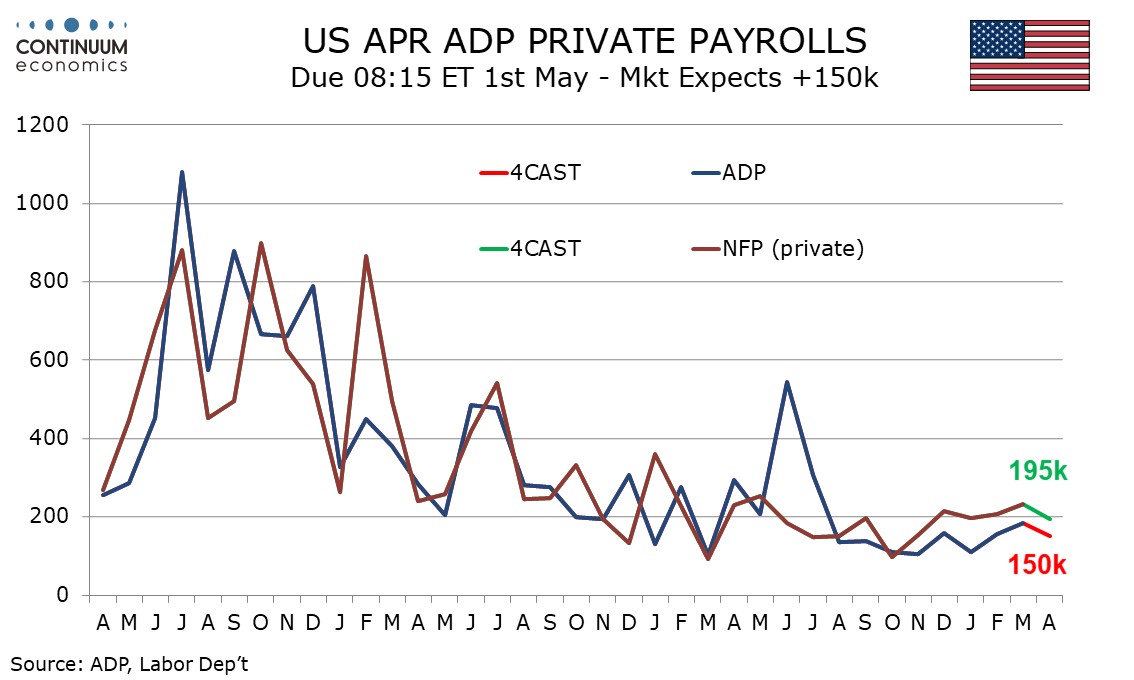

We expect a 150k increase in April’s ADP estimate for private sector employment growth, which would be in line with recent trend, but continuing to underperform private sector non-farm payrolls, which we expect to rise by 195k. We expect overall payrolls to rise by 255k.

The last eight months have seen ADP gain by between 104k and 184k, the latter rise coming in March, suggesting some acceleration in a trend which slowed significantly in the second half of 2023. A 45k underperformance of private sector non-farm payrolls would be marginally the smallest of six straight underperformances. With government non-farm payrolls trending strongly headline non-farm payrolls are coming in well above the ADP trend though it is private sector data that is most comparable.

ADP volatility has come mainly from leisure and hospitality, which at 63k in March was above trend, and may slow in April, while construction may find a 33k March rise difficult to match. Generally however labor market signals remain strong, with initial claims trend remaining stable at low levels.