Published: 2024-04-22T14:47:28.000Z

Preview: Due April 23 - U.S. March S&P PMIs - Manufacturing to rise, Services to slip

Senior Economist , North America

1

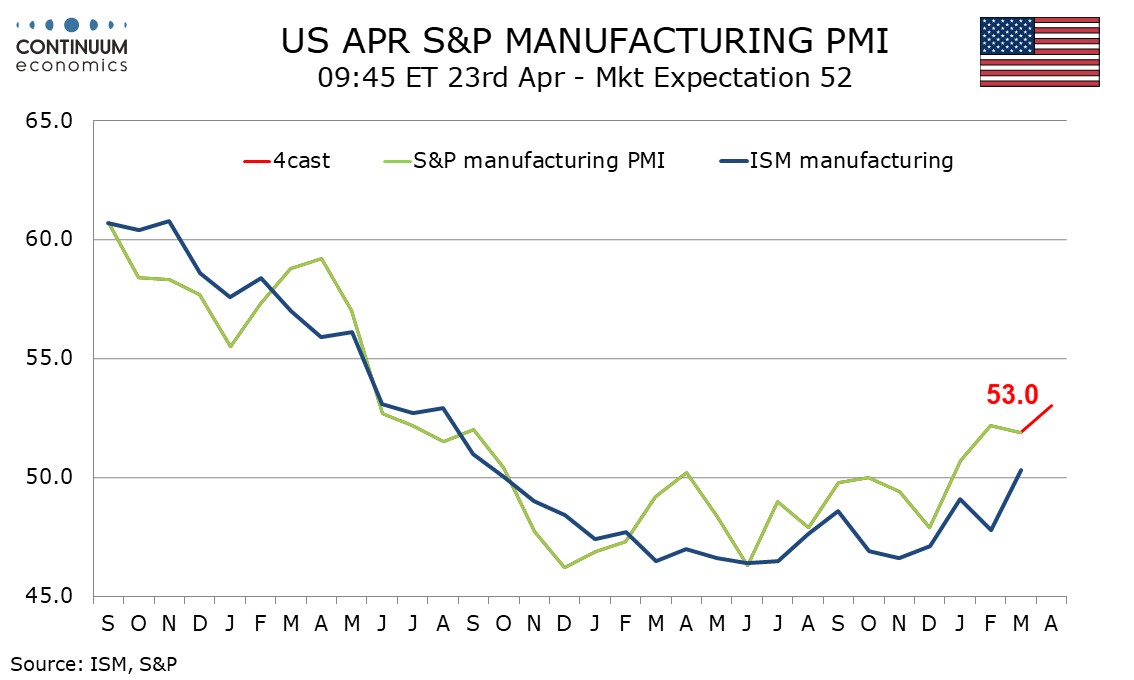

We expect March’s S and P PMIs to show a pick-up in manufacturing to 53.0 from 51.9, reaching its highest since May 2022, but a third straight slowing in services to 51.0 from 51.7.

Both the ISM manufacturing index and S and P manufacturing survey have been showing recent signs of improvement. Regional surveys are mixed though April’s Philly Fed manufacturing survey saw a significant bounce to its highest level since April 2022.

The ISM and S and P services indices are less correlated than the manufacturing indices, though both slipped in February and March. The S and P services survey has a reasonable correlation with bond yields, with the improvement from September’s 50.1 low to January’s 52.5 reflecting rising hopes of Fed easing, and subsequent slippage reflecting a fading of those hopes, which is likely to continue in April.