SEK flows: SEK falls after big shift in Riksbank rate path

SEK slightly weaker after Riksbank but downside limited

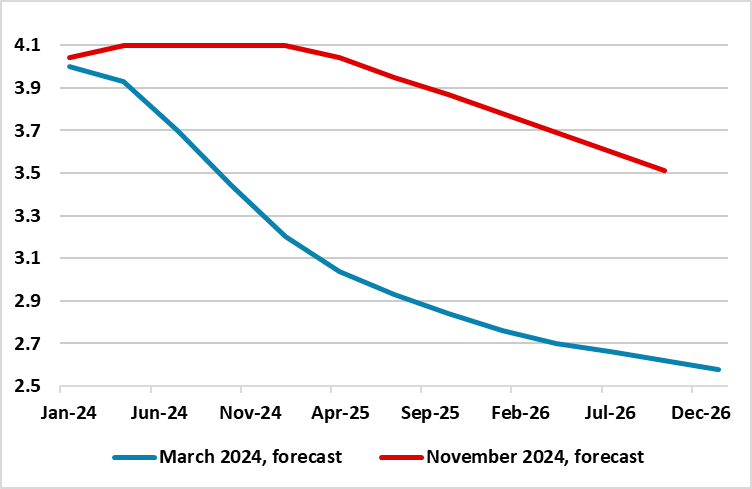

Riksbank policy rate projections

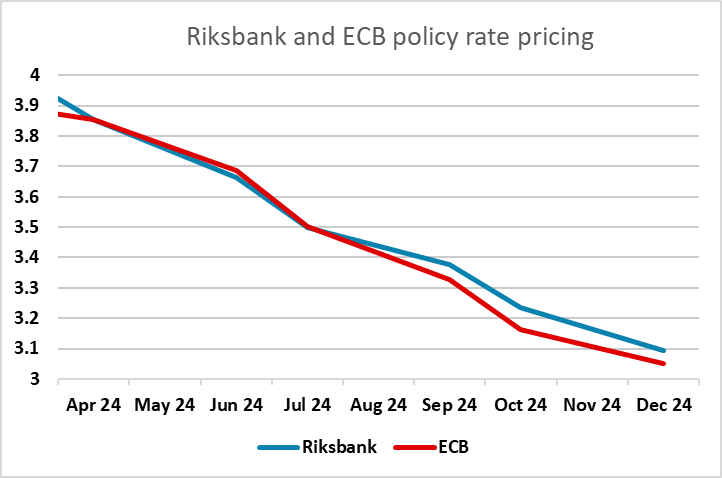

The SEK had already been soft in the last few weeks, and has fallen further after the latest Riksbank meeting, in which they have made a big shift to the downside in their projected rate path. Some shift lower had been anticipated, with the market pricing in around 90bps of easing by year end, compared to no change projected in the November MPR. An easier stance had already been flagged in the February update. However, the 3.2% policy rate now projected for Q1 2025 is still slightly above the 3.1% the market was pricing in by December this year before the meeting. While there was a dip in rates immediately after the decision, the pace of cuts in the front year is now priced to be slightly slower than it was ahead of the meeting, with the policy rate priced at 3.17% in December.

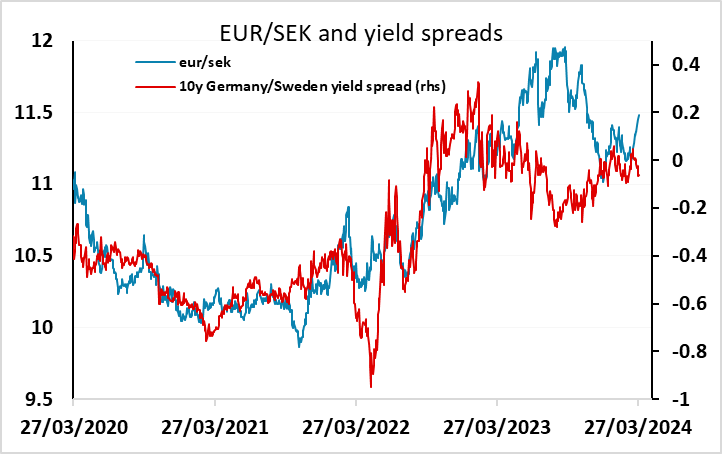

A May rate cut is still in the balance, with a cut only fully priced by June. It may depend on the performance of the SEK. The SEK has been weak in recent weeks, with EUR/SEK rising 35 figures since the March 12 low at 11.13. We have seen a modest move up after the Riksbank announcement, but we doubt there is much more upside with the upmove not correlating with the moves in yield spreads and recent Swedish data justifying a slightly more optimistic view of the economy. If EUR/SEK stays near 11.50, we doubt we will see a May cut, and that disappointment would likely push EUR/SEK lower, so risks should be on the downside for EUR/SEK.