FX Daily Strategy: Europe, February 20th

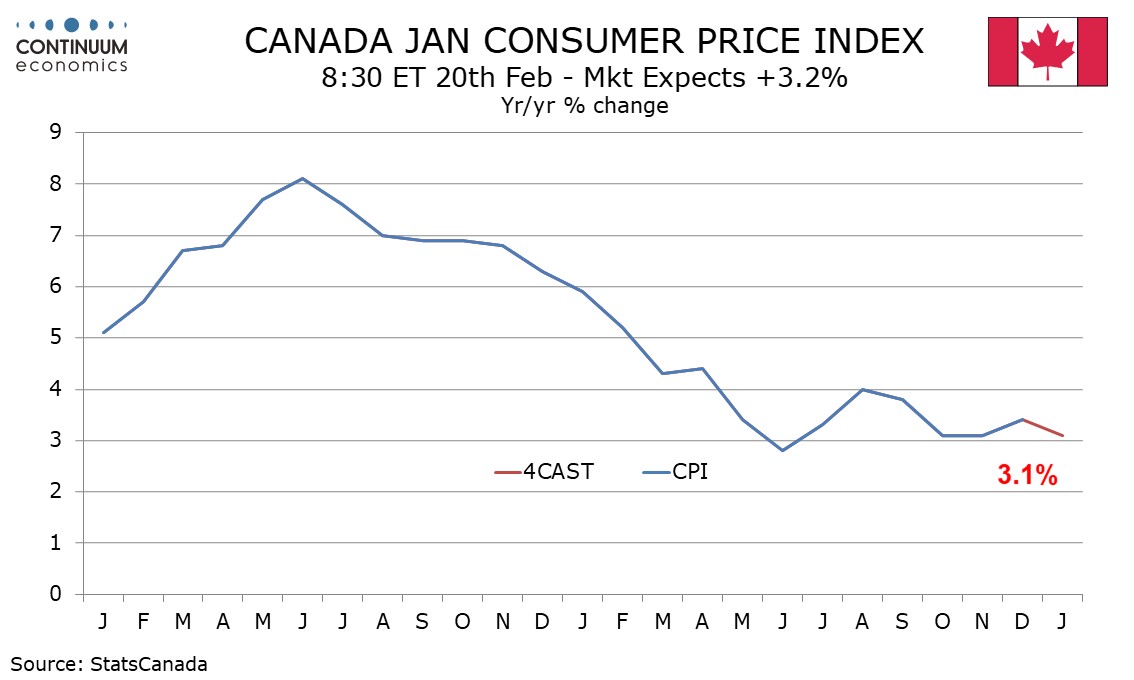

Slower Canada CPI but modest progress on core rates

Japanese Import to Preview Domestic Demand

USD/JPY Should Be Capped by 150

Australia Wage To Follow Easing Labor Market

We expect January Canadian CPI to slip to 3.1% yr/yr, reversing a rise to 3.4% yr/yr in December. Monthly data is likely to look subdued after seasonal adjustment though progress in reducing the three Bank of Canada core rates will be modest. This would be a second straight 0.2% increase ex food and energy seasonally adjusted, the first time two months have been so subdued since May and June showed two straight gains of 0.1%. Shelter, which in December rose by 0.4% both adjusted and unadjusted, the slowest since May, is likely to maintain December’s moderation if remaining relatively firm, while prices elsewhere are likely to remain subdued.

The ex food and energy rate is not one of the BoC’s core rates. Here we see marginal declines in CPI-common to 3.8% yr/yr from 3.9%, and CPI-trim to 3.6% from 3.7%, though we expect CPI-median to remain at 3.6% yr/yr, all still well above the 2.0% target with a downtrend showing signs of stalling. For the yr/yr ex food and energy pace, we actually expect an increase to 3.5% from 3.4%.

Japanese Trade balance will be playing a bigger part than previous quarters toward economics growth as private consumption is expected to remain sluggish as real wage slowly catches up. The double digit growth of export towards U.S. and E.U. has been helping Q1/2 2023 GDP and the export to Asia maybe an area to support Japanese growth. Exports are forecasted to be slightly lower than Jan and Import will dip further in the negative for domestic demand is expected to remain soft with headline trade balance to be negative.

However, it will be an interesting watch point, especially in terms of import. Headline inflation has shown moderation while wage continue to grow. Any signs of stronger import will be a positive towards Japanese growth in Q1 2024, not only in trade but also likely private consumption.

While all eyes have been on the march wage negotiation, Suzuki has stepped up his verbal intervention by stating the BoJ will move rates higher in an interview with Nikkei. Though without specific details, it is indifferent with market consensus and our central forecast. Yet, the confirmation of which, will be supporting the JPY in a medium run even as dismay Q4 GDP sparks disinflation concern. The narrowing yield differential should see more USD/JPY position unwind with speculative longs recently established the most vulnerable.

On the chart, the consolidation beneath strong resistance at the 150.88 current year high of 13 February and congestion around 151.00 has given way to a move lower, as intraday studies turn down, with prices currently balanced in cautious trade around support at 150.00. Daily stochastics are unwinding overbought areas and the positive daily Tension Indicator is flattening, suggesting a deterioration in sentiment and room for further losses in the coming sessions. A close beneath here add fresh weight to sentiment and extend losses towards the 148.80 weekly high of 19 January, where rising weekly charts could prompt renewed buying interest. Meanwhile, a close above 150.88/00, not yet seen, will turn sentiment positive and extend late-December gains towards the 151.94 year high of 13 November.

The Australian Labor market has shown early signs of rotating lower as it missed estimate and see unemployment rate higher with worse headline employment change. It is understandable for business will be feeling the blunt of cumulative rate hikes since 2022 and lock down pent up demand fully dissipates, so as sluggish Chinese recovery. The Wage Price Index should follow the soft labor report and ease lower. It is expected the q/q growth will be less than 1% in Q4 2023 while y/y growth still holding up above 4%. Yet, the outlook should be tilting to the downside and supports RBA's decision in keeping rates unchanged.

On the chart, the consolidation is giving way to the anticipated break higher, as intraday studies tick up, with prices approaching resistance at the 0.6560 range lows. Daily readings also continue to strengthen, suggesting room for a further break above here and extension of corrective gains towards congestion around 0.6600. However, broader weekly charts continue to deteriorate, suggesting potential for renewed selling interest towards here and difficulty sustaining any immediate break. Following corrective trade, lower levels are expected to attract. A close below 0.6450, not yet seen, will turn sentiment negative and extend late-December losses towards the 0.6415 Fibonacci retracement.