Published: 2024-02-19T14:00:02.000Z

Preview: Due February 20 - Canada January CPI - Slower but only modest progress on core rates

Senior Economist , North America

-

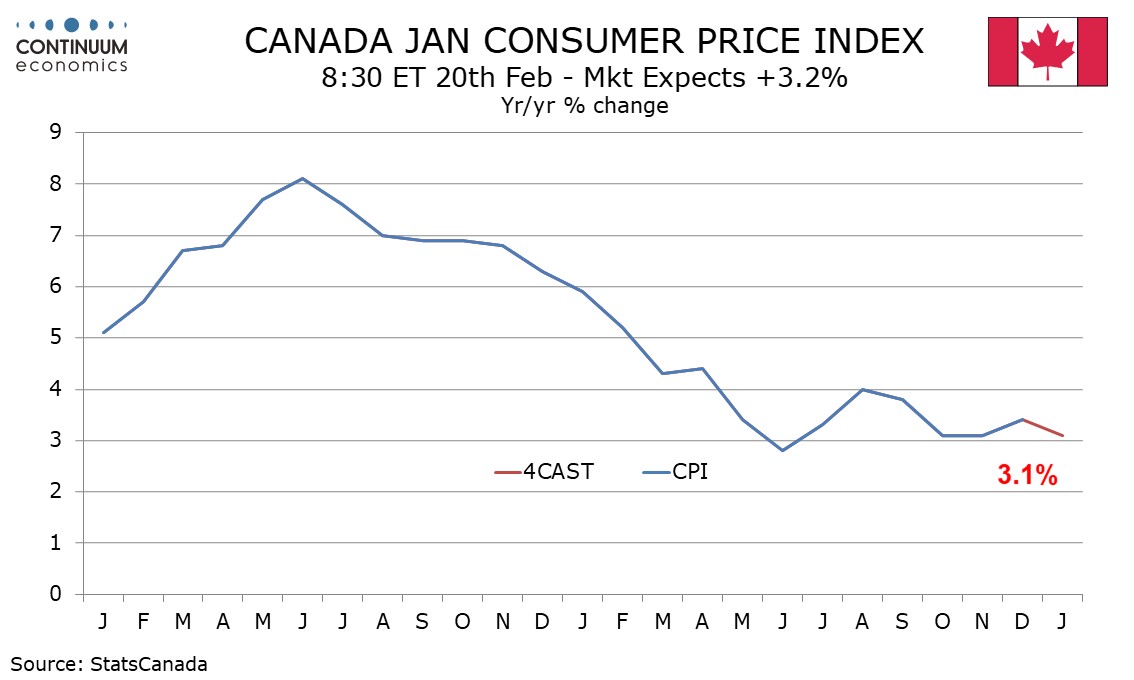

We expect January Canadian CPI to slip to 3.1% yr/yr, reversing a rise to 3.4% yr/yr in December. Monthly data is likely to look subdued after seasonal adjustment though progress in reducing the three Bank of Canada core rates will be modest.

We expect the monthly data to show overall CPI up by 0.2% with a 0.3% increase ex food and energy, though seasonally adjusted the data will look quite soft, unchanged overall and up by 0.2% ex food and energy.

This would be a second straight 0.2% increase ex food and energy seasonally adjusted, the first time two months have been so subdued since May and June showed two straight gains of 0.1%. Shelter, which in December rose by 0.4% both adjusted and unadjusted, the slowest since May, is likely to maintain December’s moderation if remaining relatively firm, while prices elsewhere are likely to remain subdued.

The ex food and energy rate is not one of the BoC’s core rates. Here we see marginal declines in CPI-common to 3.8% yr/yr from 3.9%, and CPI-trim to 3.6% from 3.7%, though we expect CPI-median to remain at 3.6% yr/yr, all still well above the 2.0% target with a downtrend showing signs of stalling. For the yr/yr ex food and energy pace, we actually expect an increase to 3.5% from 3.4%.