CAD, EUR flows: CAD benefits from better employment data

GBP weakens as May shows another drop in GDP. Trend is weakening although latest 3m/3m number is flattered by upward revision to March

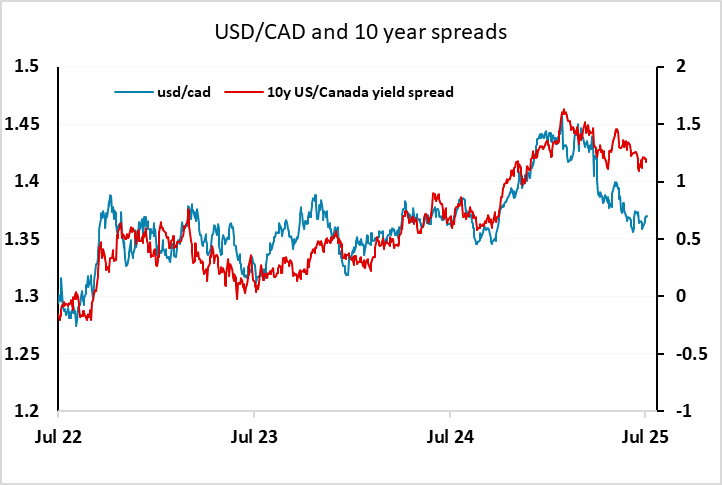

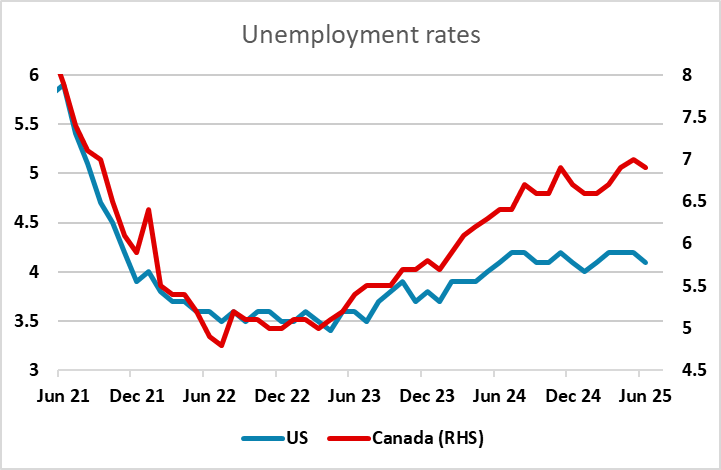

The Canadian employment report came in much stronger than expected, with a rise of 83.1k in employment and a decline in the unemployment rate to 6.9%. While 69.5k of the rise was in part-time employment, the numbers were far stronger than the near flat number expected, and may have reflected the temporary easing of trade tensions in June. But the latest announcement of a 35% tariff suggests that this sort of employment strength will be hard to maintain. Still, the data has allowed a modest recovery in the CAD with USD/CAD initially down half a figure but net down just around 20 pips since the data. Yields are up in both the US and Canada. Although there has been no real news to push US yields up this morning, the tariff announcement overnight may be a factor driving US yields higher. So far, there has been no conclusive USD impact, but the market is still waiting for more tariff news, particularly on the EU. The risks look to be that there is something similar to the Canadian tariff announcement, and if so there would likely be a negative EUR reaction., although this is far from clear given that the USD has generally weakened since the reciprocal tariff announcement in April.