JPY flows: Recovery after election could extend, but...

JPY recovered after Upper House election result was less bad than feared, and correction can extend, but risk sentiment needs to weaken if JPY is to manage a sustained recovery.

A quiet calendar suggests a quiet session in FX markets, although this isn’t always the case. There is no data of any note in the G10 today, Japan is on holiday, and there is no significant news on tariffs either, although it is always possible that some emerges. Overnight, the JPY is a little firmer after the Japanese Upper House elections, even though the government lost its majority and will need to rely on votes from smaller parties to pass legislation. Even though the government lost seats, the result was generally seen as a little less bad than was expected, and the JPY has managed a sharp recovery at the open in Asia, with USD/JPY dropping a big figure. It subsequently rallied but never quite closed the gap to Friday’s close, topping out at 148.65 before dropping back half a figure.

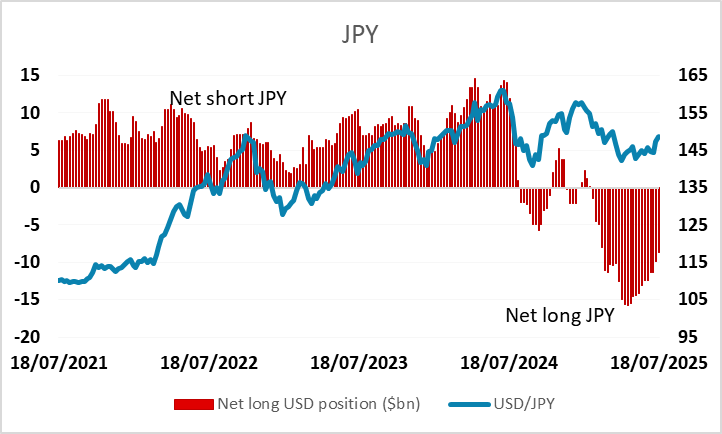

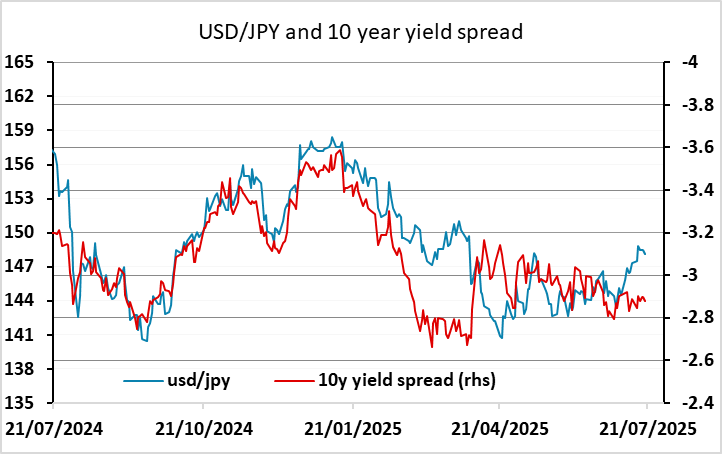

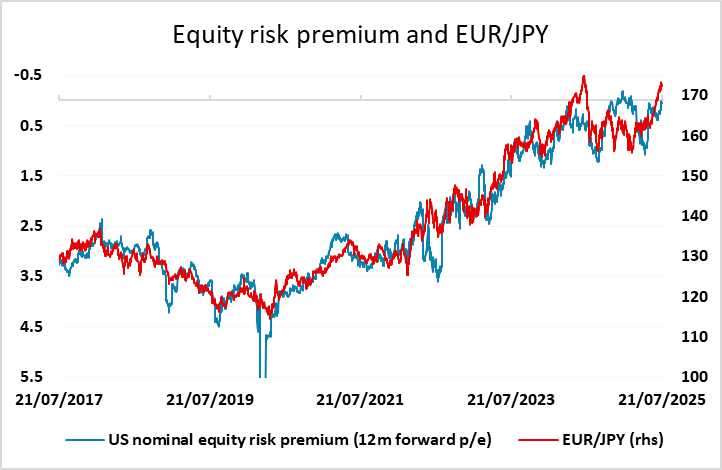

JPY weakness has been the theme of the last couple of months as US equities have risen to new all time highs, and equity risk premia have dropped to near 20 year lows. USD/JPY has outrun yield spreads and EUR/JPY has managed eight consecutive weeks of gains, a historically very rare occurrence, even exceeding the levels suggested by the correlation with risk premia. A JPY correction higher therefore looks due, with the CFTC data also suggesting that long JPY positioning has been pared back significantly in recent weeks (although it remains historically large). But a this stage this would be no more than a correction, with a rise in risk premia looking necessary to give the JPY any significant upward impetus.